- Page 1 and 2: ReGIstRAtIonDoCUMent& FInAnCIALAnnU

- Page 3 and 4: ContentsPage1 Person responsible fo

- Page 5 and 6: 1PeRsonResPonsIBLe FoRtHe ReGIstRAt

- Page 8 and 9: 3seLeCteDFInAnCIALInFoRMAtIon3.1. o

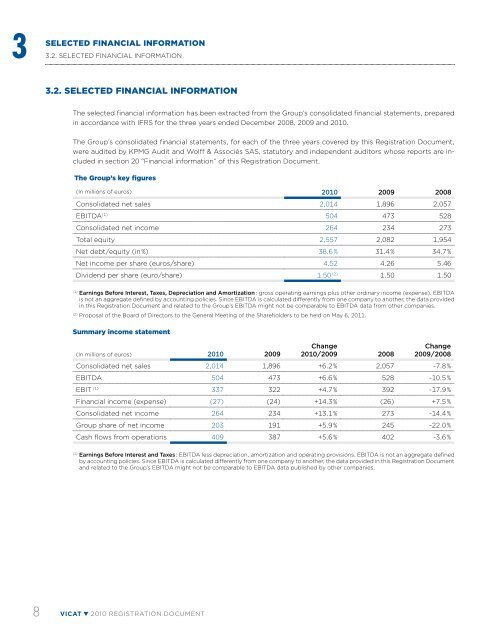

- Page 12 and 13: 3SELECTED FINANCIAL INFORMATION3.2.

- Page 14 and 15: 4RIsK FACtoRs4.1. risks relating to

- Page 16 and 17: 4RISK FACTORS4.1. Risks relating to

- Page 18: 4RISK FACTORS4.3. Legal riskswhich

- Page 21 and 22: 4RISK FACTORS4.5. Risks related to

- Page 23 and 24: 5InFoRMAtIonABoUttHe CoMPAnY5.1. Hi

- Page 25 and 26: INFORMATION ABOUT THE COMPANY5.2. I

- Page 27 and 28: INFORMATION ABOUT THE COMPANY5.2. I

- Page 29 and 30: 6BUsInessoVeRVIeW6.1. overview of t

- Page 31 and 32: 6BUSINESS OVERVIEW6.2. Group streng

- Page 33 and 34: 6BUSINESS OVERVIEW6.2. Group streng

- Page 35 and 36: 6BUSINESS OVERVIEW6.3. Description

- Page 37 and 38: 6BUSINESS OVERVIEW6.3. Description

- Page 39 and 40: 6BUSINESS OVERVIEW6.3. Description

- Page 41 and 42: 6BUSINESS OVERVIEW6.3. Description

- Page 43 and 44: 6BUSINESS OVERVIEW6.3. Description

- Page 45 and 46: 6BUSINESS OVERVIEW6.3. Description

- Page 47 and 48: 6BUSINESS OVERVIEW6.3. Description

- Page 49 and 50: 6BUSINESS OVERVIEW6.3. Description

- Page 51 and 52: 6BUSINESS OVERVIEW6.3. Description

- Page 53 and 54: 6BUSINESS OVERVIEW6.3. Description

- Page 55 and 56: 6BUSINESS OVERVIEW6.3. Description

- Page 57 and 58: 6BUSINESS OVERVIEW6.3. Description

- Page 59 and 60: 7oRGAnIsAtIonCHARt7.1. Simplified l

- Page 61 and 62:

7ORGANISATION CHART7.2. Information

- Page 63 and 64:

7ORGANISATION CHART7.2. Information

- Page 65 and 66:

REAL ESTATE, FACTORIES AND EQUIPMEN

- Page 67 and 68:

REAL ESTATE, FACTORIES AND EQUIPMEN

- Page 69 and 70:

REAL ESTATE, FACTORIES AND EQUIPMEN

- Page 71 and 72:

9eXAMInAtIonoF tHe FInAnCIALPosItIo

- Page 73 and 74:

EXAMINATION OF THE FINANCIAL POSITI

- Page 75 and 76:

EXAMINATION OF THE FINANCIAL POSITI

- Page 77 and 78:

EXAMINATION OF THE FINANCIAL POSITI

- Page 79 and 80:

EXAMINATION OF THE FINANCIAL POSITI

- Page 81 and 82:

EXAMINATION OF THE FINANCIAL POSITI

- Page 83 and 84:

10CAsH FLoWAnD eQUItY10.1. EQuItY 8

- Page 85 and 86:

Cash flow and equity10.2. Cash flow

- Page 87 and 88:

Cash flow and equity10.3. INDEBTEDN

- Page 89 and 90:

