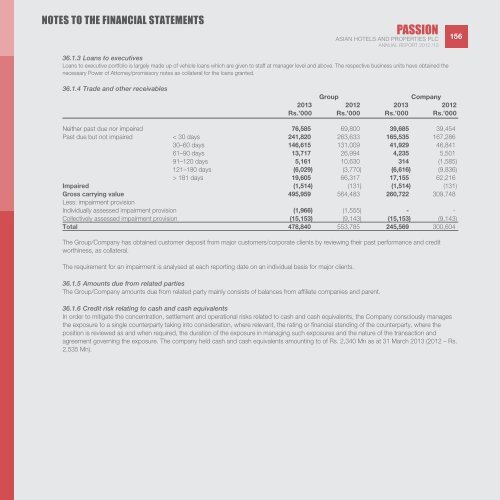

notes to the financial statementsPASSION<strong>ASIAN</strong> <strong>HOTELS</strong> <strong>AND</strong> <strong>PROPERTIES</strong> <strong>PLC</strong>Annual Report <strong>2012</strong> /<strong>13</strong>15636.1.3 Loans to executivesLoans to executive portfolio is largely made up of vehicle loans which are given to staff at manager level and above. The respective business units have obtained thenecessary Power of Attorney/promissory notes as collateral for the loans granted.36.1.4 Trade and other receivablesGroupCompany20<strong>13</strong> <strong>2012</strong> 20<strong>13</strong> <strong>2012</strong>Rs.’000 Rs.’000 Rs.’000 Rs.’000Neither past due nor impaired 76,585 69,800 39,685 39,454Past due but not impaired < 30 days 241,820 263,633 165,535 167,28630–60 days 146,615 <strong>13</strong>1,009 41,929 46,84161–90 days <strong>13</strong>,717 26,994 4,235 5,50191–120 days 5,161 10,630 314 (1,585)121–180 days (6,029) (3,770) (6,616) (9,836)> 181 days 19,605 66,317 17,155 62,216Impaired (1,514) (<strong>13</strong>1) (1,514) (<strong>13</strong>1)Gross carrying value 495,959 564,483 260,722 309,748Less: impairment provisionIndividually assessed impairment provision (1,966) (1,555) - -Collectively assessed impairment provision (15,153) (9,143) (15,153) (9,143)Total 478,840 553,785 245,569 300,604The Group/Company has obtained customer deposit from major customers/corporate clients by reviewing their past performance and creditworthiness, as collateral.The requirement for an impairment is analysed at each reporting date on an individual basis for major clients.36.1.5 Amounts due from related partiesThe Group/Company amounts due from related party mainly consists of balances from affiliate companies and parent.36.1.6 Credit risk relating to cash and cash equivalentsIn order to mitigate the concentration, settlement and operational risks related to cash and cash equivalents, the Company consciously managesthe exposure to a single counterparty taking into consideration, where relevant, the rating or financial standing of the counterparty, where theposition is reviewed as and when required, the duration of the exposure in managing such exposures and the nature of the transaction andagreement governing the exposure. The company held cash and cash equivalents amounting to of Rs. 2,340 Mn as at 31 March 20<strong>13</strong> (<strong>2012</strong> – Rs.2,535 Mn).

PASSION157 <strong>ASIAN</strong> <strong>HOTELS</strong> <strong>AND</strong> <strong>PROPERTIES</strong> <strong>PLC</strong>Annual Report <strong>2012</strong> /<strong>13</strong>notes to the financial statements36.2 Liquidity RiskThe Group’s policy is to hold cash and undrawn committed facilities at a level sufficient to ensure that the Group has available funds to meet itsshort and medium term capital and funding obligations, including organic growth and acquisition activities, and to meet any unforeseen obligationsand opportunities. The Group holds cash and undrawn committed facilities to enable the Group to manage its liquidity risk.The Group monitors its risk to a shortage of funds using a daily cash management process. This process considers the maturity of both theGroup’s financial investments and financial assets (e.g. accounts receivable, other financial assets) and projected cash flows from operations.The Group’s objective is to maintain a balance between continuity of funding and flexibility through the use of multiple sources of funding includingbank loans, loan notes, overdrafts and finance leases over a broad spread of maturities.36.2.1 Net (debt)/cashGroupCompany20<strong>13</strong> <strong>2012</strong> 20<strong>13</strong> <strong>2012</strong>Rs.’000 Rs.’000 Rs.’000 Rs.’000Short term investments 2,715,796 2,779,490 2,155,923 2,427,490Cash in hand and at bank 407,409 305,164 307,568 181,014Adjustments to liquid assets - - - -Total liquid Assets 3,123,205 3,084,654 2,463,491 2,608,504Borrowings 1,416 2,852 - -Short term borrowings - - - -Current portion of borrowings 1,437 1,437 - -Bank overdrafts 162,683 108,990 123,105 73,084Total liabilities 165,536 1<strong>13</strong>,279 123,105 73,084Net (debt)/cash 2,957,669 2,971,375 2,340,386 2,535,42036.3 Market riskMarket risk is the risk that changes in market prices, such as foreign exchange rates and interest rates will affect ‘s income or the value of itsholdings of financial instruments. The objective of market risk management is to manage and control market risk exposures within acceptableparameters, while optimizing the return.36.3.1 Currency riskForeign currency risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate, due to changes in foreign exchangerates. Group as at the reporting date, do not hold significant ‘Financial instruments’ denominated in currencies other than its functional / reportingcurrency, hence do not get significantly exposed to currency risk arising from translation of such balances in to the functional / reporting currency,which is Sri Lankan Rupees.However, Group engages in transactions associated with foreign currencies in its ordinary course of operations, hence exposed to ‘Currency risk’.Across the industry, the hotel rates targeting the foreign tourists are quoted in US Dollar terms. However a fluctuation in the exchange rate will nothave a significant impact since majority of the quotes are converted to local currency at the point of invoicing. The Group monitors fluctuations inforeign exchange rates and takes precautionary measures to revise its exchange rates on a regular basis, in an attempt to mitigate the exposure tocurrency risk arising from its transactions.