GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

GPG Report & Accounts 2003 - Guinness Peat Group plc

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

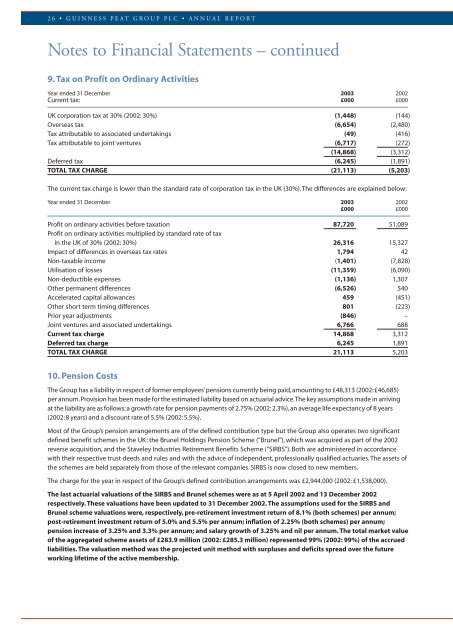

26 • GUINNESS PEAT GROUP PLC • ANNUAL REPORTNotes to Financial Statements – continued9. Tax on Profit on Ordinary ActivitiesYear ended 31 December <strong>2003</strong> 2002Current tax: £000 £000UK corporation tax at 30% (2002: 30%) (1,448) (144)Overseas tax (6,654) (2,480)Tax attributable to associated undertakings (49) (416)Tax attributable to joint ventures (6,717) (272)(14,868) (3,312)Deferred tax (6,245) (1,891)TOTAL TAX CHARGE (21,113) (5,203)The current tax charge is lower than the standard rate of corporation tax in the UK (30%). The differences are explained below:Year ended 31 December <strong>2003</strong> 2002£000 £000Profit on ordinary activities before taxation 87,720 51,089Profit on ordinary activities multiplied by standard rate of taxin the UK of 30% (2002: 30%) 26,316 15,327Impact of differences in overseas tax rates 1,794 42Non-taxable income (1,401) (7,828)Utilisation of losses (11,359) (6,090)Non-deductible expenses (1,136) 1,307Other permanent differences (6,526) 540Accelerated capital allowances 459 (451)Other short term timing differences 801 (223)Prior year adjustments (846) –Joint ventures and associated undertakings 6,766 688Current tax charge 14,868 3,312Deferred tax charge 6,245 1,891TOTAL TAX CHARGE 21,113 5,20310. Pension CostsThe <strong>Group</strong> has a liability in respect of former employees’pensions currently being paid, amounting to £48,313 (2002: £46,685)per annum. Provision has been made for the estimated liability based on actuarial advice.The key assumptions made in arrivingat the liability are as follows: a growth rate for pension payments of 2.75% (2002: 2.3%), an average life expectancy of 8 years(2002: 8 years) and a discount rate of 5.5% (2002: 5.5%).Most of the <strong>Group</strong>’s pension arrangements are of the defined contribution type but the <strong>Group</strong> also operates two significantdefined benefit schemes in the UK: the Brunel Holdings Pension Scheme (“Brunel”), which was acquired as part of the 2002reverse acquisition, and the Staveley Industries Retirement Benefits Scheme (“SIRBS”). Both are administered in accordancewith their respective trust deeds and rules and with the advice of independent, professionally qualified actuaries. The assets ofthe schemes are held separately from those of the relevant companies. SIRBS is now closed to new members.The charge for the year in respect of the <strong>Group</strong>’s defined contribution arrangements was £2,944,000 (2002: £1,538,000).The last actuarial valuations of the SIRBS and Brunel schemes were as at 5 April 2002 and 13 December 2002respectively. These valuations have been updated to 31 December 2002. The assumptions used for the SIRBS andBrunel scheme valuations were, respectively, pre-retirement investment return of 8.1% (both schemes) per annum;post-retirement investment return of 5.0% and 5.5% per annum; inflation of 2.25% (both schemes) per annum;pension increase of 3.25% and 3.3% per annum; and salary growth of 3.25% and nil per annum. The total market valueof the aggregated scheme assets of £283.9 million (2002: £285.3 million) represented 99% (2002: 99%) of the accruedliabilities. The valuation method was the projected unit method with surpluses and deficits spread over the futureworking lifetime of the active membership.