6 - Vicat

6 - Vicat

6 - Vicat

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

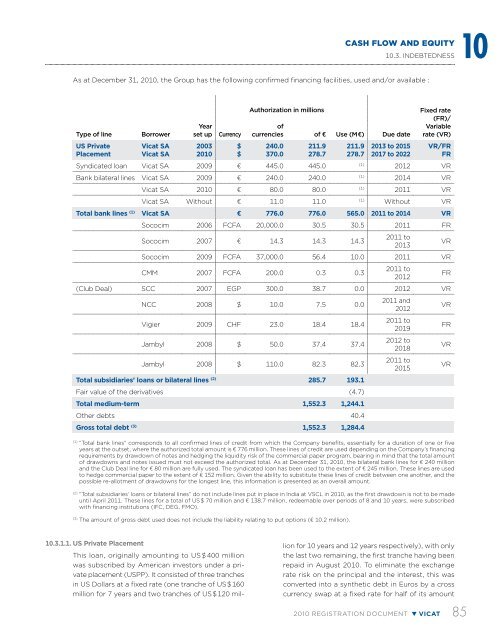

Cash flow and equity10.3. INDEBTEDNESS 10As at December 31, 2010, the Group has the following confirmed financing facilities, used and/or available :Type of lineUS PrivatePlacementBorrower<strong>Vicat</strong> SA<strong>Vicat</strong> SAYearset up20032010CurrencyAuthorization in millionsofcurrencies of €Use (M €)(1)“Total bank lines” corresponds to all confirmed lines of credit from which the Company benefits, essentially for a duration of one or fiveyears at the outset, where the authorized total amount is € 776 million. These lines of credit are used depending on the Company’s financingrequirements by drawdown of notes and hedging the liquidity risk of the commercial paper program, bearing in mind that the total amountof drawdowns and notes issued must not exceed the authorized total. As at December 31, 2010, the bilateral bank lines for € 240 millionand the Club Deal line for € 80 million are fully used. The syndicated loan has been used to the extent of € 245 million. These lines are usedto hedge commercial paper to the extent of € 152 million. Given the ability to substitute these lines of credit between one another, and thepossible re-allotment of drawdowns for the longest line, this information is presented as an overall amount.(2)“Total subsidiaries’ loans or bilateral lines” do not include lines put in place in India at VSCL in 2010, as the first drawdown is not to be madeuntil April 2011. These lines for a total of US $ 70 million and € 138.7 million, redeemable over periods of 8 and 10 years, were subscribedwith financing institutions (IFC, DEG, FMO).(3)The amount of gross debt used does not include the liability relating to put options (€ 10.2 million).$$240.0370.0211.9278.7211.9278.7Due date2013 to 20152017 to 2022Fixed rate(FR)/Variablerate (VR)VR/FRFRSyndicated loan <strong>Vicat</strong> SA 2009 € 445.0 445.0(1)2012 VRBank bilateral lines <strong>Vicat</strong> SA 2009 € 240.0 240.0(1)2014 VR<strong>Vicat</strong> SA 2010 € 80.0 80.0(1)2011 VR<strong>Vicat</strong> SA Without € 11.0 11.0(1)Without VRTotal bank lines (1) <strong>Vicat</strong> SA € 776.0 776.0 565.0 2011 to 2014 VRSococim 2006 FCFA 20,000.0 30.5 30.5 2011 FRSococim 2007 € 14.3 14.3 14.32011 to2013Sococim 2009 FCFA 37,000.0 56.4 10.0 2011 VRCMM 2007 FCFA 200.0 0.3 0.32011 to2012(Club Deal) SCC 2007 EGP 300.0 38.7 0.0 2012 VRNCC 2008 $ 10.0 7.5 0.0Vigier 2009 CHF 23.0 18.4 18.4Jambyl 2008 $ 50.0 37.4 37.4Jambyl 2008 $ 110.0 82.3 82.3Total subsidiaries’ loans or bilateral lines (2) 285.7 193.1Fair value of the derivatives (4.7)Total medium-term 1,552.3 1,244.1Other debts 40.4Gross total debt (3) 1,552.3 1,284.42011 and20122011 to20192012 to20182011 to2015VRFRVRFRVRVR10.3.1.1. US Private PlacementThis loan, originally amounting to US $ 400 millionwas subscribed by American investors under a privateplacement (USPP). It consisted of three tranchesin US Dollars at a fixed rate (one tranche of US $ 160million for 7 years and two tranches of US $ 120 millionfor 10 years and 12 years respectively), with onlythe last two remaining, the first tranche having beenrepaid in August 2010. To eliminate the exchangerate risk on the principal and the interest, this wasconverted into a synthetic debt in Euros by a crosscurrency swap at a fixed rate for half of its amount2010 registration document VICAT 85