GUINNESS PEAT GROUP PLC • ANNUAL REPORT • 4126. Share Capital - continuedFollowing adjustments, grants, exercises and lapses during the year, options outstanding under the <strong>Group</strong>’s various shareoption schemes at 31 December <strong>2003</strong> were as set out below:Exercise priceShare Option Scheme Number Date granted (p per share) Exercise period1992 SHARE OPTION SCHEMEOrdinary 5,884,505 12.05.94 25.34 12.05.97 to 11.05.04Super 4,553,482 12.05.94 25.34 12.05.99 to 11.05.04Ordinary 955,271 06.10.94 23.95 06.10.97 to 05.10.04Super 636,843 06.10.94 23.95 06.10.99 to 05.10.04Ordinary 1,116,280 25.08.95 25.11 25.08.98 to 24.08.05Super 2,516,377 25.08.95 25.11 25.08.00 to 24.08.05Ordinary 37,117 03.01.96 28.63 03.01.99 to 02.01.06Super 141,898 03.01.96 28.63 03.01.01 to 02.01.06Ordinary 282,157 11.04.96 32.33 11.04.99 to 10.04.06Super 225,401 11.04.96 32.33 11.04.01 to 10.04.06Ordinary 1,578,916 08.05.96 32.78 08.05.99 to 07.05.06Super 1,670,222 08.05.96 32.78 08.05.01 to 07.05.06Ordinary 1,366,554 13.01.97 33.10 13.01.00 to 12.01.07Super 253,065 13.01.97 33.10 13.01.02 to 12.01.07Ordinary 2,848,134 01.09.97 41.30 01.09.00 to 31.08.07Ordinary 101,223 07.11.97 40.21 07.11.00 to 06.11.07Super 220,856 07.11.97 40.21 07.11.02 to 06.11.07Ordinary 59,024 03.08.98 28.56 03.08.01 to 02.08.08Super 29,552 03.08.98 28.56 03.08.03 to 02.08.08Ordinary 2,053,393 22.03.99 35.39 22.03.02 to 21.03.09Super 1,199,823 22.03.99 35.39 22.03.04 to 21.03.09Ordinary 25,621 02.09.99 33.13 02.09.02 to 01.09.09Super 12,774,273 02.09.99 33.13 02.09.02 to 01.09.091994 SHARE OPTION SCHEMEOrdinary 140,103 12.05.94 25.34 12.05.97 to 11.05.04Super 140,103 12.05.94 25.34 12.05.99 to 11.05.04Ordinary 198,655 25.08.95 25.11 25.08.98 to 24.08.05Super 397,318 25.08.95 25.11 25.08.00 to 24.08.05Ordinary 104,778 03.01.96 28.63 03.01.99 to 02.01.06Ordinary 17,021 11.04.96 32.33 11.04.99 to 10.04.06Ordinary 91,303 08.05.96 32.78 08.05.99 to 07.05.06Ordinary 32,204 01.09.97 41.30 01.09.00 to 31.08.07Ordinary 24,157 22.03.99 35.39 22.03.02 to 21.03.09Super 29,282 02.09.99 33.13 02.09.04 to 01.09.092001 SHARE OPTION SCHEMEOrdinary 7,387,050 17.10.01 33.47 17.10.04 to 16.10.11Ordinary 302,500 19.03.02 44.21 19.03.05 to 18.03.122002 SHARE OPTION SCHEMEOrdinary 737,000 08.01.03 39.55 08.01.06 to 07.01.13Ordinary 1,990,999 21.03.03 44.55 21.03.06 to 20.03.13Ordinary 630,000 16.10.03 63.50 16.10.03 to 15.10.13Super options are normally exercisable after five years from the date of grant. Options exercised during the year comprised 303,701shares under the 1992 scheme, 40,602 shares under the 1994 scheme and 121,000 shares under the 2001 scheme (all adjusted forthe <strong>2003</strong> Capitalisation Issue). Since the year-end, options have been exercised as to 6,849,423 shares under the 1992 scheme and698,959 shares under the 1994 scheme.Options granted before 13 December 2002, being the Effective Date of the reverse acquisition of Brunel Holdings <strong>plc</strong>, were over sharesin <strong>GPG</strong> (UK) Holdings <strong>plc</strong> (“<strong>GPG</strong>UKH”) which changed its name from <strong>Guinness</strong> <strong>Peat</strong> <strong>Group</strong> <strong>plc</strong> as a result of the reverse acquisition.Options granted since that date are over the shares of <strong>Guinness</strong> <strong>Peat</strong> <strong>Group</strong> <strong>plc</strong> (“<strong>GPG</strong>”) (formerly Brunel Holdings <strong>plc</strong>). Following thereverse acquisition, certain option holders “rolled over” their rights. Those who rolled over their rights are entitled to exercise theiroptions directly into the ordinary shares of <strong>GPG</strong>. As a result of the Step-Up Rights contained in <strong>GPG</strong>UKH’s Articles of Association, theremaining option holders will receive <strong>GPG</strong> shares initially on a one-for-one basis as an automatic consequence of exercise.Prior to the reverse acquisition, Brunel Holdings <strong>plc</strong> had granted share options under the various executive share option schemes itthen had in place. These schemes have all now ceased to operate, and all share options over Brunel shares extant at the time of thereverse acquisition lapsed during <strong>2003</strong>.

