GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

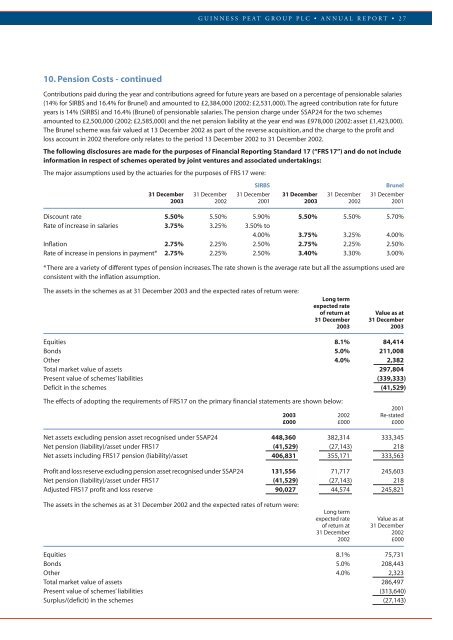

GUINNESS PEAT GROUP PLC • ANNUAL REPORT • 2710. Pension Costs - continuedContributions paid during the year and contributions agreed for future years are based on a percentage of pensionable salaries(14% for SIRBS and 16.4% for Brunel) and amounted to £2,384,000 (2002: £2,531,000). The agreed contribution rate for futureyears is 14% (SIRBS) and 16.4% (Brunel) of pensionable salaries. The pension charge under SSAP24 for the two schemesamounted to £2,500,000 (2002: £2,585,000) and the net pension liability at the year end was £978,000 (2002: asset £1,423,000).The Brunel scheme was fair valued at 13 December 2002 as part of the reverse acquisition, and the charge to the profit andloss account in 2002 therefore only relates to the period 13 December 2002 to 31 December 2002.The following disclosures are made for the purposes of Financial <strong>Report</strong>ing Standard 17 (“FRS 17”) and do not includeinformation in respect of schemes operated by joint ventures and associated undertakings:The major assumptions used by the actuaries for the purposes of FRS 17 were:SIRBSBrunel31 December 31 December 31 December 31 December 31 December 31 December<strong>2003</strong> 2002 2001 <strong>2003</strong> 2002 2001Discount rate 5.50% 5.50% 5.90% 5.50% 5.50% 5.70%Rate of increase in salaries 3.75% 3.25% 3.50% to4.00% 3.75% 3.25% 4.00%Inflation 2.75% 2.25% 2.50% 2.75% 2.25% 2.50%Rate of increase in pensions in payment* 2.75% 2.25% 2.50% 3.40% 3.30% 3.00%*There are a variety of different types of pension increases. The rate shown is the average rate but all the assumptions used areconsistent with the inflation assumption.The assets in the schemes as at 31 December <strong>2003</strong> and the expected rates of return were:Long termexpected rateof return atValue as at31 December 31 December<strong>2003</strong> <strong>2003</strong>Equities 8.1% 84,414Bonds 5.0% 211,008Other 4.0% 2,382Total market value of assets 297,804Present value of schemes’ liabilities (339,333)Deficit in the schemes (41,529)The effects of adopting the requirements of FRS17 on the primary financial statements are shown below:2001<strong>2003</strong> 2002 Re-stated£000 £000 £000Net assets excluding pension asset recognised under SSAP24 448,360 382,314 333,345Net pension (liability)/asset under FRS17 (41,529) (27,143) 218Net assets including FRS17 pension (liability)/asset 406,831 355,171 333,563Profit and loss reserve excluding pension asset recognised under SSAP24 131,556 71,717 245,603Net pension (liability)/asset under FRS17 (41,529) (27,143) 218Adjusted FRS17 profit and loss reserve 90,027 44,574 245,821The assets in the schemes as at 31 December 2002 and the expected rates of return were:Long termexpected rateValue as atof return at 31 December31 December 20022002 £000Equities 8.1% 75,731Bonds 5.0% 208,443Other 4.0% 2,323Total market value of assets 286,497Present value of schemes’ liabilities (313,640)Surplus/(deficit) in the schemes (27,143)