ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

ASIAN HOTELS AND PROPERTIES PLC AnnuAl RepoRt 2012/13

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

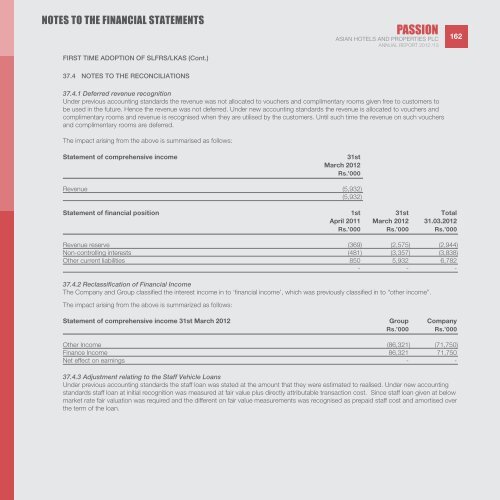

notes to the financial statementsFIRST TIME ADOPTION OF SLFRS/LKAS (Cont.)PASSION<strong>ASIAN</strong> <strong>HOTELS</strong> <strong>AND</strong> <strong>PROPERTIES</strong> <strong>PLC</strong>Annual Report <strong>2012</strong> /<strong>13</strong>16237.4 NOTES TO THE RECONCILIATIONS37.4.1 Deferred revenue recognitionUnder previous accounting standards the revenue was not allocated to vouchers and complimentary rooms given free to customers tobe used in the future. Hence the revenue was not deferred. Under new accounting standards the revenue is allocated to vouchers andcomplimentary rooms and revenue is recognised when they are utilised by the customers. Until such time the revenue on such vouchersand complimentary rooms are deferred.The impact arising from the above is summarised as follows:Statement of comprehensive income31stMarch <strong>2012</strong>Rs.’000Revenue (5,932)(5,932)Statement of financial position 1st 31st TotalApril 2011 March <strong>2012</strong> 31.03.<strong>2012</strong>Rs.’000 Rs.’000 Rs.’000Revenue reserve (369) (2,575) (2,944)Non-controlling interests (481) (3,357) (3,838)Other current liabilities 850 5,932 6,782- - -37.4.2 Reclassification of Financial IncomeThe Company and Group classified the interest income in to ‘financial income’, which was previously classified in to “other income”.The impact arising from the above is summarized as follows:Statement of comprehensive income 31st March <strong>2012</strong> Group CompanyRs.’000 Rs.’000Other Income (86,321) (71,750)Finance Income 86,321 71,750Net effect on earnings - -37.4.3 Adjustment relating to the Staff Vehicle LoansUnder previous accounting standards the staff loan was stated at the amount that they were estimated to realised. Under new accountingstandards staff loan at initial recognition was measured at fair value plus directly attributable transaction cost. Since staff loan given at belowmarket rate fair valuation was required and the different on fair value measurements was recognised as prepaid staff cost and amortised overthe term of the loan.