ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

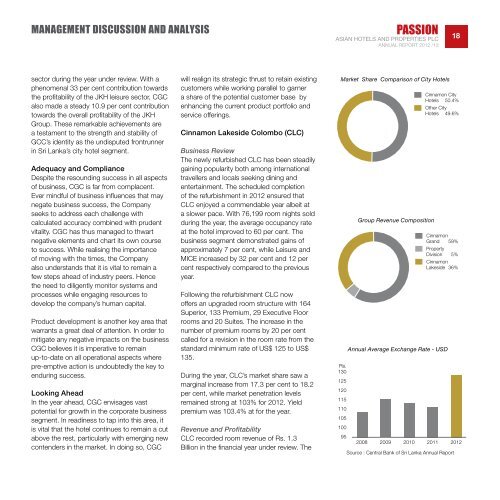

Management Discussion and AnalysisPASSION<strong>ASIAN</strong> <strong>HOTELS</strong> <strong>AND</strong> <strong>PROPERTIES</strong> <strong>PLC</strong>Annual Report <strong>2012</strong> /<strong>13</strong>18sector during the year under review. With aphenomenal 33 per cent contribution towardsthe profitability of the JKH leisure sector, CGCalso made a steady 10.9 per cent contributiontowards the overall profitability of the JKHGroup. These remarkable achievements area testament to the strength and stability ofGCC’s identity as the undisputed frontrunnerin Sri Lanka’s city hotel segment.Adequacy and ComplianceDespite the resounding success in all aspectsof business, CGC is far from complacent.Ever mindful of business influences that maynegate business success, the Companyseeks to address each challenge withcalculated accuracy combined with prudentvitality. CGC has thus managed to thwartnegative elements and chart its own courseto success. While realising the importanceof moving with the times, the Companyalso understands that it is vital to remain afew steps ahead of industry peers. Hencethe need to diligently monitor systems andprocesses while engaging resources todevelop the company’s human capital.Product development is another key area thatwarrants a great deal of attention. In order tomitigate any negative impacts on the businessCGC believes it is imperative to remainup-to-date on all operational aspects wherepre-emptive action is undoubtedly the key toenduring success.Looking AheadIn the year ahead, CGC envisages vastpotential for growth in the corporate businesssegment. In readiness to tap into this area, itis vital that the hotel continues to remain a cutabove the rest, particularly with emerging newcontenders in the market. In doing so, CGCwill realign its strategic thrust to retain existingcustomers while working parallel to garnera share of the potential customer base byenhancing the current product portfolio andservice offerings.Cinnamon Lakeside Colombo (CLC)Business ReviewThe newly refurbished CLC has been steadilygaining popularity both among internationaltravellers and locals seeking dining andentertainment. The scheduled completionof the refurbishment in <strong>2012</strong> ensured thatCLC enjoyed a commendable year albeit ata slower pace. With 76,199 room nights soldduring the year, the average occupancy rateat the hotel improved to 60 per cent. Thebusiness segment demonstrated gains ofapproximately 7 per cent, while Leisure andMICE increased by 32 per cent and 12 percent respectively compared to the previousyear.Following the refurbishment CLC nowoffers an upgraded room structure with 164Superior, <strong>13</strong>3 Premium, 29 Executive Floorrooms and 20 Suites. The increase in thenumber of premium rooms by 20 per centcalled for a revision in the room rate from thestandard minimum rate of US$ 125 to US$<strong>13</strong>5.During the year, CLC’s market share saw amarginal increase from 17.3 per cent to 18.2per cent, while market penetration levelsremained strong at 103% for <strong>2012</strong>. Yieldpremium was 103.4% at for the year.Revenue and ProfitabilityCLC recorded room revenue of Rs. 1.3Billion in the financial year under review. TheMarket Share Comparison of City HotelsRs.<strong>13</strong>012512011511010510095Group Revenue CompositionCinnamon CityHotels 50.4%Other CityHotels 49.6%CinnamonGrand 59%PropertyDivision 5%CinnamonLakeside 36%Annual Average Exchange Rate - USD2008 2009 2010 2011 <strong>2012</strong>Source : Central Bank of Sri Lanka Annual Report