Cash flow and equity10.3. INDEBTEDN

- Page 91 and 92:

10Cash flow and equity10.4. ANALYSI

- Page 93 and 94:

RESEARCH AND DEVELOPMENT, PATENTS A

- Page 95 and 96:

Information on trends12.2. Trends a

- Page 97 and 98:

13PRoFIt FoReCAstsoR estIMAtesThe C

- Page 99 and 100:

14ADMINISTRATION AND GENERAL MANAGE

- Page 101 and 102:

14ADMINISTRATION AND GENERAL MANAGE

- Page 103 and 104:

ADMINISTRATION AND GENERAL MANAGEME

- Page 105 and 106:

15ReMUneRAtIonAnD BeneFIts15.1. rem

- Page 107 and 108:

15REMUNERATION AND BENEFITS15.2. Pe

- Page 109 and 110:

16oPeRAtIon oFtHe ADMInIstRAtIVeAnD

- Page 111 and 112:

OPERATION OF THE ADMINISTRATIVE AND

- Page 113 and 114:

OPERATION OF THE ADMINISTRATIVE AND

- Page 115 and 116:

17EMPLOYEES17.1. Overview17.1.1. Br

- Page 117 and 118:

17EMPLOYEES17.1. OverviewHuman Reso

- Page 119 and 120:

EMPLOYEES17.4. Shareholding of the

- Page 121 and 122:

18PRInCIPALsHAReHoLDeRs18.1. distri

- Page 123 and 124:

19oPeRAtIonsWItH ReLAteD19.1. contr

- Page 125 and 126:

19OPeRATIONS with related19.3. Stat

- Page 127 and 128:

Financial information on the assets

- Page 129 and 130:

Financial information on the assets

- Page 131 and 132:

Financial information on the assets

- Page 133 and 134:

Financial information on the assets

- Page 135 and 136:

Financial information on the assets

- Page 137 and 138:

Financial information on the assets

- Page 139 and 140:

Financial information on the assets

- Page 141 and 142:

Financial information on the assets

- Page 143 and 144:

Financial information on the assets

- Page 145 and 146:

Financial information on the assets

- Page 147 and 148:

Financial information on the assets

- Page 149 and 150:

Financial information on the assets

- Page 151 and 152:

Financial information on the assets

- Page 153 and 154:

Financial information on the assets

- Page 155 and 156:

Financial information on the assets

- Page 157 and 158:

Financial information on the assets

- Page 159 and 160:

Financial information on the assets

- Page 161 and 162:

Financial information on the assets

- Page 163 and 164:

Financial information on the assets

- Page 165 and 166:

Financial information on the assets

- Page 167 and 168:

Financial information on the assets

- Page 169 and 170:

Financial information on the assets

- Page 171 and 172:

Financial information on the assets

- Page 173 and 174:

Financial information on the assets

- Page 175 and 176:

Financial information on the assets

- Page 177 and 178:

Financial information on the assets

- Page 179:

Financial information on the assets

- Page 182 and 183:

information on the assets and liabi

- Page 184 and 185:

information on the assets and liabi

- Page 186 and 187:

information on the assets and liabi

- Page 188 and 189:

20information on the assets and lia

- Page 190 and 191:

21ADDITIONAL INFORMATION21.1. Share

- Page 192 and 193:

21 21.2.ADDITIONAL INFORMATIONConst

- Page 194 and 195:

21ADDITIONAL INFORMATION21.2. Const

- Page 196 and 197:

21ADDITIONAL INFORMATION21.2. Const

- Page 198 and 199:

22sIGnIFICAntContRACtsGiven its act

- Page 200 and 201:

24DoCUMentsAVAILABLeto tHe PUBLICOf

- Page 202 and 203:

APPenDIX1report by the president on

- Page 204 and 205:

1APPENDIXReport by the president on

- Page 206 and 207:

1APPENDIXReport by the president on

- Page 208 and 209:

1APPENDIXReport by the president on

- Page 210 and 211:

1APPENDIXReport by the president on

- Page 212 and 213:

2appendixStatutory auditors’ repo

- Page 214 and 215:

3APPENDIXAnnual information1. Refer

- Page 216 and 217:

APPenDIX4eLeMentsConstItUtInGtHe FI

- Page 218 and 219:

GLossARY216 VICAT 2010 registration

- Page 220 and 221:

GLOSSARyCarbonationCEMCEM I(formerl

- Page 222 and 223:

GLOSSARyElectrostatic filterExhaust

- Page 224 and 225:

GLOSSARyMixerApparatus used to mix

- Page 226:

GLOSSARySilica fumeSiloSlagStandard