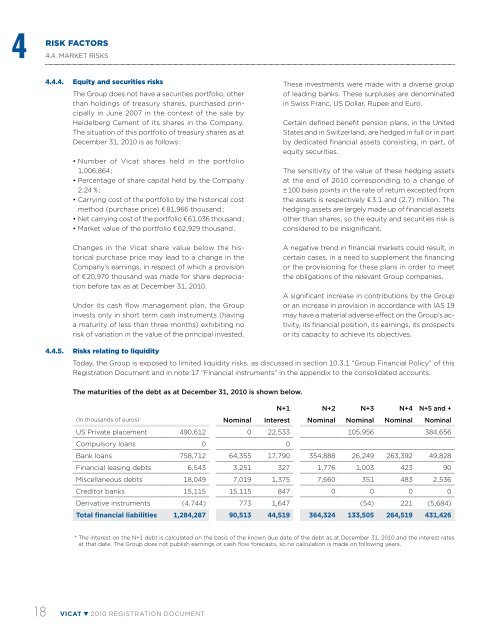

4RISK FACTORS4.4. Market Risks4.4.4. Equity and securities risksThe Group does not have a securities portfolio, otherthan holdings of treasury shares, purchased principallyin June 2007 in the context of the sale byHeidelberg Cement of its shares in the Company.The situation of this portfolio of treasury shares as atDecember 31, 2010 is as follows :• Number of <strong>Vicat</strong> shares held in the portfolio1,006,864 ;• Percentage of share capital held by the Company2.24 % ;• Carrying cost of the portfolio by the historical costmethod (purchase price) € 81,966 thousand ;• Net carrying cost of the portfolio € 61,036 thousand ;• Market value of the portfolio € 62,929 thousand .Changes in the <strong>Vicat</strong> share value below the historicalpurchase price may lead to a change in theCompany’s earnings, in respect of which a provisionof € 20,970 thousand was made for share depreciationbefore tax as at December 31, 2010.Under its cash flow management plan, the Groupinvests only in short term cash instruments (havinga maturity of less than three months) exhibiting norisk of variation in the value of the principal invested.These investments were made with a diverse groupof leading banks. These surpluses are denominatedin Swiss Franc, US Dollar, Rupee and Euro.Certain defined benefit pension plans, in the UnitedStates and in Switzerland, are hedged in full or in partby dedicated financial assets consisting, in part, ofequity securities.The sensitivity of the value of these hedging assetsat the end of 2010 corresponding to a change of± 100 basis points in the rate of return excepted fromthe assets is respectively € 3.1 and (2.7) million. Thehedging assets are largely made up of financial assetsother than shares, so the equity and securities risk isconsidered to be insignificant.A negative trend in financial markets could result, incertain cases, in a need to supplement the financingor the provisioning for these plans in order to meetthe obligations of the relevant Group companies.A significant increase in contributions by the Groupor an increase in provision in accordance with IAS 19may have a material adverse effect on the Group’s activity,its financial position, its earnings, its prospectsor its capacity to achieve its objectives.4.4.5. Risks relating to liquidityToday, the Group is exposed to limited liquidity risks, as discussed in section 10.3.1 “Group Financial Policy” of thisRegistration Document and in note 17 “Financial instruments” in the appendix to the consolidated accounts.The maturities of the debt as at December 31, 2010 is shown below.N+1 N+2 N+3 N+4 N+5 and +(In thousands of euros) Nominal Interest Nominal Nominal Nominal NominalUS Private placement 490,612 0 22,533 105,956 384,656Compulsory loans 0 0Bank loans 758,712 64,355 17,790 354,888 26,249 263,392 49,828Financial leasing debts 6,543 3,251 327 1,776 1,003 423 90Miscellaneous debts 18,049 7,019 1,375 7,660 351 483 2,536Creditor banks 15,115 15,115 847 0 0 0 0Derivative instruments (4,744) 773 1,647 (54) 221 (5,684)Total financial liabilities 1,284,287 90,513 44,519 364,324 133,505 264,519 431,426* The interest on the N+1 debt is calculated on the basis of the known due date of the debt as at December 31, 2010 and the interest ratesat that date. The Group does not publish earnings or cash flow forecasts, so no calculation is made on following years.18 VICAT 2010 registration document

