Financial - Turkish Airlines

Financial - Turkish Airlines

Financial - Turkish Airlines

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

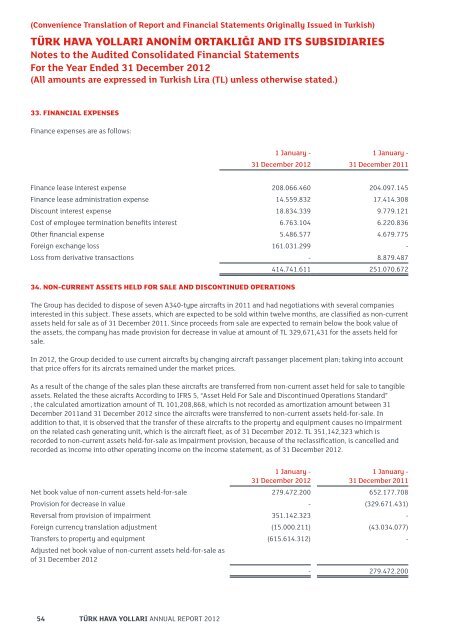

(Convenience Translation of Report and <strong>Financial</strong> Statements Originally Issued in <strong>Turkish</strong>)TÜRK HAVA YOLLARI ANONİM ORTAKLIĞI AND ITS SUBSIDIARIESNotes to the Audited Consolidated <strong>Financial</strong> StatementsFor the Year Ended 31 December 2012(All amounts are expressed in <strong>Turkish</strong> Lira (TL) unless otherwise stated.)33. FINANCIAL EXPENSESFinance expenses are as follows:1 January - 1 January -31 December 2012 31 December 2011Finance lease interest expense 208.066.460 204.097.145Finance lease administration expense 14.559.832 17.414.308Discount interest expense 18.834.339 9.779.121Cost of employee termination benefits interest 6.763.104 6.220.836Other financial expense 5.486.577 4.679.775Foreign exchange loss 161.031.299 -Loss from derivative transactions - 8.879.487414.741.611 251.070.67234. NON-CURRENT ASSETS HELD FOR SALE AND DISCONTINUED OPERATIONSThe Group has decided to dispose of seven A340-type aircrafts in 2011 and had negotiations with several companiesinterested in this subject. These assets, which are expected to be sold within twelve months, are classified as non-currentassets held for sale as of 31 December 2011. Since proceeds from sale are expected to remain below the book value ofthe assets, the company has made provision for decrease in value at amount of TL 329,671,431 for the assets held forsale.In 2012, the Group decided to use current aircrafts by changing aircraft passanger placement plan; taking into accountthat price offers for its aircrats remained under the market prices.As a result of the change of the sales plan these aircrafts are transferred from non-current asset held for sale to tangibleassets. Related the these aicrafts According to IFRS 5, “Asset Held For Sale and Discontinued Operations Standard”, the calculated amortization amount of TL 101,208,868, which is not recorded as amortization amount between 31December 2011and 31 December 2012 since the aircrafts were transferred to non-current assets held-for-sale. Inaddition to that, it is observed that the transfer of these aircrafts to the property and equipment causes no impairmenton the related cash generating unit, which is the aircraft fleet, as of 31 December 2012. TL 351,142,323 which isrecorded to non-current assets held-for-sale as impairment provision, because of the reclassification, is cancelled andrecorded as income into other operating income on the income statement, as of 31 December 2012.1 January -31 December 20121 January -31 December 2011Net book value of non-current assets held-for-sale 279.472.200 652.177.708Provision for decrease in value - (329.671.431)Reversal from provision of impairment 351.142.323 -Foreign currency translation adjustment (15.000.211) (43.034.077)Transfers to property and equipment (615.614.312) -Adjusted net book value of non-current assets held-for-sale asof 31 December 2012- 279.472.20054 TÜRK HAVA YOLLARI ANNUAL REPORT 2012