Plan Administrator's Guide â List Bill - RBC Insurance

Plan Administrator's Guide â List Bill - RBC Insurance

Plan Administrator's Guide â List Bill - RBC Insurance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

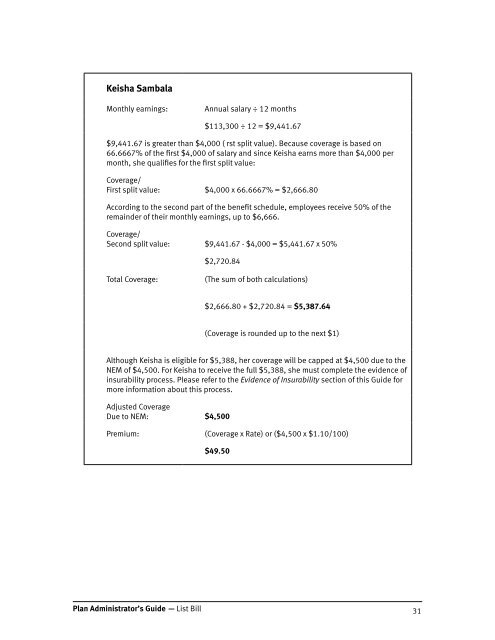

Keisha SambalaMonthly earnings:Annual salary ÷ 12 months$113,300 ÷ 12 = $9,441.67$9,441.67 is greater than $4,000 ( rst split value). Because coverage is based on66.6667% of the first $4,000 of salary and since Keisha earns more than $4,000 permonth, she qualifies for the first split value:Coverage/First split value: $4,000 x 66.6667% = $2,666.80According to the second part of the benefit schedule, employees receive 50% of theremainder of their monthly earnings, up to $6,666.Coverage/Second split value: $9,441.67 - $4,000 = $5,441.67 x 50%$2,720.84Total Coverage:(The sum of both calculations)$2,666.80 + $2,720.84 = $5,387.64(Coverage is rounded up to the next $1)Although Keisha is eligible for $5,388, her coverage will be capped at $4,500 due to theNEM of $4,500. For Keisha to receive the full $5,388, she must complete the evidence ofinsurability process. Please refer to the Evidence of Insurability section of this <strong>Guide</strong> formore information about this process.Adjusted CoverageDue to NEM: $4,500Premium: (Coverage x Rate) or ($4,500 x $1.10/100)$49.50<strong>Plan</strong> Administrator’s <strong>Guide</strong> — <strong>List</strong> <strong>Bill</strong>31