6 - Vicat

6 - Vicat

6 - Vicat

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

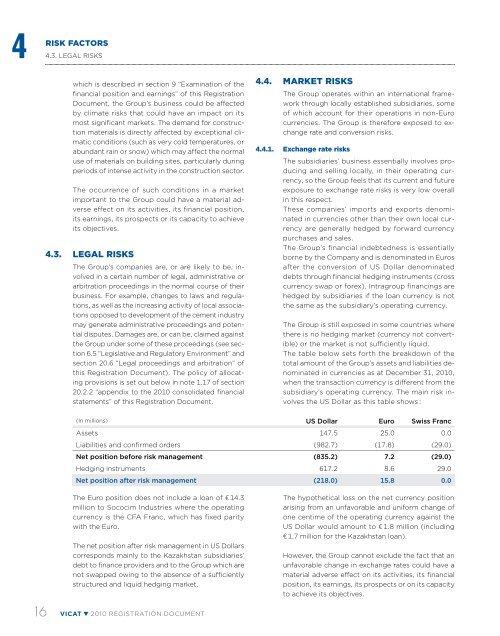

4RISK FACTORS4.3. Legal riskswhich is described in section 9 “Examination of thefinancial position and earnings” of this RegistrationDocument, the Group’s business could be affectedby climate risks that could have an impact on itsmost significant markets. The demand for constructionmaterials is directly affected by exceptional climaticconditions (such as very cold temperatures, orabundant rain or snow) which may affect the normaluse of materials on building sites, particularly duringperiods of intense activity in the construction sector.The occurrence of such conditions in a marketimportant to the Group could have a material adverseeffect on its activities, its financial position,its earnings, its prospects or its capacity to achieveits objectives.4.3. Legal risksThe Group’s companies are, or are likely to be, involvedin a certain number of legal, administrative orarbitration proceedings in the normal course of theirbusiness. For example, changes to laws and regulations,as well as the increasing activity of local associationsopposed to development of the cement industrymay generate administrative proceedings and potentialdisputes. Damages are, or can be, claimed againstthe Group under some of these proceedings (see section6.5 “Legislative and Regulatory Environment” andsection 20.6 “Legal proceedings and arbitration” ofthis Registration Document). The policy of allocatingprovisions is set out below in note 1.17 of section20.2.2 “appendix to the 2010 consolidated financialstatements” of this Registration Document.4.4. Market risksThe Group operates within an international frameworkthrough locally established subsidiaries, someof which account for their operations in non-Eurocurrencies. The Group is therefore exposed to exchangerate and conversion risks.4.4.1. Exchange rate risksThe subsidiaries’ business essentially involves producingand selling locally, in their operating currency,so the Group feels that its current and futureexposure to exchange rate risks is very low overallin this respect.These companies’ imports and exports denominatedin currencies other than their own local currencyare generally hedged by forward currencypurchases and sales.The Group’s financial indebtedness is essentiallyborne by the Company and is denominated in Eurosafter the conversion of US Dollar denominateddebts through financial hedging instruments (crosscurrency swap or forex). Intragroup financings arehedged by subsidiaries if the loan currency is notthe same as the subsidiary’s operating currency.The Group is still exposed in some countries wherethere is no hedging market (currency not convertible)or the market is not sufficiently liquid.The table below sets forth the breakdown of thetotal amount of the Group’s assets and liabilities denominatedin currencies as at December 31, 2010,when the transaction currency is different from thesubsidiary’s operating currency. The main risk involvesthe US Dollar as this table shows :(In millions) US Dollar Euro Swiss FrancAssets 147.5 25.0 0.0Liabilities and confirmed orders (982.7) (17.8) (29.0)Net position before risk management (835.2) 7.2 (29.0)Hedging instruments 617.2 8.6 29.0Net position after risk management (218.0) 15.8 0.0The Euro position does not include a loan of € 14.3million to Sococim Industries where the operatingcurrency is the CFA Franc, which has fixed paritywith the Euro.The net position after risk management in US Dollarscorresponds mainly to the Kazakhstan subsidiaries’debt to finance providers and to the Group which arenot swapped owing to the absence of a sufficientlystructured and liquid hedging market.The hypothetical loss on the net currency positionarising from an unfavorable and uniform change ofone centime of the operating currency against theUS Dollar would amount to € 1.8 million (including€ 1.7 million for the Kazakhstan loan).However, the Group cannot exclude the fact that anunfavorable change in exchange rates could have amaterial adverse effect on its activities, its financialposition, its earnings, its prospects or on its capacityto achieve its objectives.16 VICAT 2010 registration document