6 - Vicat

6 - Vicat

6 - Vicat

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

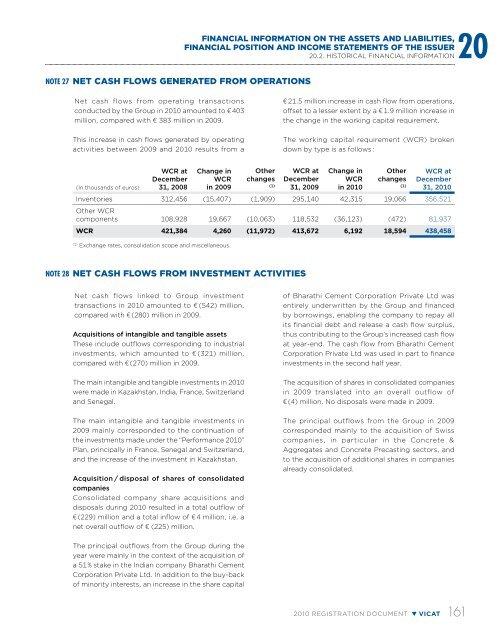

Financial information on the assets and liabilities,financial position and income statements of the issuer20.2. Historical financial information20note 27NET CASH FLOWS GENERATED FROM OPERATIONSNet cash flows from operating transactionsconducted by the Group in 2010 amounted to € 403million, compared with € 383 million in 2009.This increase in cash flows generated by operatingactivities between 2009 and 2010 results from a€ 21.5 million increase in cash flow from operations,offset to a lesser extent by a € 1.9 million increase inthe change in the working capital requirement.The working capital requirement (WCR) brokendown by type is as follows :(In thousands of euros)WCR atDecember31, 2008Change inWCRin 2009Otherchanges(1)WCR atDecember31, 2009Change inWCRin 2010Otherchanges(1)WCR atDecember31, 2010Inventories 312,456 (15,407) (1,909) 295,140 42,315 19,066 356,521Other WCRcomponents 108,928 19,667 (10,063) 118,532 (36,123) (472) 81,937WCR 421,384 4,260 (11,972) 413,672 6,192 18,594 438,458(1)Exchange rates, consolidation scope and miscellaneous.note 28 NET CASH FLOWS FROM INVESTMENT ACTIVITIESNet cash flows linked to Group investmenttransactions in 2010 amounted to € (542) million,compared with € (280) million in 2009.Acquisitions of intangible and tangible assetsThese include outflows corresponding to industrialinvestments, which amounted to € (321) million,compared with € (270) million in 2009.The main intangible and tangible investments in 2010were made in Kazakhstan, India, France, Switzerlandand Senegal.The main intangible and tangible investments in2009 mainly corresponded to the continuation ofthe investments made under the “Performance 2010”Plan, principally in France, Senegal and Switzerland,and the increase of the investment in Kazakhstan.Acquisition / disposal of shares of consolidatedcompaniesConsolidated company share acquisitions anddisposals during 2010 resulted in a total outflow of€ (229) million and a total inflow of € 4 million, i.e. anet overall outflow of € (225) million.of Bharathi Cement Corporation Private Ltd wasentirely underwritten by the Group and financedby borrowings, enabling the company to repay allits financial debt and release a cash flow surplus,thus contributing to the Group’s increased cash flowat year-end. The cash flow from Bharathi CementCorporation Private Ltd was used in part to financeinvestments in the second half year.The acquisition of shares in consolidated companiesin 2009 translated into an overall outflow of€ (4) million. No disposals were made in 2009.The principal outflows from the Group in 2009corresponded mainly to the acquisition of Swisscompanies, in particular in the Concrete &Aggregates and Concrete Precasting sectors, andto the acquisition of additional shares in companiesalready consolidated.The principal outflows from the Group during theyear were mainly in the context of the acquisition ofa 51 % stake in the Indian company Bharathi CementCorporation Private Ltd. In addition to the buy-backof minority interests, an increase in the share capital2010 registration document VICAT 161