GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

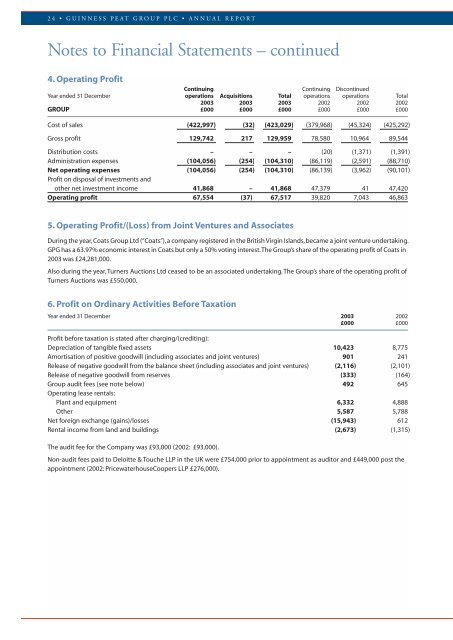

24 • GUINNESS PEAT GROUP PLC • ANNUAL REPORTNotes to Financial Statements – continued4. Operating ProfitContinuing Continuing DiscontinuedYear ended 31 December operations Acquisitions Total operations operations Total<strong>2003</strong> <strong>2003</strong> <strong>2003</strong> 2002 2002 2002GROUP £000 £000 £000 £000 £000 £000Cost of sales (422,997) (32) (423,029) (379,968) (45,324) (425,292)Gross profit 129,742 217 129,959 78,580 10,964 89,544Distribution costs – – – (20) (1,371) (1,391)Administration expenses (104,056) (254) (104,310) (86,119) (2,591) (88,710)Net operating expenses (104,056) (254) (104,310) (86,139) (3,962) (90,101)Profit on disposal of investments andother net investment income 41,868 – 41,868 47,379 41 47,420Operating profit 67,554 (37) 67,517 39,820 7,043 46,8635. Operating Profit/(Loss) from Joint Ventures and AssociatesDuring the year, Coats <strong>Group</strong> Ltd (“Coats”), a company registered in the British Virgin Islands, became a joint venture undertaking.<strong>GPG</strong> has a 63.97% economic interest in Coats but only a 50% voting interest.The <strong>Group</strong>’s share of the operating profit of Coats in<strong>2003</strong> was £24,281,000.Also during the year, Turners Auctions Ltd ceased to be an associated undertaking. The <strong>Group</strong>’s share of the operating profit ofTurners Auctions was £550,000.6. Profit on Ordinary Activities Before TaxationYear ended 31 December <strong>2003</strong> 2002£000 £000Profit before taxation is stated after charging/(crediting):Depreciation of tangible fixed assets 10,423 8,775Amortisation of positive goodwill (including associates and joint ventures) 901 241Release of negative goodwill from the balance sheet (including associates and joint ventures) (2,116) (2,101)Release of negative goodwill from reserves (333) (164)<strong>Group</strong> audit fees (see note below) 492 645Operating lease rentals:Plant and equipment 6,332 4,888Other 5,587 5,788Net foreign exchange (gains)/losses (15,943) 612Rental income from land and buildings (2,673) (1,315)The audit fee for the Company was £93,000 (2002: £93,000).Non-audit fees paid to Deloitte & Touche LLP in the UK were £754,000 prior to appointment as auditor and £449,000 post theappointment (2002: PricewaterhouseCoopers LLP £276,000).