6 - Vicat

6 - Vicat

6 - Vicat

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

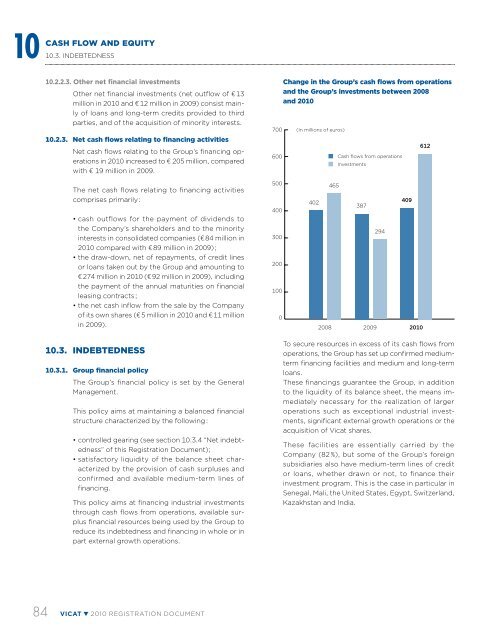

10 10.3.Cash flow and equityINDEBTEDNESS10.2.2.3. Other net financial investmentsOther net financial investments (net outflow of € 13million in 2010 and € 12 million in 2009) consist mainlyof loans and long-term credits provided to thirdparties, and of the acquisition of minority interests.10.2.3. Net cash flows relating to financing activitiesNet cash flows relating to the Group’s financing operationsin 2010 increased to € 205 million, comparedwith € 19 million in 2009.700600Change in the Group’s cash flows from operationsand the Group’s investments between 2008and 2010(In millions of euros)Cash flows from operationsInvestments612The net cash flows relating to financing activitiescomprises primarily :• cash outflows for the payment of dividends tothe Company’s shareholders and to the minorityinterests in consolidated companies (€ 84 million in2010 compared with € 89 million in 2009) ;• the draw-down, net of repayments, of credit linesor loans taken out by the Group and amounting to€ 274 million in 2010 (€ 92 million in 2009), includingthe payment of the annual maturities on financialleasing contracts ;• the net cash inflow from the sale by the Companyof its own shares (€ 5 million in 2010 and € 11 millionin 2009).500400300200100040220084654093872942009 201010.3. INDEBTEDNESS10.3.1. Group financial policyThe Group’s financial policy is set by the GeneralManagement.This policy aims at maintaining a balanced financialstructure characterized by the following :• controlled gearing (see section 10.3.4 “Net indebtedness”of this Registration Document);• satisfactory liquidity of the balance sheet characterizedby the provision of cash surpluses andconfirmed and available medium-term lines offinancing.This policy aims at financing industrial investmentsthrough cash flows from operations, available surplusfinancial resources being used by the Group toreduce its indebtedness and financing in whole or inpart external growth operations.To secure resources in excess of its cash flows fromoperations, the Group has set up confirmed mediumtermfinancing facilities and medium and long-termloans.These financings guarantee the Group, in additionto the liquidity of its balance sheet, the means immediatelynecessary for the realization of largeroperations such as exceptional industrial investments,significant external growth operations or theacquisition of <strong>Vicat</strong> shares.These facilities are essentially carried by theCompany (82 %), but some of the Group’s foreignsubsidiaries also have medium-term lines of creditor loans, whether drawn or not, to finance theirinvestment program. This is the case in particular inSenegal, Mali, the United States, Egypt, Switzerland,Kazakhstan and India.84 VICAT 2010 registration document