Financial - Turkish Airlines

Financial - Turkish Airlines

Financial - Turkish Airlines

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

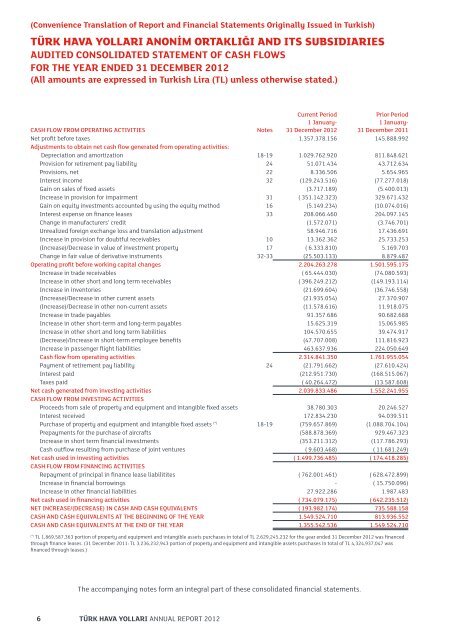

(Convenience Translation of Report and <strong>Financial</strong> Statements Originally Issued in <strong>Turkish</strong>)TÜRK HAVA YOLLARI ANONİM ORTAKLIĞI AND ITS SUBSIDIARIESAUDITED CONSOLIDATED STATEMENT OF CASH FLOWSFOR THE YEAR ENDED 31 DECEMBER 2012(All amounts are expressed in <strong>Turkish</strong> Lira (TL) unless otherwise stated.)Current Period1 January-31 December 2012Prior Period1 January-31 December 2011CASH FLOW FROM OPERATING ACTIVITIESNotesNet profit before taxes 1.357.378.156 145.888.992Adjustments to obtain net cash flow generated from operating activities:Depreciation and amortization 18-19 1.029.762.920 811.848.621Provision for retirement pay liability 24 51.071.434 43.712.634Provisions, net 22 8.336.506 5.654.965Interest income 32 (129.243.516) (77.277.018)Gain on sales of fixed assets (3.717.189) (5.400.013)Increase in provision for impairment 31 ( 351.142.323) 329.671.432Gain on equity investments accounted by using the equity method 16 (5.149.234) (10.074.016)Interest expense on finance leases 33 208.066.460 204.097.145Change in manufacturers’ credit (1.572.071) (3.746.701)Unrealized foreign exchange loss and translation adjustment 58.946.716 17.436.691Increase in provision for doubtful receivables 10 13.362.362 25.733.253(Increase)/Decrease in value of investment property 17 ( 6.333.810) 5.169.703Change in fair value of derivative instruments 32-33 (25.503.133) 8.879.487Operating profit before working capital changes 2.204.263.278 1.501.595.175Increase in trade receivables ( 65.444.030) (74.080.593)Increase in other short and long term receivables ( 396.249.212) (149.193.114)Increase in inventories (21.699.604) (36.746.558)(Increase)/Decrease in other current assets (21.935.054) 27.370.907(Increase)/Decrease in other non-current assets (11.578.616) 11.918.075Increase in trade payables 91.357.686 90.682.688Increase in other short-term and long-term payables 15.625.319 15.065.985Increase in other short and long term liabilities 104.570.655 39.474.917(Decrease)/Increase in short-term employee benefits (47.707.008) 111.816.923Increase in passenger flight liabilities 463.637.936 224.050.649Cash flow from operating activities 2.314.841.350 1.761.955.054Payment of retirement pay liability 24 (21.791.662) (27.610.424)Interest paid (212.951.730) (168.515.067)Taxes paid ( 40.264.472) (13.587.608)Net cash generated from investing activities 2.039.833.486 1.552.241.955CASH FLOW FROM INVESTING ACTIVITIESProceeds from sale of property and equipment and intangible fixed assets 38.780.303 20.246.527Interest received 172.834.230 94.039.511Purchase of property and equipment and intangible fixed assets (*) 18-19 (759.657.869) (1.088.704.104)Prepayments for the purchase of aircrafts (588.878.369) 929.467.323Increase in short term financial investments (353.211.312) (117.786.293)Cash outflow resulting from purchase of joint ventures ( 9.603.468) ( 11.681.249)Net cash used in investing activities ( 1.499.736.485) ( 174.418.285)CASH FLOW FROM FINANCING ACTIVITIESRepayment of principal in finance lease liabilitites ( 762.001.461) ( 628.472.899)Increase in financial borrowings - ( 15.750.096)Increase in other financial liabilities 27.922.286 1.987.483Net cash used in financing activities ( 734.079.175) ( 642.235.512)NET INCREASE/(DECREASE) IN CASH AND CASH EQUIVALENTS ( 193.982.174) 735.588.158CASH AND CASH EQUIVALENTS AT THE BEGINNING OF THE YEAR 1.549.524.710 813.936.552CASH AND CASH EQUIVALENTS AT THE END OF THE YEAR 1.355.542.536 1.549.524.710(*)TL 1,869,587,363 portion of property and equipment and intangible assets purchases in total of TL 2,629,245,232 for the year ended 31 December 2012 was financedthrough finance leases. (31 December 2011: TL 3,236,232,943 portion of property and equipment and intangible assets purchases in total of TL 4,324,937,047 wasfinanced through leases.)The accompanying notes form an integral part of these consolidated financial statements.6 TÜRK HAVA YOLLARI ANNUAL REPORT 2012