Financial - Turkish Airlines

Financial - Turkish Airlines

Financial - Turkish Airlines

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

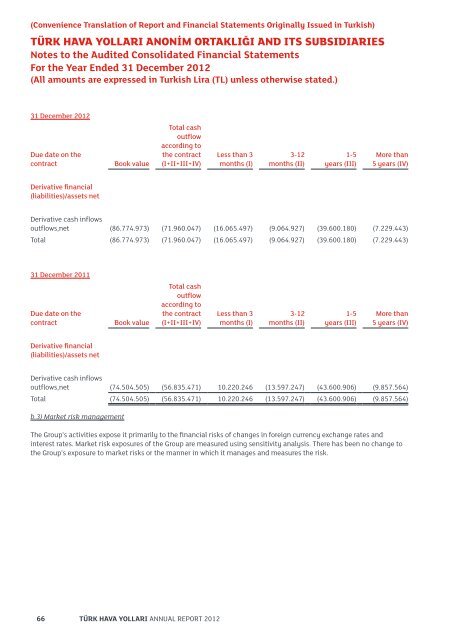

(Convenience Translation of Report and <strong>Financial</strong> Statements Originally Issued in <strong>Turkish</strong>)TÜRK HAVA YOLLARI ANONİM ORTAKLIĞI AND ITS SUBSIDIARIESNotes to the Audited Consolidated <strong>Financial</strong> StatementsFor the Year Ended 31 December 2012(All amounts are expressed in <strong>Turkish</strong> Lira (TL) unless otherwise stated.)31 December 2012Due date on thecontractBook valueTotal cashoutflowaccording tothe contract(I+II+III+IV)Less than 3months (I)3-12months (II)1-5years (III)More than5 years (IV)Derivative financial(liabilities)/assets netDerivative cash inflowsoutflows,net (86.774.973) (71.960.047) (16.065.497) (9.064.927) (39.600.180) (7.229.443)Total (86.774.973) (71.960.047) (16.065.497) (9.064.927) (39.600.180) (7.229.443)31 December 2011Due date on thecontractBook valueTotal cashoutflowaccording tothe contract(I+II+III+IV)Less than 3months (I)3-12months (II)1-5years (III)More than5 years (IV)Derivative financial(liabilities)/assets netDerivative cash inflowsoutflows,net (74.504.505) (56.835.471) 10.220.246 (13.597.247) (43.600.906) (9.857.564)Total (74.504.505) (56.835.471) 10.220.246 (13.597.247) (43.600.906) (9.857.564)b.3) Market risk managementThe Group’s activities expose it primarily to the financial risks of changes in foreign currency exchange rates andinterest rates. Market risk exposures of the Group are measured using sensitivity analysis. There has been no change tothe Group’s exposure to market risks or the manner in which it manages and measures the risk.66 TÜRK HAVA YOLLARI ANNUAL REPORT 2012