Financial - Turkish Airlines

Financial - Turkish Airlines

Financial - Turkish Airlines

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

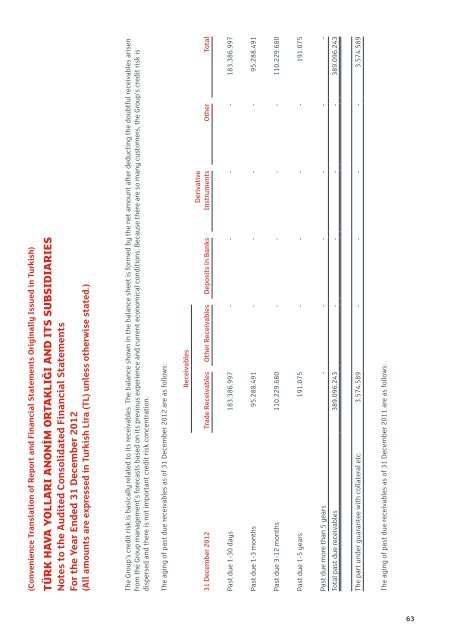

(Convenience Translation of Report and <strong>Financial</strong> Statements Originally Issued in <strong>Turkish</strong>)TÜRK HAVA YOLLARI ANONİM ORTAKLIĞI AND ITS SUBSIDIARIESNotes to the Audited Consolidated <strong>Financial</strong> StatementsFor the Year Ended 31 December 2012(All amounts are expressed in <strong>Turkish</strong> Lira (TL) unless otherwise stated.)The Group’s credit risk is basically related to its receivables. The balance shown in the balance sheet is formed by the net amount after deducting the doubtful receivables arisenfrom the Group management’s forecasts based on its previous experience and current economical conditions. Because there are so many customers, the Group’s credit risk isdispersed and there is not important credit risk concentration.The aging of past due receivables as of 31 December 2012 are as follows:Receivables31 December 2012 Trade Receivables Other Receivables Deposits in BanksDerivativeInstruments Other TotalPast due 1-30 days 183.386.997 - - - - 183.386.997Past due 1-3 months 95.288.491 - - - - 95.288.491Past due 3-12 months 110.229.680 - - - - 110.229.680Past due 1-5 years 191.075 - - - - 191.075Past due more than 5 years - - - - - -Total past due receivables 389.096.243 - - - - 389.096.243The part under guarantee with collateral etc. 3.574.589 - - - - 3.574.589The aging of past due receivables as of 31 December 2011 are as follows:63