GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

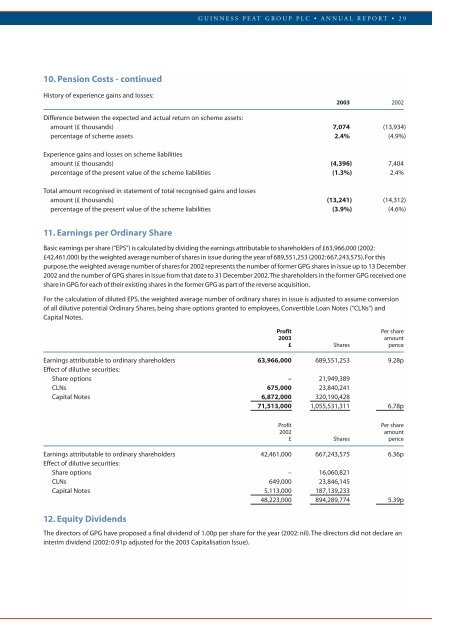

GUINNESS PEAT GROUP PLC • ANNUAL REPORT • 2910. Pension Costs - continuedHistory of experience gains and losses:<strong>2003</strong> 2002Difference between the expected and actual return on scheme assets:amount (£ thousands) 7,074 (13,934)percentage of scheme assets 2.4% (4.9%)Experience gains and losses on scheme liabilitiesamount (£ thousands) (4,396) 7,404percentage of the present value of the scheme liabilities (1.3%) 2.4%Total amount recognised in statement of total recognised gains and lossesamount (£ thousands) (13,241) (14,312)percentage of the present value of the scheme liabilities (3.9%) (4.6%)11.Earnings per Ordinary ShareBasic earnings per share (“EPS”) is calculated by dividing the earnings attributable to shareholders of £63,966,000 (2002:£42,461,000) by the weighted average number of shares in issue during the year of 689,551,253 (2002:667,243,575).For thispurpose,the weighted average number of shares for 2002 represents the number of former <strong>GPG</strong> shares in issue up to 13 December2002 and the number of <strong>GPG</strong> shares in issue from that date to 31 December 2002.The shareholders in the former <strong>GPG</strong> received oneshare in <strong>GPG</strong> for each of their existing shares in the former <strong>GPG</strong> as part of the reverse acquisition.For the calculation of diluted EPS, the weighted average number of ordinary shares in issue is adjusted to assume conversionof all dilutive potential Ordinary Shares, being share options granted to employees, Convertible Loan Notes (“CLNs”) andCapital Notes.ProfitPer share<strong>2003</strong> amount£ Shares penceEarnings attributable to ordinary shareholders 63,966,000 689,551,253 9.28pEffect of dilutive securities:Share options – 21,949,389CLNs 675,000 23,840,241Capital Notes 6,872,000 320,190,42871,513,000 1,055,531,311 6.78pProfitPer share2002 amount£ Shares penceEarnings attributable to ordinary shareholders 42,461,000 667,243,575 6.36pEffect of dilutive securities:Share options – 16,060,821CLNs 649,000 23,846,145Capital Notes 5,113,000 187,139,23348,223,000 894,289,774 5.39p12.Equity DividendsThe directors of <strong>GPG</strong> have proposed a final dividend of 1.00p per share for the year (2002: nil). The directors did not declare aninterim dividend (2002: 0.91p adjusted for the <strong>2003</strong> Capitalisation Issue).