Financial - Turkish Airlines

Financial - Turkish Airlines

Financial - Turkish Airlines

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

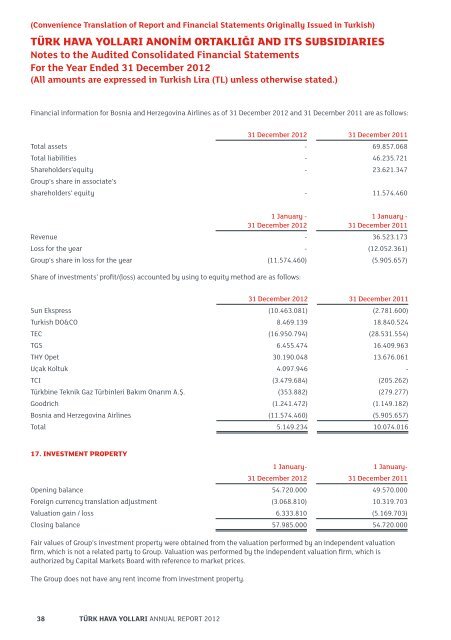

(Convenience Translation of Report and <strong>Financial</strong> Statements Originally Issued in <strong>Turkish</strong>)TÜRK HAVA YOLLARI ANONİM ORTAKLIĞI AND ITS SUBSIDIARIESNotes to the Audited Consolidated <strong>Financial</strong> StatementsFor the Year Ended 31 December 2012(All amounts are expressed in <strong>Turkish</strong> Lira (TL) unless otherwise stated.)<strong>Financial</strong> information for Bosnia and Herzegovina <strong>Airlines</strong> as of 31 December 2012 and 31 December 2011 are as follows:31 December 2012 31 December 2011Total assets - 69.857.068Total liabilities - 46.235.721Shareholders’equity - 23.621.347Group’s share in associate’sshareholders’ equity - 11.574.4601 January -31 December 20121 January -31 December 2011Revenue - 36.523.173Loss for the year - (12.052.361)Group’s share in loss for the year (11.574.460) (5.905.657)Share of investments’ profit/(loss) accounted by using to equity method are as follows:31 December 2012 31 December 2011Sun Ekspress (10.463.081) (2.781.600)<strong>Turkish</strong> DO&CO 8.469.139 18.840.524TEC (16.950.794) (28.531.554)TGS 6.455.474 16.409.963THY Opet 30.190.048 13.676.061Uçak Koltuk 4.097.946 -TCI (3.479.684) (205.262)Türkbine Teknik Gaz Türbinleri Bakım Onarım A.Ş. (353.882) (279.277)Goodrich (1.241.472) (1.149.182)Bosnia and Herzegovina <strong>Airlines</strong> (11.574.460) (5.905.657)Total 5.149.234 10.074.01617. INVESTMENT PROPERTY1 January- 1 January-31 December 2012 31 December 2011Opening balance 54.720.000 49.570.000Foreign currency translation adjustment (3.068.810) 10.319.703Valuation gain / loss 6.333.810 (5.169.703)Closing balance 57.985.000 54.720.000Fair values of Group’s investment property were obtained from the valuation performed by an independent valuationfirm, which is not a related party to Group. Valuation was performed by the independent valuation firm, which isauthorized by Capital Markets Board with reference to market prices.The Group does not have any rent income from investment property.38 TÜRK HAVA YOLLARI ANNUAL REPORT 2012