GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

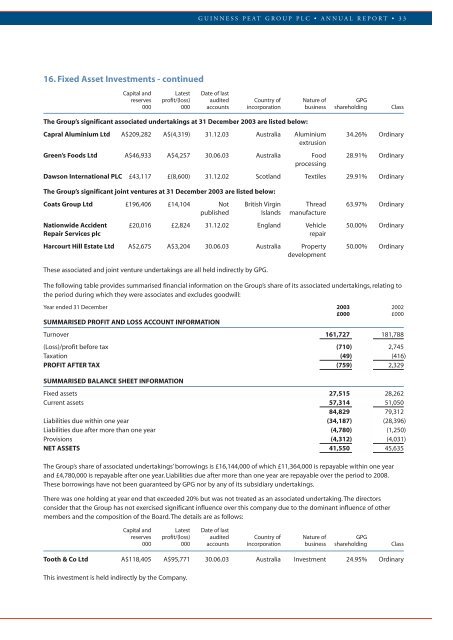

GUINNESS PEAT GROUP PLC • ANNUAL REPORT • 3316. Fixed Asset Investments - continuedCapital and Latest Date of lastreserves profit/(loss) audited Country of Nature of <strong>GPG</strong>000 000 accounts incorporation business shareholding ClassThe <strong>Group</strong>’s significant associated undertakings at 31 December <strong>2003</strong> are listed below:Capral Aluminium Ltd A$209,282 A$(4,319) 31.12.03 Australia Aluminium 34.26% OrdinaryextrusionGreen’s Foods Ltd A$46,933 A$4,257 30.06.03 Australia Food 28.91% OrdinaryprocessingDawson International PLC £43,117 £(8,600) 31.12.02 Scotland Textiles 29.91% OrdinaryThe <strong>Group</strong>’s significant joint ventures at 31 December <strong>2003</strong> are listed below:Coats <strong>Group</strong> Ltd £196,406 £14,104 Not British Virgin Thread 63.97% Ordinarypublished Islands manufactureNationwide Accident £20,016 £2,824 31.12.02 England Vehicle 50.00% OrdinaryRepair Services <strong>plc</strong>repairHarcourt Hill Estate Ltd A$2,675 A$3,204 30.06.03 Australia Property 50.00% OrdinarydevelopmentThese associated and joint venture undertakings are all held indirectly by <strong>GPG</strong>.The following table provides summarised financial information on the <strong>Group</strong>’s share of its associated undertakings, relating tothe period during which they were associates and excludes goodwill:Year ended 31 December <strong>2003</strong> 2002£000 £000SUMMARISED PROFIT AND LOSS ACCOUNT INFORMATIONTurnover 161,727 181,788(Loss)/profit before tax (710) 2,745Taxation (49) (416)PROFIT AFTER TAX (759) 2,329SUMMARISED BALANCE SHEET INFORMATIONFixed assets 27,515 28,262Current assets 57,314 51,05084,829 79,312Liabilities due within one year (34,187) (28,396)Liabilities due after more than one year (4,780) (1,250)Provisions (4,312) (4,031)NET ASSETS 41,550 45,635The <strong>Group</strong>’s share of associated undertakings’ borrowings is £16,144,000 of which £11,364,000 is repayable within one yearand £4,780,000 is repayable after one year. Liabilities due after more than one year are repayable over the period to 2008.These borrowings have not been guaranteed by <strong>GPG</strong> nor by any of its subsidiary undertakings.There was one holding at year end that exceeded 20% but was not treated as an associated undertaking. The directorsconsider that the <strong>Group</strong> has not exercised significant influence over this company due to the dominant influence of othermembers and the composition of the Board. The details are as follows:Capital and Latest Date of lastreserves profit/(loss) audited Country of Nature of <strong>GPG</strong>000 000 accounts incorporation business shareholding ClassTooth & Co Ltd A$118,405 A$95,771 30.06.03 Australia Investment 24.95% OrdinaryThis investment is held indirectly by the Company.