GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

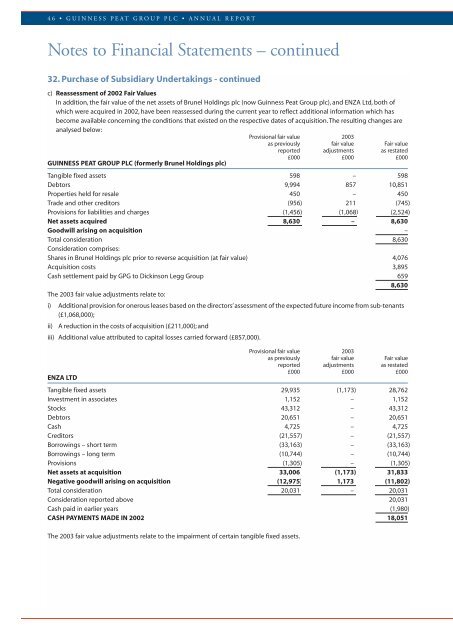

46 • GUINNESS PEAT GROUP PLC • ANNUAL REPORTNotes to Financial Statements – continued32. Purchase of Subsidiary Undertakings - continuedc) Reassessment of 2002 Fair ValuesIn addition, the fair value of the net assets of Brunel Holdings <strong>plc</strong> (now <strong>Guinness</strong> <strong>Peat</strong> <strong>Group</strong> <strong>plc</strong>), and ENZA Ltd, both ofwhich were acquired in 2002, have been reassessed during the current year to reflect additional information which hasbecome available concerning the conditions that existed on the respective dates of acquisition. The resulting changes areanalysed below:Provisional fair value <strong>2003</strong>as previously fair value Fair valuereported adjustments as restatedGUINNESS PEAT GROUP PLC (formerly Brunel Holdings <strong>plc</strong>)£000 £000 £000Tangible fixed assets 598 – 598Debtors 9,994 857 10,851Properties held for resale 450 – 450Trade and other creditors (956) 211 (745)Provisions for liabilities and charges (1,456) (1,068) (2,524)Net assets acquired 8,630 – 8,630Goodwill arising on acquisition –Total consideration 8,630Consideration comprises:Shares in Brunel Holdings <strong>plc</strong> prior to reverse acquisition (at fair value) 4,076Acquisition costs 3,895Cash settlement paid by <strong>GPG</strong> to Dickinson Legg <strong>Group</strong> 6598,630The <strong>2003</strong> fair value adjustments relate to:i) Additional provision for onerous leases based on the directors’assessment of the expected future income from sub-tenants(£1,068,000);ii) A reduction in the costs of acquisition (£211,000); andiii) Additional value attributed to capital losses carried forward (£857,000).ENZA LTDProvisional fair value <strong>2003</strong>as previously fair value Fair valuereported adjustments as restated£000 £000 £000Tangible fixed assets 29,935 (1,173) 28,762Investment in associates 1,152 – 1,152Stocks 43,312 – 43,312Debtors 20,651 – 20,651Cash 4,725 – 4,725Creditors (21,557) – (21,557)Borrowings – short term (33,163) – (33,163)Borrowings – long term (10,744) – (10,744)Provisions (1,305) – (1,305)Net assets at acquisition 33,006 (1,173) 31,833Negative goodwill arising on acquisition (12,975) 1,173 (11,802)Total consideration 20,031 – 20,031Consideration reported above 20,031Cash paid in earlier years (1,980)CASH PAYMENTS MADE IN 2002 18,051The <strong>2003</strong> fair value adjustments relate to the impairment of certain tangible fixed assets.