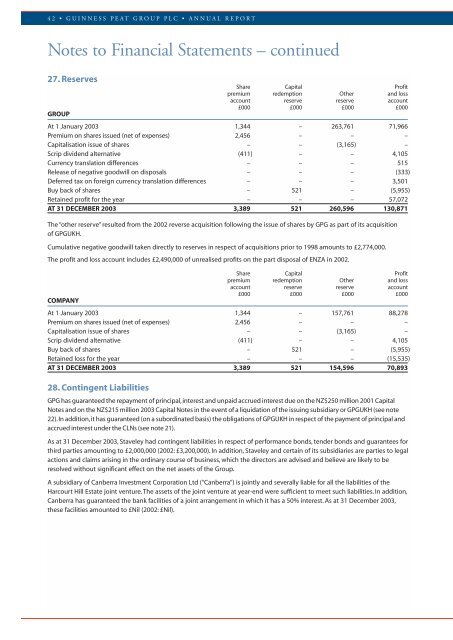

42 • GUINNESS PEAT GROUP PLC • ANNUAL REPORTNotes to Financial Statements – continued27. ReservesGROUPShare Capital Profitpremium redemption Other and lossaccount reserve reserve account£000 £000 £000 £000At 1 January <strong>2003</strong> 1,344 – 263,761 71,966Premium on shares issued (net of expenses) 2,456 – – –Capitalisation issue of shares – – (3,165) –Scrip dividend alternative (411) – – 4,105Currency translation differences – – – 515Release of negative goodwill on disposals – – – (333)Deferred tax on foreign currency translation differences – – – 3,501Buy back of shares – 521 – (5,955)Retained profit for the year – – – 57,072AT 31 DECEMBER <strong>2003</strong> 3,389 521 260,596 130,871The “other reserve” resulted from the 2002 reverse acquisition following the issue of shares by <strong>GPG</strong> as part of its acquisitionof <strong>GPG</strong>UKH.Cumulative negative goodwill taken directly to reserves in respect of acquisitions prior to 1998 amounts to £2,774,000.The profit and loss account includes £2,490,000 of unrealised profits on the part disposal of ENZA in 2002.COMPANYShare Capital Profitpremium redemption Other and lossaccount reserve reserve account£000 £000 £000 £000At 1 January <strong>2003</strong> 1,344 – 157,761 88,278Premium on shares issued (net of expenses) 2,456 – – –Capitalisation issue of shares – – (3,165) –Scrip dividend alternative (411) – – 4,105Buy back of shares – 521 – (5,955)Retained loss for the year – – – (15,535)AT 31 DECEMBER <strong>2003</strong> 3,389 521 154,596 70,89328. Contingent Liabilities<strong>GPG</strong> has guaranteed the repayment of principal,interest and unpaid accrued interest due on the NZ$250 million 2001 CapitalNotes and on the NZ$215 million <strong>2003</strong> Capital Notes in the event of a liquidation of the issuing subsidiary or <strong>GPG</strong>UKH (see note22).In addition,it has guaranteed (on a subordinated basis) the obligations of <strong>GPG</strong>UKH in respect of the payment of principal andaccrued interest under the CLNs (see note 21).As at 31 December <strong>2003</strong>, Staveley had contingent liabilities in respect of performance bonds, tender bonds and guarantees forthird parties amounting to £2,000,000 (2002: £3,200,000). In addition, Staveley and certain of its subsidiaries are parties to legalactions and claims arising in the ordinary course of business, which the directors are advised and believe are likely to beresolved without significant effect on the net assets of the <strong>Group</strong>.A subsidiary of Canberra Investment Corporation Ltd (“Canberra”) is jointly and severally liable for all the liabilities of theHarcourt Hill Estate joint venture. The assets of the joint venture at year-end were sufficient to meet such liabilities. In addition,Canberra has guaranteed the bank facilities of a joint arrangement in which it has a 50% interest. As at 31 December <strong>2003</strong>,these facilities amounted to £Nil (2002: £Nil).