GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

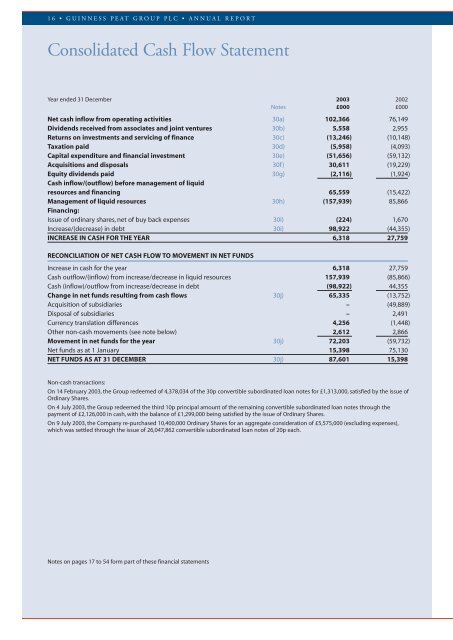

16 • GUINNESS PEAT GROUP PLC • ANNUAL REPORTConsolidated Cash Flow StatementYear ended 31 December <strong>2003</strong> 2002Notes £000 £000Net cash inflow from operating activities 30a) 102,366 76,149Dividends received from associates and joint ventures 30b) 5,558 2,955Returns on investments and servicing of finance 30c) (13,246) (10,148)Taxation paid 30d) (5,958) (4,093)Capital expenditure and financial investment 30e) (51,656) (59,132)Acquisitions and disposals 30f ) 30,611 (19,229)Equity dividends paid 30g) (2,116) (1,924)Cash inflow/(outflow) before management of liquidresources and financing 65,559 (15,422)Management of liquid resources 30h) (157,939) 85,866Financing:Issue of ordinary shares, net of buy back expenses 30i) (224) 1,670Increase/(decrease) in debt 30i) 98,922 (44,355)INCREASE IN CASH FOR THE YEAR 6,318 27,759RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN NET FUNDSIncrease in cash for the year 6,318 27,759Cash outflow/(inflow) from increase/decrease in liquid resources 157,939 (85,866)Cash (inflow)/outflow from increase/decrease in debt (98,922) 44,355Change in net funds resulting from cash flows 30j) 65,335 (13,752)Acquisition of subsidiaries – (49,889)Disposal of subsidiaries – 2,491Currency translation differences 4,256 (1,448)Other non-cash movements (see note below) 2,612 2,866Movement in net funds for the year 30j) 72,203 (59,732)Net funds as at 1 January 15,398 75,130NET FUNDS AS AT 31 DECEMBER 30j) 87,601 15,398Non-cash transactions:On 14 February <strong>2003</strong>, the <strong>Group</strong> redeemed of 4,378,034 of the 30p convertible subordinated loan notes for £1,313,000, satisfied by the issue ofOrdinary Shares.On 4 July <strong>2003</strong>, the <strong>Group</strong> redeemed the third 10p principal amount of the remaining convertible subordinated loan notes through thepayment of £2,126,000 in cash, with the balance of £1,299,000 being satisfied by the issue of Ordinary Shares.On 9 July <strong>2003</strong>, the Company re-purchased 10,400,000 Ordinary Shares for an aggregate consideration of £5,575,000 (excluding expenses),which was settled through the issue of 26,047,862 convertible subordinated loan notes of 20p each.Notes on pages 17 to 54 form part of these financial statements