GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

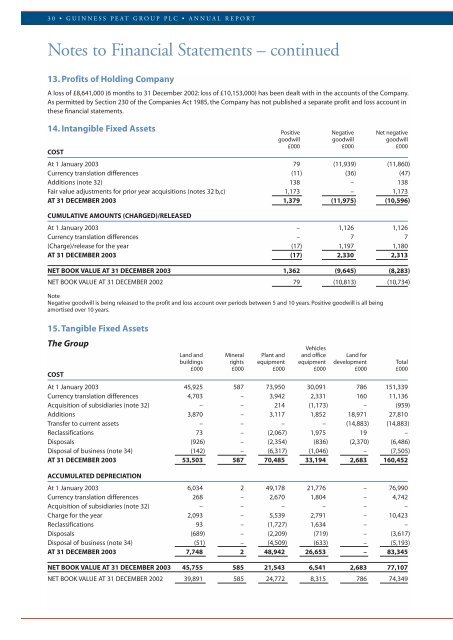

30 • GUINNESS PEAT GROUP PLC • ANNUAL REPORTNotes to Financial Statements – continued13. Profits of Holding CompanyA loss of £8,641,000 (6 months to 31 December 2002: loss of £10,153,000) has been dealt with in the accounts of the Company.As permitted by Section 230 of the Companies Act 1985, the Company has not published a separate profit and loss account inthese financial statements.14. Intangible Fixed AssetsPositive Negative Net negativegoodwill goodwill goodwillCOST£000 £000 £000At 1 January <strong>2003</strong> 79 (11,939) (11,860)Currency translation differences (11) (36) (47)Additions (note 32) 138 – 138Fair value adjustments for prior year acquisitions (notes 32 b,c) 1,173 – 1,173AT 31 DECEMBER <strong>2003</strong> 1,379 (11,975) (10,596)CUMULATIVE AMOUNTS (CHARGED)/RELEASEDAt 1 January <strong>2003</strong> – 1,126 1,126Currency translation differences – 7 7(Charge)/release for the year (17) 1,197 1,180AT 31 DECEMBER <strong>2003</strong> (17) 2,330 2,313NET BOOK VALUE AT 31 DECEMBER <strong>2003</strong> 1,362 (9,645) (8,283)NET BOOK VALUE AT 31 DECEMBER 2002 79 (10,813) (10,734)NoteNegative goodwill is being released to the profit and loss account over periods between 5 and 10 years. Positive goodwill is all beingamortised over 10 years.15. Tangible Fixed AssetsThe <strong>Group</strong>COSTVehiclesLand and Mineral Plant and and office Land forbuildings rights equipment equipment development Total£000 £000 £000 £000 £000 £000At 1 January <strong>2003</strong> 45,925 587 73,950 30,091 786 151,339Currency translation differences 4,703 – 3,942 2,331 160 11,136Acquisition of subsidiaries (note 32) – – 214 (1,173) – (959)Additions 3,870 – 3,117 1,852 18,971 27,810Transfer to current assets – – – – (14,883) (14,883)Reclassifications 73 – (2,067) 1,975 19 –Disposals (926) – (2,354) (836) (2,370) (6,486)Disposal of business (note 34) (142) – (6,317) (1,046) – (7,505)AT 31 DECEMBER <strong>2003</strong> 53,503 587 70,485 33,194 2,683 160,452ACCUMULATED DEPRECIATIONAt 1 January <strong>2003</strong> 6,034 2 49,178 21,776 – 76,990Currency translation differences 268 – 2,670 1,804 – 4,742Acquisition of subsidiaries (note 32) – – – – – –Charge for the year 2,093 – 5,539 2,791 – 10,423Reclassifications 93 – (1,727) 1,634 – –Disposals (689) – (2,209) (719) – (3,617)Disposal of business (note 34) (51) – (4,509) (633) – (5,193)AT 31 DECEMBER <strong>2003</strong> 7,748 2 48,942 26,653 – 83,345NET BOOK VALUE AT 31 DECEMBER <strong>2003</strong> 45,755 585 21,543 6,541 2,683 77,107NET BOOK VALUE AT 31 DECEMBER 2002 39,891 585 24,772 8,315 786 74,349