4RISK FACTORS4.5. Risks related to the companyThe liquidity risk is therefore covered by surpluses inthe cash flow as well as by the availability of unusedconfirmed credit lines for the Company, over 1 and4 year periods.Considering the small number of companies concerned,essentially <strong>Vicat</strong> SA, the parent company ofthe Group, the low level of net debt (as at December31, 2010 the Group’s gearing and leverage were38.6 % and 195.9 % respectively) and the liquidity ofthe Group’s balance sheet, the existence of covenantscontained in some of these credit lines agreementsdoes not constitute a risk for the Group’s financialposition. At December 31, 2010, the Group is compliantwith all ratios required by covenants in containedfinancing contracts.4.5. Risks related to the company4.5.1. Risks related to dependence on managers andkey employeesThe Group’s future success relies, in particular, onthe complete involvement of its senior managers.The management team has been marked by stabilityover a long period (service with the Group in mostcases of over fifteen years) and benefits from significantexperience of the markets in which the Groupoperates.In addition, the Group’s continuing growth will requirethe recruitment of a qualified and internationallymobile supervisory staff. Should the Groupsuddenly lose several of its managers or be unableto attract these key employees, it could encounterdifficulties affecting its competitiveness and itsprofitability. These difficulties could have a materialadverse effect on the Group’s activities, its financialposition, its results of operations and prospects oron its capacity to achieve its objectives.4.5.2. Risks relating to the financial organization of theGroupSome of the Group’s subsidiaries are located in countriesthat can be subject to constraints as regardstaxation or exchange controls restricting or makingmore expensive the distribution of dividends outsideof these countries. Although the Group considersthat this risk is limited, it cannot exclude the possibilitythat this may happen in the future, which couldhave a material adverse effect on its activities, itsfinancial position, results of operations, prospects oron its capacity to achieve its objectives.4.5.3. Risks related to dependence on customersTo date, the Group carries out its three businesses ineleven countries with a varied customer base. Indeed,customers of the Cement, Concrete & Aggregatesbusinesses and of the Other Products & Servicesare distinct economic players in each of the marketswhere the Group operates: primarily distributors andconcrete mixers for the Cement business, constructionand public works contractors for the Concrete& Aggregates business, and others depending onthe sectors comprising Other Products & Services.The Group does not have global customers presentacross a number of these markets.Nevertheless, some of the Group’s best customersare also important counterparties, in particular, inthe Cement business, whose loss would be damagingto the Group’s positions in the relevant markets.Although the Group considers that such a risk is limited,it cannot exclude the possibility that such a lossmight occur in one or more of its markets, whichcould have a material adverse effect on its activitiesin the country concerned, its financial position, itsresults of operations, its prospects or on its capacityto achieve its objectives.4.6. Risk managementThe risk hedging policy is defined by the Group’s CEOand is implemented under the supervision of the deputyCEOs of the Group, with the assistance of the legaldepartment. This policy aims to identify potential risks,and define and implement measures to limit these risksthrough prevention and hedging policies, in order topromote controlled risk management. For each risk,detailed above in sections 4.1 to 4.5, the measurestaken to hedge the risk are specified where applicable.In addition, the Group’s policy on internal audit isdescribed in appendix 1 “Report by the President onthe corporate governance and internal audit” of thisRegistration Document.4.6.1. Risk prevention policyThe risk prevention policy is an integral part of theGroup’s industrial policy. It is the responsibility ofeach operational manager, by country or type ofbusiness, and is based, in particular, on the choiceof first-rank suppliers for industrial investments, onthe constitution of buffer stocks, on the institutionof monitoring and risk prevention procedures andon a training policy. The Group has also establishedan Internal Audit department which reports to theGroup’s General Management and is able to involveitself in all the Group’s businesses and subsidiaries.2010 registration document VICAT 19

- Page 1 and 2: ReGIstRAtIonDoCUMent& FInAnCIALAnnU

- Page 3 and 4: ContentsPage1 Person responsible fo

- Page 5 and 6: 1PeRsonResPonsIBLe FoRtHe ReGIstRAt

- Page 8 and 9: 3seLeCteDFInAnCIALInFoRMAtIon3.1. o

- Page 10 and 11: 3SELECTED FINANCIAL INFORMATION3.2.

