ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

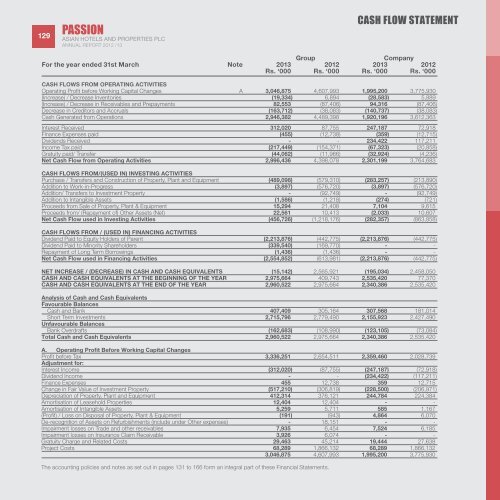

PASSION129 <strong>ASIAN</strong> <strong>HOTELS</strong> <strong>AND</strong> <strong>PROPERTIES</strong> <strong>PLC</strong>Annual Report <strong>2012</strong> /<strong>13</strong>GroupCompanyFor the year ended 31st March Note 20<strong>13</strong> <strong>2012</strong> 20<strong>13</strong> <strong>2012</strong>Rs. ‘000 Rs. ‘000 Rs. ‘000 Rs. ‘000CASH FLOWS FROM OPERATING ACTIVITIESOperating Profit before Working Capital Changes a 3,046,875 4,607,993 1,995,200 3,775,930(Increase) / Decrease Inventories (19,334) 6,894 (28,583) 5,889(Increase) / Decrease in Receivables and Prepayments 82,553 (87,406) 94,316 (87,406)Decrease in Creditors and Accruals (163,712) (38,083) (140,737) (38,083)Cash Generated from Operations 2,946,382 4,489,398 1,920,196 3,612,363Interest Received 312,020 87,755 247,187 72,918Finance Expenses paid (455) (12,738) (359) (12,715)Dividends Received - - 234,422 117,211Income Tax paid (217,449) (154,371) (67,323) (20,858)Gratuity paid/ Transfer (44,062) (11,966) (32,924) (4,236)Net Cash Flow from Operating Activities 2,996,436 4,398,078 2,301,199 3,764,683CASH FLOWS FROM/(USED IN) INVESTING ACTIVITIESPurchase / Transfers and Construction of Property, Plant and Equipment (489,098) (579,310) (283,257) (2<strong>13</strong>,890)Addition to Work-in-Progress (3,897) (576,720) (3,897) (576,720)Addition/ Transfers to Investment Property - (92,749) - (92,749)Addition to Intangible Assets (1,586) (1,218) (274) (721)Proceeds from Sale of Property, Plant & Equipment 15,294 21,408 7,104 9,615Proceeds from/ (Repayment of) Other Assets (Net) 22,561 10,4<strong>13</strong> (2,033) 10,607Net Cash Flow used in Investing Activities (456,726) (1,218,176) (282,357) (863,858)CASH FLOWS FROM / (USED IN) FINANCING ACTIVITIESDividend Paid to Equity Holders of Parent (2,2<strong>13</strong>,876) (442,775) (2,2<strong>13</strong>,876) (442,775)Dividend Paid to Minority Shareholders (339,540) (169,770) - -Repayment of Long Term Borrowings (1,436) (1,436) - -Net Cash Flow used in Financing Activities (2,554,852) (6<strong>13</strong>,981) (2,2<strong>13</strong>,876) (442,775)NET INCREASE / (DECREASE) IN CASH <strong>AND</strong> CASH EQUIVALENTS (15,142) 2,565,921 (195,034) 2,458,050CASH <strong>AND</strong> CASH EQUIVALENTS AT THE BEGINNING OF THE YEAR 2,975,664 409,743 2,535,420 77,370CASH <strong>AND</strong> CASH EQUIVALENTS AT THE END OF THE YEAR 2,960,522 2,975,664 2,340,386 2,535,420Analysis of Cash and Cash EquivalentsFavourable BalancesCash and Bank 407,409 305,164 307,568 181,014Short Term Investments 2,715,796 2,779,490 2,155,923 2,427,490Unfavourable BalancesBank Overdrafts (162,683) (108,990) (123,105) (73,084)Total Cash and Cash Equivalents 2,960,522 2,975,664 2,340,386 2,535,420A. Operating Profit Before Working Capital ChangesProfit before Tax 3,336,251 2,654,511 2,359,460 2,028,739Adjustment for:Interest Income (312,020) (87,755) (247,187) (72,918)Dividend Income - - (234,422) (117,211)Finance Expenses 455 12,738 359 12,715Change in Fair Value of Investment Property (517,210) (306,819) (228,500) (206,971)Depreciation of Property, Plant and Equipment 412,314 376,121 244,784 224,384Amortisation of Leasehold Properties 12,404 12,404 - -Amortisation of Intangible Assets 5,259 5,711 585 1,167(Profit) / Loss on Disposal of Property, Plant & Equipment (191) (943) 4,864 6,070De-recognition of Assets on Refurbishments (include under Other expenses) - 18,151 - -Impairment losses on Trade and other receivables 7,935 6,454 7,524 6,185Impairment losses on Insurance Claim Receivable 3,926 6,074 - -Gratuity Charge and Related Costs 29,463 45,214 19,444 27,638Project Costs 68,289 1,866,<strong>13</strong>2 68,289 1,866,<strong>13</strong>23,046,875 4,607,993 1,995,200 3,775,930The accounting policies and notes as set out in pages <strong>13</strong>1 to 166 form an integral part of these Financial Statements.CASH FLOW STATEMENT