GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

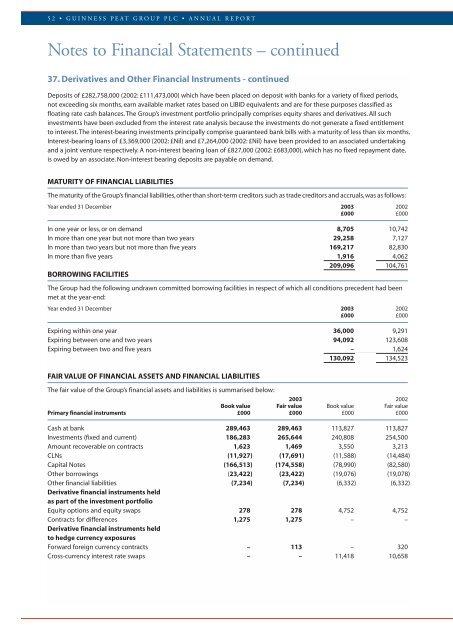

52 • GUINNESS PEAT GROUP PLC • ANNUAL REPORTNotes to Financial Statements – continued37. Derivatives and Other Financial Instruments - continuedDeposits of £282,758,000 (2002: £111,473,000) which have been placed on deposit with banks for a variety of fixed periods,not exceeding six months, earn available market rates based on LIBID equivalents and are for these purposes classified asfloating rate cash balances. The <strong>Group</strong>’s investment portfolio principally comprises equity shares and derivatives. All suchinvestments have been excluded from the interest rate analysis because the investments do not generate a fixed entitlementto interest. The interest-bearing investments principally comprise guaranteed bank bills with a maturity of less than six months.Interest-bearing loans of £3,369,000 (2002: £Nil) and £7,264,000 (2002: £Nil) have been provided to an associated undertakingand a joint venture respectively. A non-interest bearing loan of £827,000 (2002: £683,000), which has no fixed repayment date,is owed by an associate. Non-interest bearing deposits are payable on demand.MATURITY OF FINANCIAL LIABILITIESThe maturity of the <strong>Group</strong>’s financial liabilities,other than short-term creditors such as trade creditors and accruals,was as follows:Year ended 31 December <strong>2003</strong> 2002£000 £000In one year or less, or on demand 8,705 10,742In more than one year but not more than two years 29,258 7,127In more than two years but not more than five years 169,217 82,830In more than five years 1,916 4,062209,096 104,761BORROWING FACILITIESThe <strong>Group</strong> had the following undrawn committed borrowing facilities in respect of which all conditions precedent had beenmet at the year-end:Year ended 31 December <strong>2003</strong> 2002£000 £000Expiring within one year 36,000 9,291Expiring between one and two years 94,092 123,608Expiring between two and five years – 1,624130,092 134,523FAIR VALUE OF FINANCIAL ASSETS AND FINANCIAL LIABILITIESThe fair value of the <strong>Group</strong>’s financial assets and liabilities is summarised below:<strong>2003</strong> 2002Book value Fair value Book value Fair valuePrimary financial instruments £000 £000 £000 £000Cash at bank 289,463 289,463 113,827 113,827Investments (fixed and current) 186,283 265,644 240,808 254,500Amount recoverable on contracts 1,623 1,469 3,550 3,213CLNs (11,927) (17,691) (11,588) (14,484)Capital Notes (166,513) (174,558) (78,990) (82,580)Other borrowings (23,422) (23,422) (19,076) (19,078)Other financial liabilities (7,234) (7,234) (6,332) (6,332)Derivative financial instruments heldas part of the investment portfolioEquity options and equity swaps 278 278 4,752 4,752Contracts for differences 1,275 1,275 – –Derivative financial instruments heldto hedge currency exposuresForward foreign currency contracts – 113 – 320Cross-currency interest rate swaps – – 11,418 10,658