6 - Vicat

6 - Vicat

6 - Vicat

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

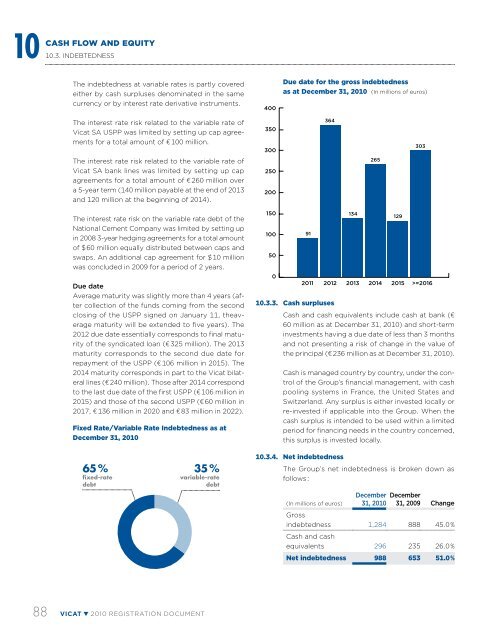

10 10.3.Cash flow and equityINDEBTEDNESSThe indebtedness at variable rates is partly coveredeither by cash surpluses denominated in the samecurrency or by interest rate derivative instruments.400Due date for the gross indebtednessas at December 31, 2010 (In millions of euros)The interest rate risk related to the variable rate of<strong>Vicat</strong> SA USPP was limited by setting up cap agreementsfor a total amount of € 100 million.350300364303The interest rate risk related to the variable rate of<strong>Vicat</strong> SA bank lines was limited by setting up capagreements for a total amount of € 260 million overa 5-year term (140 million payable at the end of 2013and 120 million at the beginning of 2014).250200265The interest rate risk on the variable rate debt of theNational Cement Company was limited by setting upin 2008 3-year hedging agreements for a total amountof $ 60 million equally distributed between caps andswaps. An additional cap agreement for $ 10 millionwas concluded in 2009 for a period of 2 years.Due dateAverage maturity was slightly more than 4 years (aftercollection of the funds coming from the secondclosing of the USPP signed on January 11, theaveragematurity will be extended to five years). The2012 due date essentially corresponds to final maturityof the syndicated loan (€ 325 million). The 2013maturity corresponds to the second due date forrepayment of the USPP (€ 106 million in 2015). The2014 maturity corresponds in part to the <strong>Vicat</strong> bilaterallines (€ 240 million). Those after 2014 correspondto the last due date of the first USPP (€ 106 million in2015) and those of the second USPP (€ 60 million in2017, € 136 million in 2020 and € 83 million in 2022).Fixed Rate/Variable Rate Indebtedness as atDecember 31, 2010150100500911342011 2012 2013 2014 2015 >=201610.3.3. Cash surplusesCash and cash equivalents include cash at bank (€60 million as at December 31, 2010) and short-terminvestments having a due date of less than 3 monthsand not presenting a risk of change in the value ofthe principal (€ 236 million as at December 31, 2010).Cash is managed country by country, under the controlof the Group’s financial management, with cashpooling systems in France, the United States andSwitzerland. Any surplus is either invested locally orre-invested if applicable into the Group. When thecash surplus is intended to be used within a limitedperiod for financing needs in the country concerned,this surplus is invested locally.12965 %fixed-ratedebt35 %variable-ratedebt10.3.4. Net indebtednessThe Group’s net indebtedness is broken down asfollows :(In millions of euros)December31, 2010December31, 2009 ChangeGrossindebtedness 1,284 888 45.0 %Cash and cashequivalents 296 235 26.0 %Net indebtedness 988 653 51.0 %88 VICAT 2010 registration document