ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

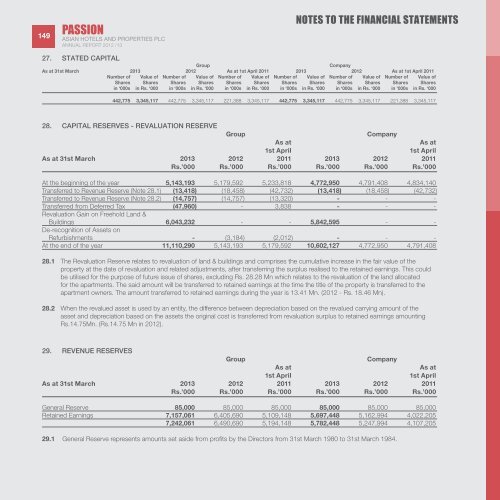

PASSION149 <strong>ASIAN</strong> <strong>HOTELS</strong> <strong>AND</strong> <strong>PROPERTIES</strong> <strong>PLC</strong>Annual Report <strong>2012</strong> /<strong>13</strong>27. STATED CAPITALnotes to the financial statementsGroupCompanyAs at 31st March 20<strong>13</strong> <strong>2012</strong> As at 1st April 2011 20<strong>13</strong> <strong>2012</strong> As at 1st April 2011Number of Value of Number of Value of Number of Value of Number of Value of Number of Value of Number of Value ofShares Shares Shares Shares Shares Shares Shares Shares Shares Shares Shares Sharesin ‘000s in Rs. ‘000 in ‘000s in Rs. ‘000 in ‘000s in Rs. ‘000 in ‘000s in Rs. ‘000 in ‘000s in Rs. ‘000 in ‘000s in Rs. ‘000442,775 3,345,117 442,775 3,345,117 221,388 3,345,117 442,775 3,345,117 442,775 3,345,117 221,388 3,345,11728. CAPITAL RESERVES - REVALUATION RESERVEGroupCompanyAs atAs at1st April1st AprilAs at 31st March 20<strong>13</strong> <strong>2012</strong> 2011 20<strong>13</strong> <strong>2012</strong> 2011Rs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000At the beginning of the year 5,143,193 5,179,592 5,233,818 4,772,950 4,791,408 4,834,140Transferred to Revenue Reserve (Note 28.1) (<strong>13</strong>,418) (18,458) (42,732) (<strong>13</strong>,418) (18,458) (42,732)Transferred to Revenue Reserve (Note 28.2) (14,757) (14,757) (<strong>13</strong>,320) - - -Transferred from Deferred Tax (47,960) - 3,838 - - -Revaluation Gain on Freehold Land &Buildings 6,043,232 - - 5,842,595 - -De-recognition of Assets onRefurbishments - (3,184) (2,012) - - -At the end of the year 11,110,290 5,143,193 5,179,592 10,602,127 4,772,950 4,791,40828.1 The Revaluation Reserve relates to revaluation of land & buildings and comprises the cumulative increase in the fair value of theproperty at the date of revaluation and related adjustments, after transferring the surplus realised to the retained earnings. This couldbe utilised for the purpose of future issue of shares, excluding Rs. 28.28 Mn which relates to the revaluation of the land allocatedfor the apartments. The said amount will be transferred to retained earnings at the time the title of the property is transferred to theapartment owners. The amount transferred to retained earnings during the year is <strong>13</strong>.41 Mn. (<strong>2012</strong> - Rs. 18.46 Mn).28.2 When the revalued asset is used by an entity, the difference between depreciation based on the revalued carrying amount of theasset and depreciation based on the assets the original cost is transferred from revaluation surplus to retained earnings amountingRs.14.75Mn. (Rs.14.75 Mn in <strong>2012</strong>).29. REVENUE RESERVESGroupCompanyAs atAs at1st April1st AprilAs at 31st March 20<strong>13</strong> <strong>2012</strong> 2011 20<strong>13</strong> <strong>2012</strong> 2011Rs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000 Rs.’000General Reserve 85,000 85,000 85,000 85,000 85,000 85,000Retained Earnings 7,157,061 6,405,690 5,109,148 5,697,448 5,162,994 4,022,2057,242,061 6,490,690 5,194,148 5,782,448 5,247,994 4,107,20529.1 General Reserve represents amounts set aside from profits by the Directors from 31st March 1980 to 31st March 1984.