ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

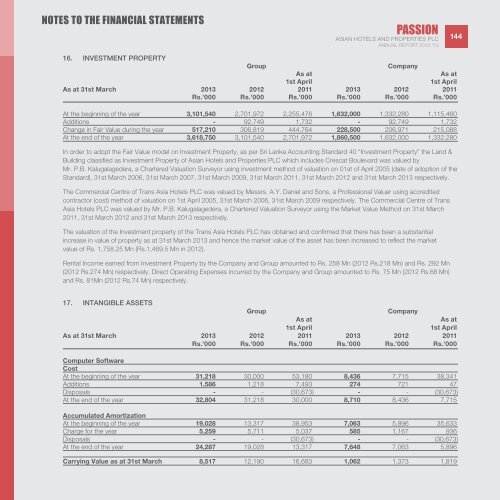

notes to the financial statementsPASSION<strong>ASIAN</strong> <strong>HOTELS</strong> <strong>AND</strong> <strong>PROPERTIES</strong> <strong>PLC</strong>Annual Report <strong>2012</strong> /<strong>13</strong>14416. INVESTMENT PROPERTYGroupCompanyAs atAs at1st April1st AprilAs at 31st March 20<strong>13</strong> <strong>2012</strong> 2011 20<strong>13</strong> <strong>2012</strong> 2011Rs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000At the beginning of the year 3,101,540 2,701,972 2,255,476 1,632,000 1,332,280 1,115,460Additions - 92,749 1,732 - 92,749 1,732Change in Fair Value during the year 517,210 306,819 444,764 228,500 206,971 215,088At the end of the year 3,618,750 3,101,540 2,701,972 1,860,500 1,632,000 1,332,280In order to adopt the Fair Value model on Investment Property, as per Sri Lanka Accounting Standard 40 “Investment Property” the Land &Building classified as Investment Property of Asian Hotels and Properties <strong>PLC</strong> which includes Crescat Boulevard was valued byMr. P.B. Kalugalagedera, a Chartered Valuation Surveyor using investment method of valuation on 01st of April 2005 (date of adoption of theStandard), 31st March 2006, 31st March 2007, 31st March 2009, 31st March 2011, 31st March <strong>2012</strong> and 31st March 20<strong>13</strong> respectively.The Commercial Centre of Trans Asia Hotels <strong>PLC</strong> was valued by Messrs. A.Y. Daniel and Sons, a Professional Valuer using accreditedcontractor (cost) method of valuation on 1st April 2005, 31st March 2006, 31st March 2009 respectively. The Commercial Centre of TransAsia Hotels <strong>PLC</strong> was valued by Mr. P.B. Kalugalagedera, a Chartered Valuation Surveyor using the Market Value Method on 31st March2011, 31st March <strong>2012</strong> and 31st March 20<strong>13</strong> respectively.The valuation of the Investment property of the Trans Asia Hotels <strong>PLC</strong> has obtained and confirmed that there has been a substantialincrease in value of property as at 31st March 20<strong>13</strong> and hence the market value of the asset has been increased to reflect the marketvalue of Rs. 1,758.25 Mn (Rs.1,469.5 Mn in <strong>2012</strong>).Rental Income earned from Investment Property by the Company and Group amounted to Rs. 258 Mn (<strong>2012</strong> Rs.218 Mn) and Rs. 292 Mn(<strong>2012</strong> Rs.274 Mn) respectively. Direct Operating Expenses incurred by the Company and Group amounted to Rs. 75 Mn (<strong>2012</strong> Rs.68 Mn)and Rs. 81Mn (<strong>2012</strong> Rs.74 Mn) respectively.17. INTANGIBLE ASSETSGroupCompanyAs atAs at1st April1st AprilAs at 31st March 20<strong>13</strong> <strong>2012</strong> 2011 20<strong>13</strong> <strong>2012</strong> 2011Rs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000Computer SoftwareCostAt the beginning of the year 31,218 30,000 53,180 8,436 7,715 38,341Additions 1,586 1,218 7,493 274 721 47Disposals - - (30,673) - - (30,673)At the end of the year 32,804 31,218 30,000 8,710 8,436 7,715Accumulated AmortizationAt the beginning of the year 19,028 <strong>13</strong>,317 38,953 7,063 5,896 35,633Charge for the year 5,259 5,711 5,037 585 1,167 936Disposals - - (30,673) - - (30,673)At the end of the year 24,287 19,028 <strong>13</strong>,317 7,648 7,063 5,896Carrying Value as at 31st March 8,517 12,190 16,683 1,062 1,373 1,819