6 - Vicat

6 - Vicat

6 - Vicat

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

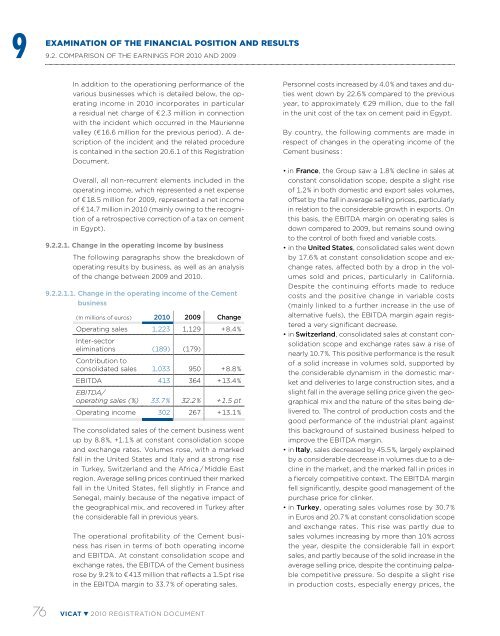

9EXAMINATION OF THE FINANCIAL POSITION AND RESULTS9.2. Comparison of the earnings for 2010 and 2009In addition to the operationing performance of thevarious businesses which is detailed below, the operatingincome in 2010 incorporates in particulara residual net charge of € 2.3 million in connectionwith the incident which occurred in the Mauriennevalley (€ 16.6 million for the previous period). A descriptionof the incident and the related procedureis contained in the section 20.6.1 of this RegistrationDocument.Overall, all non-recurrent elements included in theoperating income, which represented a net expenseof € 18.5 million for 2009, represented a net incomeof € 14.7 million in 2010 (mainly owing to the recognitionof a retrospective correction of a tax on cementin Egypt).9.2.2.1. Change in the operating income by businessThe following paragraphs show the breakdown ofoperating results by business, as well as an analysisof the change between 2009 and 2010.9.2.2.1.1. Change in the operating income of the Cementbusiness(In millions of euros) 2010 2009 ChangeOperating sales 1,223 1,129 + 8.4 %Inter-sectoreliminations (189) (179)Contribution toconsolidated sales 1,033 950 + 8.8 %EBITDA 413 364 + 13.4 %EBITDA/operating sales ( %) 33.7 % 32.2 % + 1.5 ptOperating income 302 267 + 13.1 %The consolidated sales of the cement business wentup by 8.8 %, +1.1 % at constant consolidation scopeand exchange rates. Volumes rose, with a markedfall in the United States and Italy and a strong risein Turkey, Switzerland and the Africa / Middle Eastregion. Average selling prices continued their markedfall in the United States, fell slightly in France andSenegal, mainly because of the negative impact ofthe geographical mix, and recovered in Turkey afterthe considerable fall in previous years.The operational profitability of the Cement businesshas risen in terms of both operating incomeand EBITDA. At constant consolidation scope andexchange rates, the EBITDA of the Cement businessrose by 9.2 % to € 413 million that reflects a 1.5 pt risein the EBITDA margin to 33.7 % of operating sales.Personnel costs increased by 4.0 % and taxes and dutieswent down by 22.6 % compared to the previousyear, to approximately € 29 million, due to the fallin the unit cost of the tax on cement paid in Egypt.By country, the following comments are made inrespect of changes in the operating income of theCement business :• in France, the Group saw a 1.8 % decline in sales atconstant consolidation scope, despite a slight riseof 1.2 % in both domestic and export sales volumes,offset by the fall in average selling prices, particularlyin relation to the considerable growth in exports. Onthis basis, the EBITDA margin on operating sales isdown compared to 2009, but remains sound owingto the control of both fixed and variable costs.• in the United States, consolidated sales went downby 17.6 % at constant consolidation scope and exchangerates, affected both by a drop in the volumessold and prices, particularly in California.Despite the continuing efforts made to reducecosts and the positive change in variable costs(mainly linked to a further increase in the use ofalternative fuels), the EBITDA margin again registereda very significant decrease.• in Switzerland, consolidated sales at constant consolidationscope and exchange rates saw a rise ofnearly 10.7 %. This positive performance is the resultof a solid increase in volumes sold, supported bythe considerable dynamism in the domestic marketand deliveries to large construction sites, and aslight fall in the average selling price given the geographicalmix and the nature of the sites being deliveredto. The control of production costs and thegood performance of the industrial plant againstthis background of sustained business helped toimprove the EBITDA margin.• in Italy, sales decreased by 45.5 %, largely explainedby a considerable decrease in volumes due to a declinein the market, and the marked fall in prices ina fiercely competitive context. The EBITDA marginfell significantly, despite good management of thepurchase price for clinker.• in Turkey, operating sales volumes rose by 30.7 %in Euros and 20.7 % at constant consolidation scopeand exchange rates. This rise was partly due tosales volumes increasing by more than 10 % acrossthe year, despite the considerable fall in exportsales, and partly because of the solid increase in theaverage selling price, despite the continuing palpablecompetitive pressure. So despite a slight risein production costs, especially energy prices, the76 VICAT 2010 registration document