Financial - Turkish Airlines

Financial - Turkish Airlines

Financial - Turkish Airlines

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

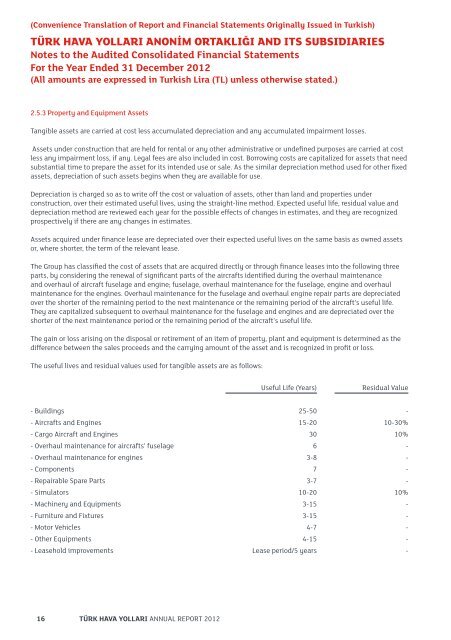

(Convenience Translation of Report and <strong>Financial</strong> Statements Originally Issued in <strong>Turkish</strong>)TÜRK HAVA YOLLARI ANONİM ORTAKLIĞI AND ITS SUBSIDIARIESNotes to the Audited Consolidated <strong>Financial</strong> StatementsFor the Year Ended 31 December 2012(All amounts are expressed in <strong>Turkish</strong> Lira (TL) unless otherwise stated.)2.5.3 Property and Equipment AssetsTangible assets are carried at cost less accumulated depreciation and any accumulated impairment losses.Assets under construction that are held for rental or any other administrative or undefined purposes are carried at costless any impairment loss, if any. Legal fees are also included in cost. Borrowing costs are capitalized for assets that needsubstantial time to prepare the asset for its intended use or sale. As the similar depreciation method used for other fixedassets, depreciation of such assets begins when they are available for use.Depreciation is charged so as to write off the cost or valuation of assets, other than land and properties underconstruction, over their estimated useful lives, using the straight-line method. Expected useful life, residual value anddepreciation method are reviewed each year for the possible effects of changes in estimates, and they are recognizedprospectively if there are any changes in estimates.Assets acquired under finance lease are depreciated over their expected useful lives on the same basis as owned assetsor, where shorter, the term of the relevant lease.The Group has classified the cost of assets that are acquired directly or through finance leases into the following threeparts, by considering the renewal of significant parts of the aircrafts identified during the overhaul maintenanceand overhaul of aircraft fuselage and engine; fuselage, overhaul maintenance for the fuselage, engine and overhaulmaintenance for the engines. Overhaul maintenance for the fuselage and overhaul engine repair parts are depreciatedover the shorter of the remaining period to the next maintenance or the remaining period of the aircraft’s useful life.They are capitalized subsequent to overhaul maintenance for the fuselage and engines and are depreciated over theshorter of the next maintenance period or the remaining period of the aircraft’s useful life.The gain or loss arising on the disposal or retirement of an item of property, plant and equipment is determined as thedifference between the sales proceeds and the carrying amount of the asset and is recognized in profit or loss.The useful lives and residual values used for tangible assets are as follows:Useful Life (Years)Residual Value- Buildings 25-50 -- Aircrafts and Engines 15-20 10-30%- Cargo Aircraft and Engines 30 10%- Overhaul maintenance for aircrafts’ fuselage 6 -- Overhaul maintenance for engines 3-8 -- Components 7 -- Repairable Spare Parts 3-7 -- Simulators 10-20 10%- Machinery and Equipments 3-15 -- Furniture and Fixtures 3-15 -- Motor Vehicles 4-7 -- Other Equipments 4-15 -- Leasehold improvements Lease period/5 years -16 TÜRK HAVA YOLLARI ANNUAL REPORT 2012