A Multidisciplinary Research Journal - Devanga Arts College

A Multidisciplinary Research Journal - Devanga Arts College

A Multidisciplinary Research Journal - Devanga Arts College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

cent and 3 per cent respectively. More than four – fifth of the Customers have Savings bank<br />

account.<br />

BORROWING<br />

The Regional Rural Bank was started with a view to provide multi agency grants for<br />

agricultural lending in addition to cooperatives and commercial banks. The Regional Rural<br />

Banks are aiming at providing agricultural and non-agricultural loans to people living in rural<br />

areas. It is interesting to know how the sample respondents have availed themselves of the loan<br />

facilities provided by the bank.<br />

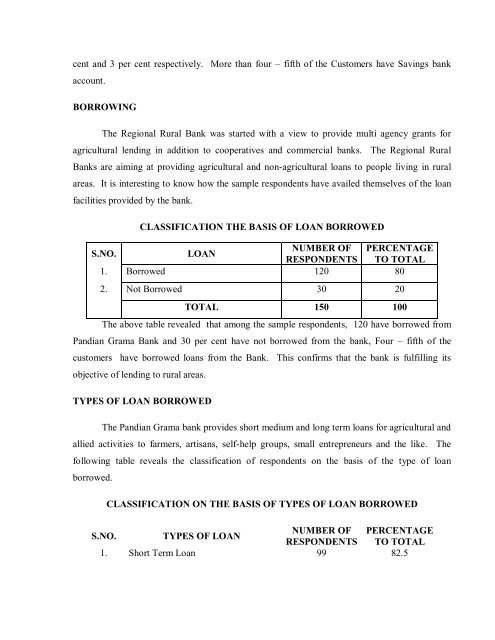

CLASSIFICATION THE BASIS OF LOAN BORROWED<br />

S.NO. LOAN<br />

NUMBER OF<br />

RESPONDENTS<br />

PERCENTAGE<br />

TO TOTAL<br />

1. Borrowed 120 80<br />

2. Not Borrowed 30 20<br />

TOTAL 150 100<br />

The above table revealed that among the sample respondents, 120 have borrowed from<br />

Pandian Grama Bank and 30 per cent have not borrowed from the bank, Four – fifth of the<br />

customers have borrowed loans from the Bank. This confirms that the bank is fulfilling its<br />

objective of lending to rural areas.<br />

TYPES OF LOAN BORROWED<br />

The Pandian Grama bank provides short medium and long term loans for agricultural and<br />

allied activities to farmers, artisans, self-help groups, small entrepreneurs and the like. The<br />

following table reveals the classification of respondents on the basis of the type of loan<br />

borrowed.<br />

CLASSIFICATION ON THE BASIS OF TYPES OF LOAN BORROWED<br />

S.NO. TYPES OF LOAN<br />

NUMBER OF<br />

RESPONDENTS<br />

PERCENTAGE<br />

TO TOTAL<br />

1. Short Term Loan 99 82.5