Financial - Turkish Airlines

Financial - Turkish Airlines

Financial - Turkish Airlines

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

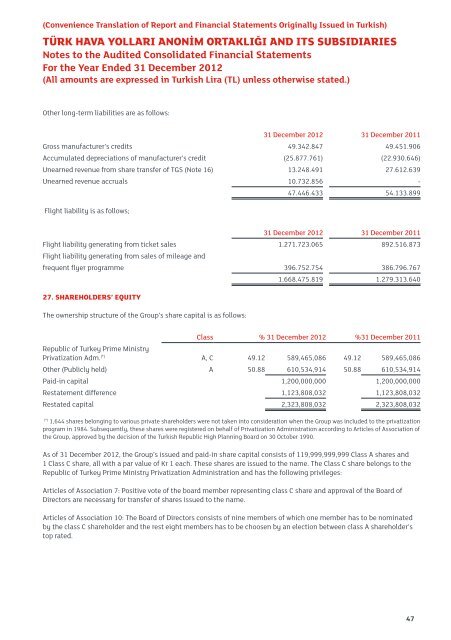

(Convenience Translation of Report and <strong>Financial</strong> Statements Originally Issued in <strong>Turkish</strong>)TÜRK HAVA YOLLARI ANONİM ORTAKLIĞI AND ITS SUBSIDIARIESNotes to the Audited Consolidated <strong>Financial</strong> StatementsFor the Year Ended 31 December 2012(All amounts are expressed in <strong>Turkish</strong> Lira (TL) unless otherwise stated.)Other long-term liabilities are as follows:31 December 2012 31 December 2011Gross manufacturer’s credits 49.342.847 49.451.906Accumulated depreciations of manufacturer’s credit (25.877.761) (22.930.646)Unearned revenue from share transfer of TGS (Note 16) 13.248.491 27.612.639Unearned revenue accruals 10.732.856 -47.446.433 54.133.899Flight liability is as follows;31 December 2012 31 December 2011Flight liability generating from ticket sales 1.271.723.065 892.516.873Flight liability generating from sales of mileage andfrequent flyer programme 396.752.754 386.796.7671.668.475.819 1.279.313.64027. SHAREHOLDERS’ EQUITYThe ownership structure of the Group’s share capital is as follows:Class % 31 December 2012 %31 December 2011Republic of Turkey Prime MinistryPrivatization Adm. (*) A, C 49.12 589,465,086 49.12 589,465,086Other (Publicly held) A 50.88 610,534,914 50.88 610,534,914Paid-in capital 1,200,000,000 1,200,000,000Restatement difference 1,123,808,032 1,123,808,032Restated capital 2,323,808,032 2,323,808,032(*)1,644 shares belonging to various private shareholders were not taken into consideration when the Group was included to the privatizationprogram in 1984. Subsequently, these shares were registered on behalf of Privatization Administration according to Articles of Association ofthe Group, approved by the decision of the <strong>Turkish</strong> Republic High Planning Board on 30 October 1990.As of 31 December 2012, the Group’s issued and paid-in share capital consists of 119,999,999,999 Class A shares and1 Class C share, all with a par value of Kr 1 each. These shares are issued to the name. The Class C share belongs to theRepublic of Turkey Prime Ministry Privatization Administration and has the following privileges:Articles of Association 7: Positive vote of the board member representing class C share and approval of the Board ofDirectors are necessary for transfer of shares issued to the name.Articles of Association 10: The Board of Directors consists of nine members of which one member has to be nominatedby the class C shareholder and the rest eight members has to be choosen by an election between class A shareholder’stop rated.47