PDF Download - Deutsche Bahn AG

PDF Download - Deutsche Bahn AG

PDF Download - Deutsche Bahn AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

|<br />

ANNUAl FINANCIAl STATEmENTS<br />

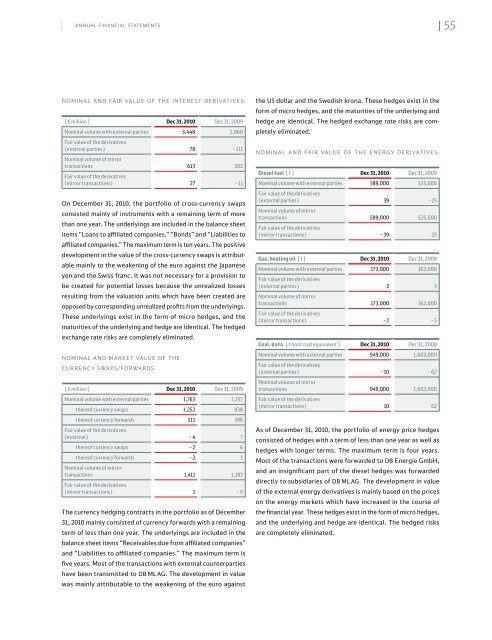

NOmINAl AND FAIR VAlUE OF THE INTEREST DERIVATIVES:<br />

[ € million ] Dec 31, 2010 dec 31, 2009<br />

Nominal volume with external parties 3,448 2,060<br />

fair value of the derivatives<br />

(external parties) 78 –111<br />

Nominal volume of mirror<br />

transactions 613 202<br />

fair value of the derivatives<br />

(mirror transactions) 27 –11<br />

On December 31, 2010, the portfolio of crosscurrency swaps<br />

consisted mainly of instruments with a remaining term of more<br />

than one year. The underlyings are included in the balance sheet<br />

items “loans to affiliated companies,” “Bonds” and “liabilities to<br />

affiliated companies.” The maximum term is ten years. The positive<br />

development in the value of the crosscurrency swaps is attributable<br />

mainly to the weakening of the euro against the Japanese<br />

yen and the Swiss franc. It was not necessary for a provision to<br />

be created for potential losses because the unrealized losses<br />

resulting from the valuation units which have been created are<br />

opposed by corresponding unrealized profits from the underlyings.<br />

These underlyings exist in the form of micro hedges, and the<br />

maturities of the underlying and hedge are identical. The hedged<br />

exchange rate risks are completely eliminated.<br />

NOmINAl AND mARKET VAlUE OF THE<br />

CURRENCY SWAPS/FORWARDS<br />

[ € million ] Dec 31, 2010 dec 31, 2009<br />

Nominal volume with external parties 1,763 1,257<br />

thereof currency swaps 1,252 838<br />

thereof currency forwards<br />

fair value of the derivatives<br />

511 396<br />

(external) –4 7<br />

thereof currency swaps –2 6<br />

thereof currency forwards<br />

Nominal volume of mirror<br />

–2 1<br />

transactions 1,411 1,183<br />

fair value of the derivatives<br />

(mirror transactions) 1 –9<br />

The currency hedging contracts in the portfolio as of December<br />

31, 2010 mainly consisted of currency forwards with a remaining<br />

term of less than one year. The underlyings are included in the<br />

balance sheet items “Receivables due from affiliated companies”<br />

and “liabilities to affiliated companies.” The maximum term is<br />

five years. most of the transactions with external counterparties<br />

have been transmitted to DB ml <strong>AG</strong>. The development in value<br />

was mainly attributable to the weakening of the euro against<br />

the US dollar and the Swedish krona. These hedges exist in the<br />

form of micro hedges, and the maturities of the underlying and<br />

hedge are identical. The hedged exchange rate risks are completely<br />

eliminated.<br />

NOmINAl AND FAIR VAlUE OF THE ENERGY DERIVATIVES:<br />

Diesel fuel [t] Dec 31, 2010 dec 31, 2009<br />

Nominal volume with external parties<br />

fair value of the derivatives<br />

589,000 525,000<br />

(external parties)<br />

Nominal volume of mirror<br />

39 –25<br />

transactions 589,000 525,000<br />

fair value of the derivatives<br />

(mirror transactions) – 39 25<br />

gas, heating oil [t] Dec 31, 2010 dec 31, 2009<br />

Nominal volume with external parties 173,000 162,000<br />

fair value of the derivatives<br />

(external parties) 2 5<br />

Nominal volume of mirror<br />

transactions 173,000 162,000<br />

fair value of the derivatives<br />

(mirror transactions) –2 –5<br />

coal, BAfA [ t hard coal equivalent ] Dec 31, 2010 dec 31, 2009<br />

Nominal volume with external parties 949,000 1,603,000<br />

fair value of the derivatives<br />

(external parties) –10 – 62<br />

Nominal volume of mirror<br />

transactions 949,000 1,603,000<br />

fair value of the derivatives<br />

(mirror transactions) 10 62<br />

As of December 31, 2010, the portfolio of energy price hedges<br />

consisted of hedges with a term of less than one year as well as<br />

hedges with longer terms. The maximum term is four years.<br />

most of the transactions were forwarded to DB Energie GmbH,<br />

and an insignificant part of the diesel hedges was forwarded<br />

directly to subsidiaries of DB ml <strong>AG</strong>. The development in value<br />

of the external energy derivatives is mainly based on the prices<br />

on the energy markets which have increased in the course of<br />

the financial year. These hedges exist in the form of micro hedges,<br />

and the underlying and hedge are identical. The hedged risks<br />

are completely eliminated.<br />

55