ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

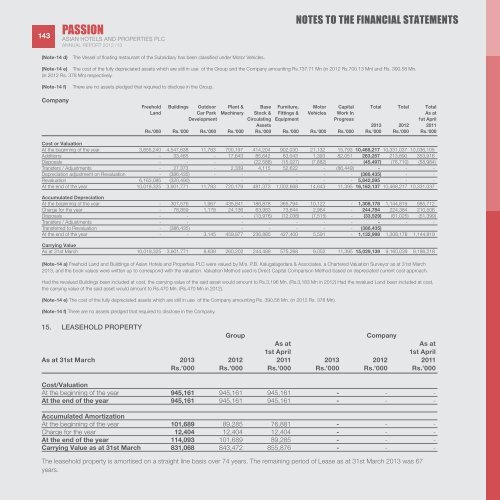

PASSION143 <strong>ASIAN</strong> <strong>HOTELS</strong> <strong>AND</strong> <strong>PROPERTIES</strong> <strong>PLC</strong>Annual Report <strong>2012</strong> /<strong>13</strong>notes to the financial statements(Note-14 d)The Vessel of floating restaurant of the Subsidiary has been classified under Motor Vehicles.(Note-14 e) The cost of the fully depreciated assets which are still in use of the Group and the Company amounting Rs.737.71 Mn (in <strong>2012</strong> Rs.700.<strong>13</strong> Mn) and Rs. 390.58 Mn.(in <strong>2012</strong> Rs. 378 Mn) respectively.(Note-14 f)CompanyThere are no assets pledged that required to disclose in the Group.Freehold Buildings Outdoor Plant & Base Furniture, Motor Capital Total Total TotalLand Car Park Machinery Stock & Fittings & Vehicles Work In As atDevelopment Circulating Equipment Progress 1st AprilAssets 20<strong>13</strong> <strong>2012</strong> 2011Rs.‘000 Rs.‘000 Rs.‘000 Rs.‘000 Rs.‘000 Rs.‘000 Rs.‘000 Rs.‘000 Rs.‘000 Rs.‘000 Rs.‘000Cost or ValuationAt the beginning of the year 3,855,240 4,547,838 11,783 700,197 414,204 902,030 21,<strong>13</strong>2 15,793 10,468,217 10,331,037 10,036,105Additions - 33,485 - 17,643 85,642 63,043 1,393 82,051 283,257 2<strong>13</strong>,890 353,916Disposals - - - - (22,588) (15,027) (7,882) - (45,497) (76,710) (58,984)Transfers / Adjustments - 27,373 - 2,339 4,115 52,622 - (86,449) - - -Depreciation adjustment on Revaluation - (386,435) - - - - - - (386,435) - -Revaluation 6,163,085 (320,490) - - - - - 5,842,595 - -At the end of the year 10,018,325 3,901,771 11,783 720,179 481,373 1,002,668 14,643 11,395 16,162,<strong>13</strong>7 10,468,217 10,331,037Accumulated DepreciationAt the beginning of the year - 307,576 1,967 435,841 186,878 365,794 10,122 - 1,308,178 1,144,819 985,712Charge for the year - 78,859 1,178 24,<strong>13</strong>6 63,983 73,644 2,984 - 244,784 224,384 210,506Disposals - - - (<strong>13</strong>,976) (12,038) (7,515) - (33,529) (61,025) (51,399)Transfers / Adjustments - - - - - - - - - -Transferred to Revaluation - (386,435) - - - - - (386,435)At the end of the year - - 3,145 459,977 236,885 427,400 5,591 - 1,<strong>13</strong>2,998 1,308,178 1,144,819Carrying ValueAs at 31st March 10,018,325 3,901,771 8,638 260,202 244,488 575,268 9,052 11,395 15,029,<strong>13</strong>9 9,160,039 9,186,218(Note-14 a) Freehold Land and Buildings of Asian Hotels and Properties <strong>PLC</strong> were valued by M/s. P.B. Kalugalagedara & Associates, a Chartered Valuation Surveyor as at 31st March20<strong>13</strong>, and the book values were written up to correspond with the valuation. Valuation Method used is Direct Capital Comparison Method based on depreciated current cost approach.Had the revalued Buildings been included at cost, the carrying value of the said asset would amount to Rs.3,196 Mn. (Rs.3,183 Mn in <strong>2012</strong>) Had the revalued Land been included at cost,the carrying value of the said asset would amount to Rs.470 Mn. (Rs.470 Mn in <strong>2012</strong>).(Note-14 e) The cost of the fully depreciated assets which are still in use of the Company amounting Rs. 390.58 Mn. (in <strong>2012</strong> Rs. 378 Mn).(Note-14 f) There are no assets pledged that required to disclose in the Company.15. LEASEHOLD PROPERTYGroupCompanyAs atAs at1st April1st AprilAs at 31st March 20<strong>13</strong> <strong>2012</strong> 2011 20<strong>13</strong> <strong>2012</strong> 2011Rs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000Cost/ValuationAt the beginning of the year 945,161 945,161 945,161 - - -At the end of the year 945,161 945,161 945,161 - - -Accumulated AmortizationAt the beginning of the year 101,689 89,285 76,881 - - -Charge for the year 12,404 12,404 12,404 - - -At the end of the year 114,093 101,689 89,285 - - -Carrying Value as at 31st March 831,068 843,472 855,876 - - -The leasehold property is amortised on a straight line basis over 74 years. The remaining period of Lease as at 31st March 20<strong>13</strong> was 67years.