6 - Vicat

6 - Vicat

6 - Vicat

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

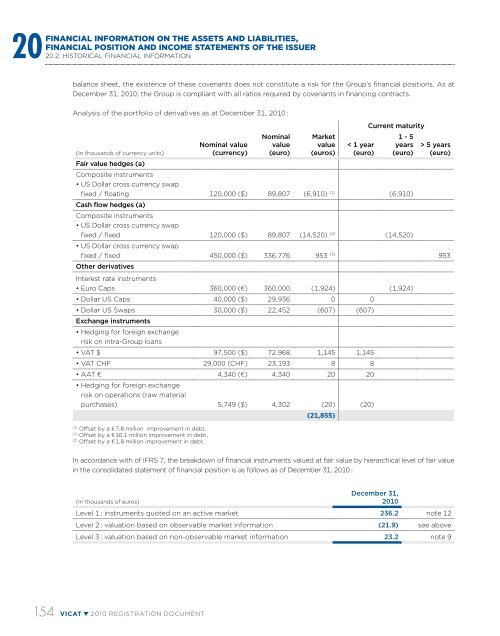

Financial information on the assets and liabilities,financial position and income statements of the issuer2020.2. Historical financial informationbalance sheet, the existence of these covenants does not constitute a risk for the Group’s financial positions. As atDecember 31, 2010, the Group is compliant with all ratios required by covenants in financing contracts.Analysis of the portfolio of derivatives as at December 31, 2010 :(In thousands of currency units)Fair value hedges (a)Nominal value(currency)Nominalvalue(euro)Marketvalue(euros)< 1 year(euro)Current maturity1 - 5years(euro)> 5 years(euro)Composite instruments• US Dollar cross currency swapfixed / floating 120,000 ($) 89,807 (6,910) (1) (6,910)Cash flow hedges (a)Composite instruments• US Dollar cross currency swapfixed / fixed 120,000 ($) 89,807 (14,520) (2) (14,520)• US Dollar cross currency swapfixed / fixed 450,000 ($) 336,776 953 (3) 953Other derivativesInterest rate instruments• Euro Caps 360,000 (€) 360,000 (1,924) (1,924)• Dollar US Caps 40,000 ($) 29,936 0 0• Dollar US Swaps 30,000 ($) 22,452 (607) (607)Exchange instruments• Hedging for foreign exchangerisk on intra-Group loans• VAT $ 97,500 ($) 72,968 1,145 1,145• VAT CHF 29,000 (CHF) 23,193 8 8• AAT € 4,340 (€) 4,340 20 20• Hedging for foreign exchangerisk on operations (raw materialpurchases) 5,749 ($) 4,302 (20) (20)(21,855)(1)Offset by a € 7.8 million improvement in debt.(2)Offset by a € 16.1 million improvement in debt.(3)Offset by a € 1.8 million improvement in debt.In accordance with of IFRS 7, the breakdown of financial instruments valued at fair value by hierarchical level of fair valuein the consolidated statement of financial position is as follows as of December 31, 2010 :December 31,(In thousands of euros)2010Level 1 : instruments quoted on an active market 236.2 note 12Level 2 : valuation based on observable market information (21.9) see aboveLevel 3 : valuation based on non-observable market information 23.2 note 9154 VICAT 2010 registration document