GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

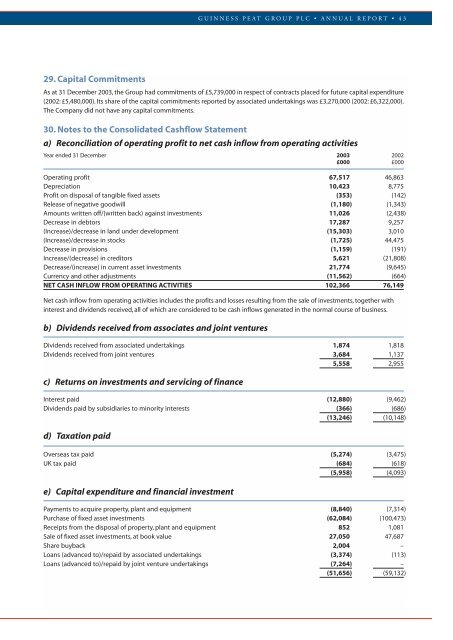

GUINNESS PEAT GROUP PLC • ANNUAL REPORT • 4329. Capital CommitmentsAs at 31 December <strong>2003</strong>, the <strong>Group</strong> had commitments of £5,739,000 in respect of contracts placed for future capital expenditure(2002: £5,480,000). Its share of the capital commitments reported by associated undertakings was £3,270,000 (2002: £6,322,000).The Company did not have any capital commitments.30. Notes to the Consolidated Cashflow Statementa) Reconciliation of operating profit to net cash inflow from operating activitiesYear ended 31 December <strong>2003</strong> 2002£000 £000Operating profit 67,517 46,863Depreciation 10,423 8,775Profit on disposal of tangible fixed assets (353) (142)Release of negative goodwill (1,180) (1,343)Amounts written off/(written back) against investments 11,026 (2,438)Decrease in debtors 17,287 9,257(Increase)/decrease in land under development (15,303) 3,010(Increase)/decrease in stocks (1,725) 44,475Decrease in provisions (1,159) (191)Increase/(decrease) in creditors 5,621 (21,808)Decrease/(increase) in current asset investments 21,774 (9,645)Currency and other adjustments (11,562) (664)NET CASH INFLOW FROM OPERATING ACTIVITIES 102,366 76,149Net cash inflow from operating activities includes the profits and losses resulting from the sale of investments, together withinterest and dividends received, all of which are considered to be cash inflows generated in the normal course of business.b) Dividends received from associates and joint venturesDividends received from associated undertakings 1,874 1,818Dividends received from joint ventures 3,684 1,1375,558 2,955c) Returns on investments and servicing of financeInterest paid (12,880) (9,462)Dividends paid by subsidiaries to minority interests (366) (686)(13,246) (10,148)d) Taxation paidOverseas tax paid (5,274) (3,475)UK tax paid (684) (618)(5,958) (4,093)e) Capital expenditure and financial investmentPayments to acquire property, plant and equipment (8,840) (7,314)Purchase of fixed asset investments (62,084) (100,473)Receipts from the disposal of property, plant and equipment 852 1,081Sale of fixed asset investments, at book value 27,050 47,687Share buyback 2,004 –Loans (advanced to)/repaid by associated undertakings (3,374) (113)Loans (advanced to)/repaid by joint venture undertakings (7,264) –(51,656) (59,132)