ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

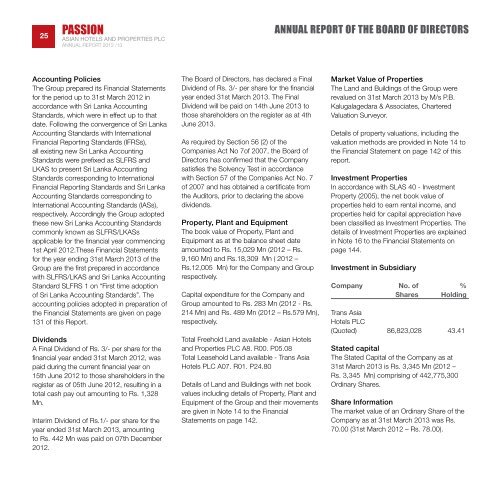

PASSION annual report of the board of directors25 <strong>ASIAN</strong> <strong>HOTELS</strong> <strong>AND</strong> <strong>PROPERTIES</strong> <strong>PLC</strong>Annual Report <strong>2012</strong> /<strong>13</strong>Accounting PoliciesThe Group prepared its Financial Statementsfor the period up to 31st March <strong>2012</strong> inaccordance with Sri Lanka AccountingStandards, which were in effect up to thatdate. Following the convergence of Sri LankaAccounting Standards with InternationalFinancial Reporting Standards (IFRSs),all existing new Sri Lanka AccountingStandards were prefixed as SLFRS andLKAS to present Sri Lanka AccountingStandards corresponding to InternationalFinancial Reporting Standards and Sri LankaAccounting Standards corresponding toInternational Accounting Standards (IASs),respectively. Accordingly the Group adoptedthese new Sri Lanka Accounting Standardscommonly known as SLFRS/LKASsapplicable for the financial year commencing1st April <strong>2012</strong>.These Financial Statementsfor the year ending 31st March 20<strong>13</strong> of theGroup are the first prepared in accordancewith SLFRS/LKAS and Sri Lanka AccountingStandard SLFRS 1 on “First time adoptionof Sri Lanka Accounting Standards”. Theaccounting policies adopted in preparation ofthe Financial Statements are given on page<strong>13</strong>1 of this Report.DividendsA Final Dividend of Rs. 3/- per share for thefinancial year ended 31st March <strong>2012</strong>, waspaid during the current financial year on15th June <strong>2012</strong> to those shareholders in theregister as of 05th June <strong>2012</strong>, resulting in atotal cash pay out amounting to Rs. 1,328Mn.Interim Dividend of Rs.1/- per share for theyear ended 31st March 20<strong>13</strong>, amountingto Rs. 442 Mn was paid on 07th December<strong>2012</strong>.The Board of Directors, has declared a FinalDividend of Rs. 3/- per share for the financialyear ended 31st March 20<strong>13</strong>. The FinalDividend will be paid on 14th June 20<strong>13</strong> tothose shareholders on the register as at 4thJune 20<strong>13</strong>.As required by Section 56 (2) of theCompanies Act No 7of 2007, the Board ofDirectors has confirmed that the Companysatisfies the Solvency Test in accordancewith Section 57 of the Companies Act No. 7of 2007 and has obtained a certificate fromthe Auditors, prior to declaring the abovedividends.Property, Plant and EquipmentThe book value of Property, Plant andEquipment as at the balance sheet dateamounted to Rs. 15,029 Mn (<strong>2012</strong> – Rs.9,160 Mn) and Rs.18,309 Mn ( <strong>2012</strong> –Rs.12,005 Mn) for the Company and Grouprespectively.Capital expenditure for the Company andGroup amounted to Rs. 283 Mn (<strong>2012</strong> - Rs.214 Mn) and Rs. 489 Mn (<strong>2012</strong> – Rs.579 Mn),respectively.Total Freehold Land available - Asian Hotelsand Properties <strong>PLC</strong> A8. R00. P05.08Total Leasehold Land available - Trans AsiaHotels <strong>PLC</strong> A07. R01. P24.80Details of Land and Buildings with net bookvalues including details of Property, Plant andEquipment of the Group and their movementsare given in Note 14 to the FinancialStatements on page 142.Market Value of PropertiesThe Land and Buildings of the Group wererevalued on 31st March 20<strong>13</strong> by M/s P.B.Kalugalagedara & Associates, CharteredValuation Surveyor.Details of property valuations, including thevaluation methods are provided in Note 14 tothe Financial Statement on page 142 of thisreport.Investment PropertiesIn accordance with SLAS 40 - InvestmentProperty (2005), the net book value ofproperties held to earn rental income, andproperties held for capital appreciation havebeen classified as Investment Properties. Thedetails of Investment Properties are explainedin Note 16 to the Financial Statements onpage 144.Investment in SubsidiaryCompany No. of %Shares HoldingTrans AsiaHotels <strong>PLC</strong>(Quoted) 86,823,028 43.41Stated capitalThe Stated Capital of the Company as at31st March 20<strong>13</strong> is Rs. 3,345 Mn (<strong>2012</strong> –Rs. 3,345 Mn) comprising of 442,775,300Ordinary Shares.Share InformationThe market value of an Ordinary Share of theCompany as at 31st March 20<strong>13</strong> was Rs.70.00 (31st March <strong>2012</strong> – Rs. 78.00).