- Page 12 and 13: 3SELECTED FINANCIAL INFORMATION3.2.

- Page 14 and 15: 4RIsK FACtoRs4.1. risks relating to

- Page 16 and 17: 4RISK FACTORS4.1. Risks relating to

- Page 18: 4RISK FACTORS4.3. Legal riskswhich

- Page 23 and 24: 5InFoRMAtIonABoUttHe CoMPAnY5.1. Hi

- Page 25 and 26: INFORMATION ABOUT THE COMPANY5.2. I

- Page 27 and 28: INFORMATION ABOUT THE COMPANY5.2. I

- Page 29 and 30: 6BUsInessoVeRVIeW6.1. overview of t

- Page 31 and 32: 6BUSINESS OVERVIEW6.2. Group streng

- Page 33 and 34: 6BUSINESS OVERVIEW6.2. Group streng

- Page 35 and 36: 6BUSINESS OVERVIEW6.3. Description

- Page 37 and 38: 6BUSINESS OVERVIEW6.3. Description

- Page 39 and 40: 6BUSINESS OVERVIEW6.3. Description

- Page 41 and 42: 6BUSINESS OVERVIEW6.3. Description

- Page 43 and 44: 6BUSINESS OVERVIEW6.3. Description

- Page 45 and 46: 6BUSINESS OVERVIEW6.3. Description

- Page 47 and 48: 6BUSINESS OVERVIEW6.3. Description

- Page 49 and 50: 6BUSINESS OVERVIEW6.3. Description

- Page 51 and 52: 6BUSINESS OVERVIEW6.3. Description

- Page 53 and 54: 6BUSINESS OVERVIEW6.3. Description

- Page 55 and 56: 6BUSINESS OVERVIEW6.3. Description

- Page 57 and 58: 6BUSINESS OVERVIEW6.3. Description

- Page 59 and 60: 7oRGAnIsAtIonCHARt7.1. Simplified l

- Page 61 and 62: 7ORGANISATION CHART7.2. Information

- Page 63 and 64: 7ORGANISATION CHART7.2. Information

- Page 65 and 66: REAL ESTATE, FACTORIES AND EQUIPMEN

- Page 67 and 68: REAL ESTATE, FACTORIES AND EQUIPMEN

- Page 69 and 70:

REAL ESTATE, FACTORIES AND EQUIPMEN

- Page 71 and 72:

9eXAMInAtIonoF tHe FInAnCIALPosItIo

- Page 73 and 74:

EXAMINATION OF THE FINANCIAL POSITI

- Page 75 and 76:

EXAMINATION OF THE FINANCIAL POSITI

- Page 77 and 78:

EXAMINATION OF THE FINANCIAL POSITI

- Page 79 and 80:

EXAMINATION OF THE FINANCIAL POSITI

- Page 81 and 82:

EXAMINATION OF THE FINANCIAL POSITI

- Page 83 and 84:

10CAsH FLoWAnD eQUItY10.1. EQuItY 8

- Page 85 and 86:

Cash flow and equity10.2. Cash flow

- Page 87 and 88:

Cash flow and equity10.3. INDEBTEDN

- Page 89 and 90:

Cash flow and equity10.3. INDEBTEDN

- Page 91 and 92:

10Cash flow and equity10.4. ANALYSI

- Page 93 and 94:

RESEARCH AND DEVELOPMENT, PATENTS A

- Page 95 and 96:

Information on trends12.2. Trends a

- Page 97 and 98:

13PRoFIt FoReCAstsoR estIMAtesThe C

- Page 99 and 100:

14ADMINISTRATION AND GENERAL MANAGE

- Page 101 and 102:

14ADMINISTRATION AND GENERAL MANAGE

- Page 103 and 104:

