6 - Vicat

6 - Vicat

6 - Vicat

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

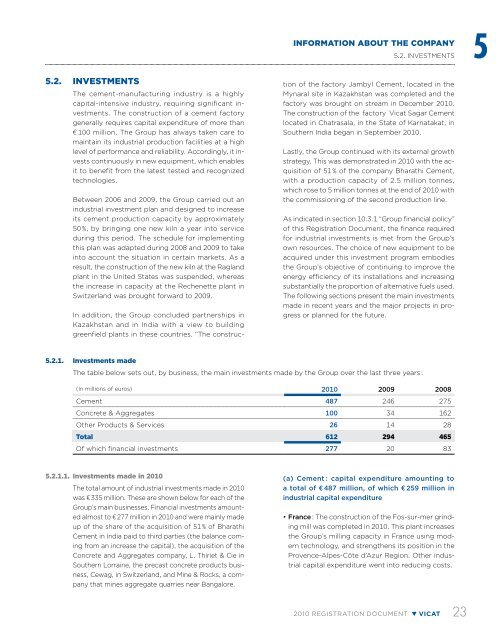

INFORMATION ABOUT THE COMPANY5.2. Investments 55.2. InvestmentsThe cement-manufacturing industry is a highlycapital-intensive industry, requiring significant investments.The construction of a cement factorygenerally requires capital expenditure of more than€ 100 million. The Group has always taken care tomaintain its industrial production facilities at a highlevel of performance and reliability. Accordingly, it investscontinuously in new equipment, which enablesit to benefit from the latest tested and recognizedtechnologies.Between 2006 and 2009, the Group carried out anindustrial investment plan and designed to increaseits cement production capacity by approximately50 %, by bringing one new kiln a year into serviceduring this period. The schedule for implementingthis plan was adapted during 2008 and 2009 to takeinto account the situation in certain markets. As aresult, the construction of the new kiln at the Raglandplant in the United States was suspended, whereasthe increase in capacity at the Rechenette plant inSwitzerland was brought forward to 2009.In addition, the Group concluded partnerships inKazakhstan and in India with a view to buildinggreenfield plants in these countries. “The constructionof the factory Jambyl Cement, located in theMynaral site in Kazakhstan was completed and thefactory was brought on stream in December 2010.The construction of the factory <strong>Vicat</strong> Sagar Cementlocated in Chatrasala, in the State of Karnatakat, inSouthern India began in September 2010.Lastly, the Group continued with its external growthstrategy. This was demonstrated in 2010 with the acquisitionof 51 % of the company Bharathi Cement,with a production capacity of 2.5 million tonnes,which rose to 5 million tonnes at the end of 2010 withthe commissioning of the second production line.As indicated in section 10.3.1 “Group financial policy”of this Registration Document, the finance requiredfor industrial investments is met from the Group’sown resources. The choice of new equipment to beacquired under this investment program embodiesthe Group’s objective of continuing to improve theenergy efficiency of its installations and increasingsubstantially the proportion of alternative fuels used.The following sections present the main investmentsmade in recent years and the major projects in progressor planned for the future.5.2.1. Investments madeThe table below sets out, by business, the main investments made by the Group over the last three years :(In millions of euros) 2010 2009 2008Cement 487 246 275Concrete & Aggregates 100 34 162Other Products & Services 26 14 28Total 612 294 465Of which financial investments 277 20 835.2.1.1. Investments made in 2010The total amount of industrial investments made in 2010was € 335 million. These are shown below for each of theGroup’s main businesses. Financial investments amountedalmost to € 277 million in 2010 and were mainly madeup of the share of the acquisition of 51 % of BharathiCement in India paid to third parties (the balance comingfrom an increase the capital), the acquisition of theConcrete and Aggregates company, L. Thiriet & Cie inSouthern Lorraine, the precast concrete products business,Cewag, in Switzerland, and Mine & Rocks, a companythat mines aggregate quarries near Bangalore.(a) Cement : capital expenditure amounting toa total of € 487 million, of which € 259 million inindustrial capital expenditure• France : The construction of the Fos-sur-mer grindingmill was completed in 2010. This plant increasesthe Group’s milling capacity in France using moderntechnology, and strengthens its position in theProvence-Alpes-Côte d’Azur Region. Other industrialcapital expenditure went into reducing costs.2010 registration document VICAT 23