Financial - Turkish Airlines

Financial - Turkish Airlines

Financial - Turkish Airlines

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

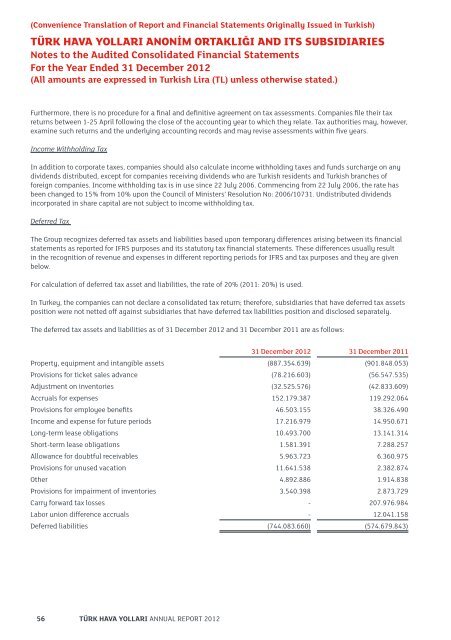

(Convenience Translation of Report and <strong>Financial</strong> Statements Originally Issued in <strong>Turkish</strong>)TÜRK HAVA YOLLARI ANONİM ORTAKLIĞI AND ITS SUBSIDIARIESNotes to the Audited Consolidated <strong>Financial</strong> StatementsFor the Year Ended 31 December 2012(All amounts are expressed in <strong>Turkish</strong> Lira (TL) unless otherwise stated.)Furthermore, there is no procedure for a final and definitive agreement on tax assessments. Companies file their taxreturns between 1-25 April following the close of the accounting year to which they relate. Tax authorities may, however,examine such returns and the underlying accounting records and may revise assessments within five years.Income Withholding TaxIn addition to corporate taxes, companies should also calculate income withholding taxes and funds surcharge on anydividends distributed, except for companies receiving dividends who are <strong>Turkish</strong> residents and <strong>Turkish</strong> branches offoreign companies. Income withholding tax is in use since 22 July 2006. Commencing from 22 July 2006, the rate hasbeen changed to 15% from 10% upon the Council of Ministers’ Resolution No: 2006/10731. Undistributed dividendsincorporated in share capital are not subject to income withholding tax.Deferred TaxThe Group recognizes deferred tax assets and liabilities based upon temporary differences arising between its financialstatements as reported for IFRS purposes and its statutory tax financial statements. These differences usually resultin the recognition of revenue and expenses in different reporting periods for IFRS and tax purposes and they are givenbelow.For calculation of deferred tax asset and liabilities, the rate of 20% (2011: 20%) is used.In Turkey, the companies can not declare a consolidated tax return; therefore, subsidiaries that have deferred tax assetsposition were not netted off against subsidiaries that have deferred tax liabilities position and disclosed separately.The deferred tax assets and liabilities as of 31 December 2012 and 31 December 2011 are as follows:31 December 2012 31 December 2011Property, equipment and intangible assets (887.354.639) (901.848.053)Provisions for ticket sales advance (78.216.603) (56.547.535)Adjustment on inventories (32.525.576) (42.833.609)Accruals for expenses 152.179.387 119.292.064Provisions for employee benefits 46.503.155 38.326.490Income and expense for future periods 17.216.979 14.950.671Long-term lease obligations 10.493.700 13.141.314Short-term lease obligations 1.581.391 7.288.257Allowance for doubtful receivables 5.963.723 6.360.975Provisions for unused vacation 11.641.538 2.382.874Other 4.892.886 1.914.838Provisions for impairment of inventories 3.540.398 2.873.729Carry forward tax losses - 207.976.984Labor union difference accruals - 12.041.158Deferred liabilities (744.083.660) (574.679.843)56 TÜRK HAVA YOLLARI ANNUAL REPORT 2012