ADMINISTRATION AND GENERAL MANAGEME

- Page 105 and 106:

15ReMUneRAtIonAnD BeneFIts15.1. rem

- Page 107 and 108:

15REMUNERATION AND BENEFITS15.2. Pe

- Page 109 and 110:

16oPeRAtIon oFtHe ADMInIstRAtIVeAnD

- Page 111 and 112:

OPERATION OF THE ADMINISTRATIVE AND

- Page 113 and 114:

OPERATION OF THE ADMINISTRATIVE AND

- Page 115 and 116:

17EMPLOYEES17.1. Overview17.1.1. Br

- Page 117 and 118:

17EMPLOYEES17.1. OverviewHuman Reso

- Page 119 and 120:

EMPLOYEES17.4. Shareholding of the

- Page 121 and 122:

18PRInCIPALsHAReHoLDeRs18.1. distri

- Page 123 and 124:

19oPeRAtIonsWItH ReLAteD19.1. contr

- Page 125 and 126:

19OPeRATIONS with related19.3. Stat

- Page 127 and 128:

Financial information on the assets

- Page 129 and 130:

Financial information on the assets

- Page 131 and 132:

Financial information on the assets

- Page 133 and 134:

Financial information on the assets

- Page 135 and 136:

Financial information on the assets

- Page 137 and 138:

Financial information on the assets

- Page 139 and 140:

Financial information on the assets

- Page 141 and 142:

Financial information on the assets

- Page 143 and 144:

Financial information on the assets

- Page 145 and 146:

Financial information on the assets

- Page 147 and 148:

Financial information on the assets

- Page 149 and 150:

Financial information on the assets

- Page 151 and 152:

Financial information on the assets

- Page 153 and 154:

Financial information on the assets

- Page 155 and 156:

Financial information on the assets

- Page 157 and 158:

Financial information on the assets

- Page 159 and 160:

Financial information on the assets

- Page 161 and 162:

Financial information on the assets

- Page 163 and 164:

Financial information on the assets

- Page 165 and 166:

Financial information on the assets

- Page 167 and 168:

Financial information on the assets

- Page 169 and 170:

Financial information on the assets

- Page 171 and 172:

Financial information on the assets

- Page 173 and 174:

Financial information on the assets

- Page 175 and 176:

Financial information on the assets

- Page 177 and 178:

Financial information on the assets

- Page 179:

Financial information on the assets

- Page 182 and 183:

information on the assets and liabi

- Page 184 and 185:

information on the assets and liabi

- Page 186 and 187:

information on the assets and liabi

- Page 188 and 189:

20information on the assets and lia

- Page 190 and 191:

21ADDITIONAL INFORMATION21.1. Share

- Page 192 and 193:

21 21.2.ADDITIONAL INFORMATIONConst

- Page 194 and 195:

21ADDITIONAL INFORMATION21.2. Const

- Page 196 and 197:

21ADDITIONAL INFORMATION21.2. Const

- Page 198 and 199:

22sIGnIFICAntContRACtsGiven its act

- Page 200 and 201:

24DoCUMentsAVAILABLeto tHe PUBLICOf

- Page 202 and 203:

APPenDIX1report by the president on

- Page 204 and 205:

1APPENDIXReport by the president on

- Page 206 and 207:

1APPENDIXReport by the president on

- Page 208 and 209:

1APPENDIXReport by the president on

- Page 210 and 211:

1APPENDIXReport by the president on

- Page 212 and 213:

2appendixStatutory auditors’ repo

- Page 214 and 215:

3APPENDIXAnnual information1. Refer

- Page 216 and 217:

APPenDIX4eLeMentsConstItUtInGtHe FI

- Page 218 and 219:

GLossARY216 VICAT 2010 registration

- Page 220 and 221:

GLOSSARyCarbonationCEMCEM I(formerl

- Page 222 and 223:

GLOSSARyElectrostatic filterExhaust

- Page 224 and 225:

GLOSSARyMixerApparatus used to mix

- Page 226:

GLOSSARySilica fumeSiloSlagStandard