Financial - Turkish Airlines

Financial - Turkish Airlines

Financial - Turkish Airlines

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

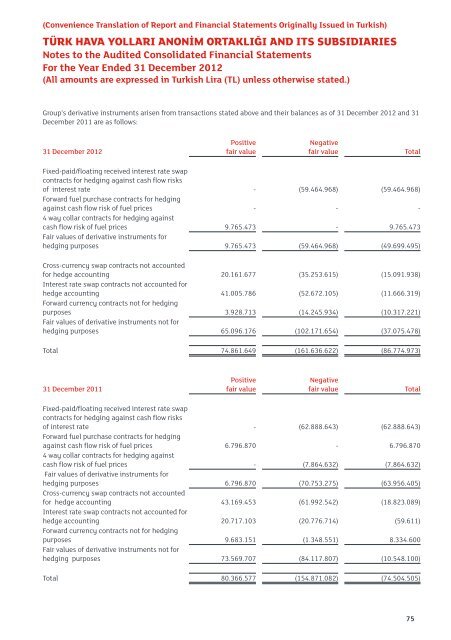

(Convenience Translation of Report and <strong>Financial</strong> Statements Originally Issued in <strong>Turkish</strong>)TÜRK HAVA YOLLARI ANONİM ORTAKLIĞI AND ITS SUBSIDIARIESNotes to the Audited Consolidated <strong>Financial</strong> StatementsFor the Year Ended 31 December 2012(All amounts are expressed in <strong>Turkish</strong> Lira (TL) unless otherwise stated.)Group’s derivative instruments arisen from transactions stated above and their balances as of 31 December 2012 and 31December 2011 are as follows:31 December 2012Positivefair valueNegativefair valueTotalFixed-paid/floating received interest rate swapcontracts for hedging against cash flow risksof interest rate - (59.464.968) (59.464.968)Forward fuel purchase contracts for hedgingagainst cash flow risk of fuel prices - - -4 way collar contracts for hedging againstcash flow risk of fuel prices 9.765.473 - 9.765.473Fair values of derivative instruments forhedging purposes 9.765.473 (59.464.968) (49.699.495)Cross-currency swap contracts not accountedfor hedge accounting 20.161.677 (35.253.615) (15.091.938)Interest rate swap contracts not accounted forhedge accounting 41.005.786 (52.672.105) (11.666.319)Forward currency contracts not for hedgingpurposes 3.928.713 (14.245.934) (10.317.221)Fair values of derivative instruments not forhedging purposes 65.096.176 (102.171.654) (37.075.478)Total 74.861.649 (161.636.622) (86.774.973)31 December 2011Positivefair valueNegativefair valueTotalFixed-paid/floating received interest rate swapcontracts for hedging against cash flow risksof interest rate - (62.888.643) (62.888.643)Forward fuel purchase contracts for hedgingagainst cash flow risk of fuel prices 6.796.870 - 6.796.8704 way collar contracts for hedging againstcash flow risk of fuel prices - (7.864.632) (7.864.632)Fair values of derivative instruments forhedging purposes 6.796.870 (70.753.275) (63.956.405)Cross-currency swap contracts not accountedfor hedge accounting 43.169.453 (61.992.542) (18.823.089)Interest rate swap contracts not accounted forhedge accounting 20.717.103 (20.776.714) (59.611)Forward currency contracts not for hedgingpurposes 9.683.151 (1.348.551) 8.334.600Fair values of derivative instruments not forhedging purposes 73.569.707 (84.117.807) (10.548.100)Total 80.366.577 (154.871.082) (74.504.505)75