GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

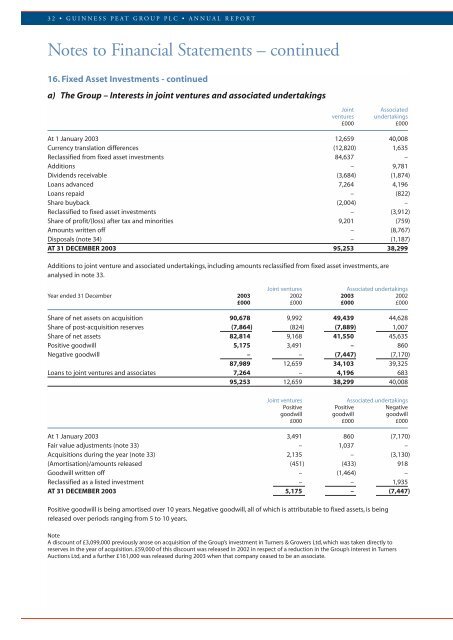

32 • GUINNESS PEAT GROUP PLC • ANNUAL REPORTNotes to Financial Statements – continued16. Fixed Asset Investments - continueda) The <strong>Group</strong> – Interests in joint ventures and associated undertakingsJointAssociatedventures undertakings£000 £000At 1 January <strong>2003</strong> 12,659 40,008Currency translation differences (12,820) 1,635Reclassified from fixed asset investments 84,637 –Additions – 9,781Dividends receivable (3,684) (1,874)Loans advanced 7,264 4,196Loans repaid – (822)Share buyback (2,004) –Reclassified to fixed asset investments – (3,912)Share of profit/(loss) after tax and minorities 9,201 (759)Amounts written off – (8,767)Disposals (note 34) – (1,187)AT 31 DECEMBER <strong>2003</strong> 95,253 38,299Additions to joint venture and associated undertakings, including amounts reclassified from fixed asset investments, areanalysed in note 33.Joint venturesAssociated undertakingsYear ended 31 December <strong>2003</strong> 2002 <strong>2003</strong> 2002£000 £000 £000 £000Share of net assets on acquisition 90,678 9,992 49,439 44,628Share of post-acquisition reserves (7,864) (824) (7,889) 1,007Share of net assets 82,814 9,168 41,550 45,635Positive goodwill 5,175 3,491 – 860Negative goodwill – – (7,447) (7,170)87,989 12,659 34,103 39,325Loans to joint ventures and associates 7,264 – 4,196 68395,253 12,659 38,299 40,008Joint venturesAssociated undertakingsPositive Positive Negativegoodwill goodwill goodwill£000 £000 £000At 1 January <strong>2003</strong> 3,491 860 (7,170)Fair value adjustments (note 33) – 1,037 –Acquisitions during the year (note 33) 2,135 – (3,130)(Amortisation)/amounts released (451) (433) 918Goodwill written off – (1,464) –Reclassified as a listed investment – – 1,935AT 31 DECEMBER <strong>2003</strong> 5,175 – (7,447)Positive goodwill is being amortised over 10 years. Negative goodwill, all of which is attributable to fixed assets, is beingreleased over periods ranging from 5 to 10 years.NoteA discount of £3,099,000 previously arose on acquisition of the <strong>Group</strong>’s investment in Turners & Growers Ltd, which was taken directly toreserves in the year of acquisition. £59,000 of this discount was released in 2002 in respect of a reduction in the <strong>Group</strong>’s interest in TurnersAuctions Ltd, and a further £161,000 was released during <strong>2003</strong> when that company ceased to be an associate.