Financial - Turkish Airlines

Financial - Turkish Airlines

Financial - Turkish Airlines

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

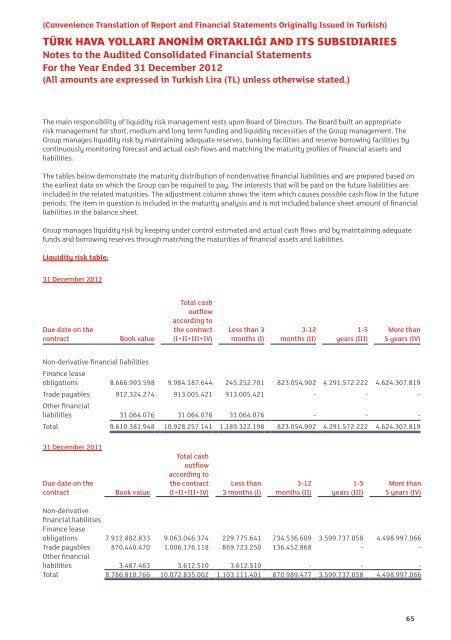

(Convenience Translation of Report and <strong>Financial</strong> Statements Originally Issued in <strong>Turkish</strong>)TÜRK HAVA YOLLARI ANONİM ORTAKLIĞI AND ITS SUBSIDIARIESNotes to the Audited Consolidated <strong>Financial</strong> StatementsFor the Year Ended 31 December 2012(All amounts are expressed in <strong>Turkish</strong> Lira (TL) unless otherwise stated.)The main responsibility of liquidity risk management rests upon Board of Directors. The Board built an appropriaterisk management for short, medium and long term funding and liquidity necessities of the Group management. TheGroup manages liquidity risk by maintaining adequate reserves, banking facilities and reserve borrowing facilities bycontinuously monitoring forecast and actual cash flows and matching the maturity profiles of financial assets andliabilities.The tables below demonstrate the maturity distribution of nonderivative financial liabilities and are prepared based onthe earliest date on which the Group can be required to pay. The interests that will be paid on the future liabilities areincluded in the related maturities. The adjustment column shows the item which causes possible cash flow in the futureperiods. The item in question is included in the maturity analysis and is not included balance sheet amount of financialliabilities in the balance sheet.Group manages liquidity risk by keeping under control estimated and actual cash flows and by maintaining adequatefunds and borrowing reserves through matching the maturities of financial assets and liabilities.Liquidity risk table:31 December 2012Due date on thecontractBook valueTotal cashoutflowaccording tothe contract(I+II+III+IV)Less than 3months (I)3-12months (II)1-5years (III)More than5 years (IV)Non-derivative financial liabilitiesFinance leaseobligations 8.666.993.598 9.984.187.644 245.252.701 823.054.902 4.291.572.222 4.624.307.819Trade payables 912.324.274 913.005.421 913.005.421 - - -Other financialliabilities 31.064.076 31.064.076 31.064.076 - - -Total 9.610.381.948 10.928.257.141 1.189.322.198 823.054.902 4.291.572.222 4.624.307.81931 December 2011Due date on thecontractBook valueTotal cashoutflowaccording tothe contract(I+II+III+IV)Less than3 months (I)3-12months (II)1-5years (III)More than5 years (IV)Non-derivativefinancial liabilitiesFinance leaseobligations 7.912.882.833 9.063.046.374 229.775.641 734.536.609 3.599.737.058 4.498.997.066Trade payables 870.440.470 1.006.176.118 869.723.250 136.452.868 - -Other financialliabilities 3.487.463 3.612.510 3.612.510 - - -Total 8.786.810.766 10.072.835.002 1.103.111.401 870.989.477 3.599.737.058 4.498.997.06665