Financial - Turkish Airlines

Financial - Turkish Airlines

Financial - Turkish Airlines

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

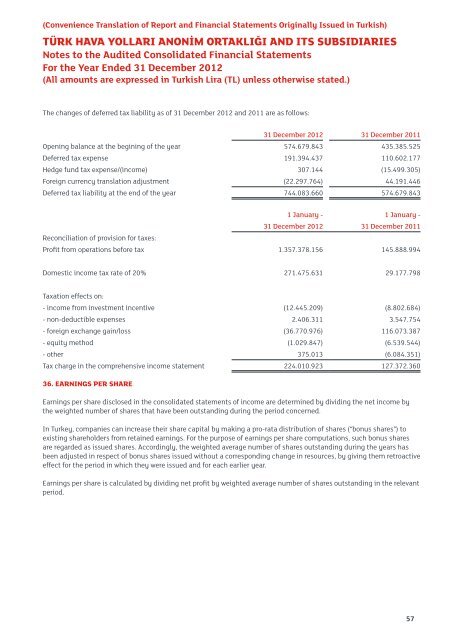

(Convenience Translation of Report and <strong>Financial</strong> Statements Originally Issued in <strong>Turkish</strong>)TÜRK HAVA YOLLARI ANONİM ORTAKLIĞI AND ITS SUBSIDIARIESNotes to the Audited Consolidated <strong>Financial</strong> StatementsFor the Year Ended 31 December 2012(All amounts are expressed in <strong>Turkish</strong> Lira (TL) unless otherwise stated.)The changes of deferred tax liability as of 31 December 2012 and 2011 are as follows:31 December 2012 31 December 2011Opening balance at the begining of the year 574.679.843 435.385.525Deferred tax expense 191.394.437 110.602.177Hedge fund tax expense/(income) 307.144 (15.499.305)Foreign currency translation adjustment (22.297.764) 44.191.446Deferred tax liability at the end of the year 744.083.660 574.679.8431 January - 1 January -31 December 2012 31 December 2011Reconciliation of provision for taxes:Profit from operations before tax 1.357.378.156 145.888.994Domestic income tax rate of 20% 271.475.631 29.177.798Taxation effects on:- income from investment incentive (12.445.209) (8.802.684)- non-deductible expenses 2.406.311 3.547.754- foreign exchange gain/loss (36.770.976) 116.073.387- equity method (1.029.847) (6.539.544)- other 375.013 (6.084.351)Tax charge in the comprehensive income statement 224.010.923 127.372.36036. EARNINGS PER SHAREEarnings per share disclosed in the consolidated statements of income are determined by dividing the net income bythe weighted number of shares that have been outstanding during the period concerned.In Turkey, companies can increase their share capital by making a pro-rata distribution of shares (“bonus shares”) toexisting shareholders from retained earnings. For the purpose of earnings per share computations, such bonus sharesare regarded as issued shares. Accordingly, the weighted average number of shares outstanding during the years hasbeen adjusted in respect of bonus shares issued without a corresponding change in resources, by giving them retroactiveeffect for the period in which they were issued and for each earlier year.Earnings per share is calculated by dividing net profit by weighted average number of shares outstanding in the relevantperiod.57