GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

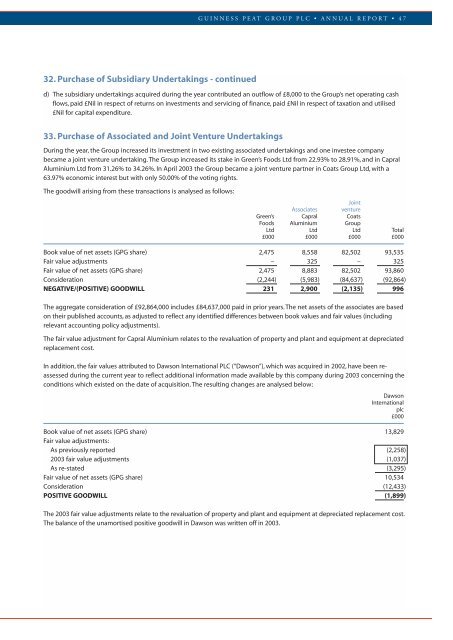

GUINNESS PEAT GROUP PLC • ANNUAL REPORT • 4732. Purchase of Subsidiary Undertakings - continuedd) The subsidiary undertakings acquired during the year contributed an outflow of £8,000 to the <strong>Group</strong>’s net operating cashflows, paid £Nil in respect of returns on investments and servicing of finance, paid £Nil in respect of taxation and utilised£Nil for capital expenditure.33. Purchase of Associated and Joint Venture UndertakingsDuring the year, the <strong>Group</strong> increased its investment in two existing associated undertakings and one investee companybecame a joint venture undertaking. The <strong>Group</strong> increased its stake in Green’s Foods Ltd from 22.93% to 28.91%, and in CapralAluminium Ltd from 31.26% to 34.26%. In April <strong>2003</strong> the <strong>Group</strong> became a joint venture partner in Coats <strong>Group</strong> Ltd, with a63.97% economic interest but with only 50.00% of the voting rights.The goodwill arising from these transactions is analysed as follows:JointAssociates ventureGreen’s Capral CoatsFoods Aluminium <strong>Group</strong>Ltd Ltd Ltd Total£000 £000 £000 £000Book value of net assets (<strong>GPG</strong> share) 2,475 8,558 82,502 93,535Fair value adjustments – 325 – 325Fair value of net assets (<strong>GPG</strong> share) 2,475 8,883 82,502 93,860Consideration (2,244) (5,983) (84,637) (92,864)NEGATIVE/(POSITIVE) GOODWILL 231 2,900 (2,135) 996The aggregate consideration of £92,864,000 includes £84,637,000 paid in prior years. The net assets of the associates are basedon their published accounts, as adjusted to reflect any identified differences between book values and fair values (includingrelevant accounting policy adjustments).The fair value adjustment for Capral Aluminium relates to the revaluation of property and plant and equipment at depreciatedreplacement cost.In addition, the fair values attributed to Dawson International PLC (“Dawson”), which was acquired in 2002, have been reassessedduring the current year to reflect additional information made available by this company during <strong>2003</strong> concerning theconditions which existed on the date of acquisition. The resulting changes are analysed below:DawsonInternational<strong>plc</strong>£000Book value of net assets (<strong>GPG</strong> share) 13,829Fair value adjustments:As previously reported (2,258)<strong>2003</strong> fair value adjustments (1,037)As re-stated (3,295)Fair value of net assets (<strong>GPG</strong> share) 10,534Consideration (12,433)POSITIVE GOODWILL (1,899)The <strong>2003</strong> fair value adjustments relate to the revaluation of property and plant and equipment at depreciated replacement cost.The balance of the unamortised positive goodwill in Dawson was written off in <strong>2003</strong>.