GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

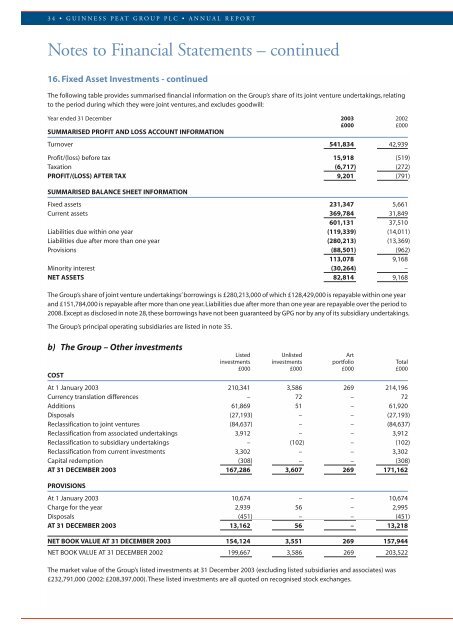

34 • GUINNESS PEAT GROUP PLC • ANNUAL REPORTNotes to Financial Statements – continued16. Fixed Asset Investments - continuedThe following table provides summarised financial information on the <strong>Group</strong>’s share of its joint venture undertakings, relatingto the period during which they were joint ventures, and excludes goodwill:Year ended 31 December <strong>2003</strong> 2002£000 £000SUMMARISED PROFIT AND LOSS ACCOUNT INFORMATIONTurnover 541,834 42,939Profit/(loss) before tax 15,918 (519)Taxation (6,717) (272)PROFIT/(LOSS) AFTER TAX 9,201 (791)SUMMARISED BALANCE SHEET INFORMATIONFixed assets 231,347 5,661Current assets 369,784 31,849601,131 37,510Liabilities due within one year (119,339) (14,011)Liabilities due after more than one year (280,213) (13,369)Provisions (88,501) (962)113,078 9,168Minority interest (30,264) –NET ASSETS 82,814 9,168The <strong>Group</strong>’s share of joint venture undertakings’borrowings is £280,213,000 of which £128,429,000 is repayable within one yearand £151,784,000 is repayable after more than one year.Liabilities due after more than one year are repayable over the period to2008.Except as disclosed in note 28,these borrowings have not been guaranteed by <strong>GPG</strong> nor by any of its subsidiary undertakings.The <strong>Group</strong>’s principal operating subsidiaries are listed in note 35.b) The <strong>Group</strong> – Other investmentsCOSTListed Unlisted Artinvestments investments portfolio Total£000 £000 £000 £000At 1 January <strong>2003</strong> 210,341 3,586 269 214,196Currency translation differences – 72 – 72Additions 61,869 51 – 61,920Disposals (27,193) – – (27,193)Reclassification to joint ventures (84,637) – – (84,637)Reclassification from associated undertakings 3,912 – – 3,912Reclassification to subsidiary undertakings – (102) – (102)Reclassification from current investments 3,302 – – 3,302Capital redemption (308) – – (308)AT 31 DECEMBER <strong>2003</strong> 167,286 3,607 269 171,162PROVISIONSAt 1 January <strong>2003</strong> 10,674 – – 10,674Charge for the year 2,939 56 – 2,995Disposals (451) – – (451)AT 31 DECEMBER <strong>2003</strong> 13,162 56 – 13,218NET BOOK VALUE AT 31 DECEMBER <strong>2003</strong> 154,124 3,551 269 157,944NET BOOK VALUE AT 31 DECEMBER 2002 199,667 3,586 269 203,522The market value of the <strong>Group</strong>’s listed investments at 31 December <strong>2003</strong> (excluding listed subsidiaries and associates) was£232,791,000 (2002: £208,397,000). These listed investments are all quoted on recognised stock exchanges.