Plan Administrator's Guide â List Bill - RBC Insurance

Plan Administrator's Guide â List Bill - RBC Insurance

Plan Administrator's Guide â List Bill - RBC Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

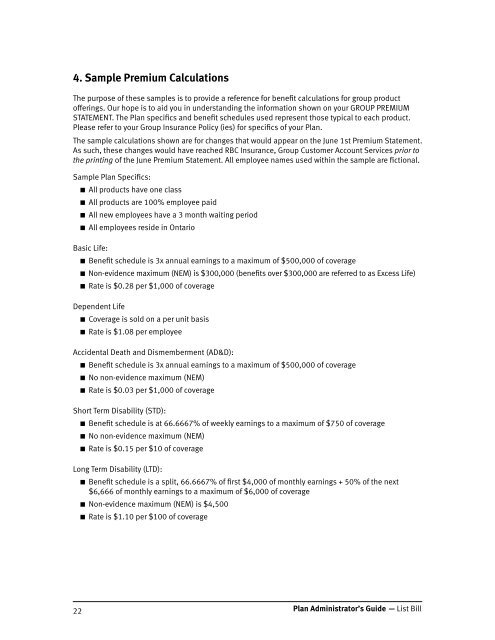

4. Sample Premium CalculationsThe purpose of these samples is to provide a reference for benefit calculations for group productofferings. Our hope is to aid you in understanding the information shown on your GROUP PREMIUMSTATEMENT. The <strong>Plan</strong> specifics and benefit schedules used represent those typical to each product.Please refer to your Group <strong>Insurance</strong> Policy (ies) for specifics of your <strong>Plan</strong>.The sample calculations shown are for changes that would appear on the June 1st Premium Statement.As such, these changes would have reached <strong>RBC</strong> <strong>Insurance</strong>, Group Customer Account Services prior tothe printing of the June Premium Statement. All employee names used within the sample are fictional.Sample <strong>Plan</strong> Specifics:■■All products have one class■■All products are 100% employee paid■■All new employees have a 3 month waiting period■■All employees reside in OntarioBasic Life:■■Benefit schedule is 3x annual earnings to a maximum of $500,000 of coverage■ Non-evidence maximum (NEM) is $300,000 (benefits over $300,000 are referred to as Excess Life)■■Rate is $0.28 per $1,000 of coverageDependent Life■■Coverage is sold on a per unit basis■■Rate is $1.08 per employeeAccidental Death and Dismemberment (AD&D):■■Benefit schedule is 3x annual earnings to a maximum of $500,000 of coverage■■No non-evidence maximum (NEM)■■Rate is $0.03 per $1,000 of coverageShort Term Disability (STD):■■Benefit schedule is at 66.6667% of weekly earnings to a maximum of $750 of coverage■■No non-evidence maximum (NEM)■■Rate is $0.15 per $10 of coverageLong Term Disability (LTD):■■Benefit schedule is a split, 66.6667% of first $4,000 of monthly earnings + 50% of the next$6,666 of monthly earnings to a maximum of $6,000 of coverage■■Non-evidence maximum (NEM) is $4,500■■Rate is $1.10 per $100 of coverage22 <strong>Plan</strong> Administrator’s <strong>Guide</strong> — <strong>List</strong> <strong>Bill</strong>