- Page 1 and 2:

ECONOMIC REPORT OF THE PRESIDENT To

- Page 4:

C O N T E N T S ECONOMIC REPORT OF

- Page 8 and 9:

economic report of the president To

- Page 10 and 11: when a hardworking American loses h

- Page 12: the annual report of the council of

- Page 16 and 17: C O N T E N T S CHAPTER 1 INCLUSIVE

- Page 18 and 19: CHAPTER 5 TECHNOLOGY AND INNOVATION

- Page 20 and 21: APPENDIXES A. Report to the Preside

- Page 22 and 23: 3.4. Percent Gap Between Actual and

- Page 24 and 25: 6.6. Relationship between Output Gr

- Page 26 and 27: C H A P T E R 1 INCLUSIVE GROWTH IN

- Page 28 and 29: To promote inclusive growth, both c

- Page 30 and 31: Percent 20 15 Figure 1-1 Share of I

- Page 32 and 33: Table 1-1 Increase in Income Share

- Page 34 and 35: Figure 1-3 Distribution of Househol

- Page 36 and 37: narrows the pool of human capital t

- Page 38 and 39: over the past several decades has b

- Page 40 and 41: Figure 1-6a The "Great Gatsby Curve

- Page 42 and 43: Figure 1-7 Change in Employment by

- Page 44 and 45: and sellers—consumer and producer

- Page 46 and 47: Percent 15 10 Figure 1-9 Corporate

- Page 48 and 49: Percent 30 Figure 1-11 Share of Wor

- Page 50 and 51: Figure 1-12 Real Construction Costs

- Page 52 and 53: promoting equality of opportunity;

- Page 54 and 55: the division of rents, they can red

- Page 56 and 57: C H A P T E R 2 THE YEAR IN REVIEW

- Page 58 and 59: cold weather.1 The economy rebounde

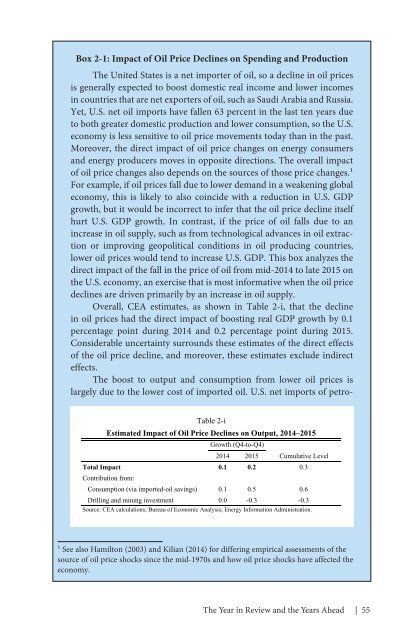

- Page 62 and 63: Roughly speaking, the decline in th

- Page 64 and 65: Percent of GDP 10 Figure 2-3 Federa

- Page 66 and 67: Figure 2-5 Government Purchases as

- Page 68 and 69: 13 percent of GDP. Until 1990, Stat

- Page 70 and 71: of new purchases.2 The increase in

- Page 72 and 73: Figure 2-8 Actual and Consensus For

- Page 74 and 75: Figure 2-10 Rates of Part-Time Work

- Page 76 and 77: less than a tenth of the overall de

- Page 78 and 79: Business fixed investment grew 3.1

- Page 80 and 81: Percent 10 Figure 2-14 Personal Sav

- Page 82 and 83: BEA revises the official statistics

- Page 84 and 85: Index* 100 Figure 2-16 Real Income

- Page 86 and 87: Box 2-5: Are Official Estimates of

- Page 88 and 89: of consumer surplus, which should,

- Page 90 and 91: Figure 2-19 National House Price In

- Page 92 and 93: Box 2-6: Constraints on Housing Sup

- Page 94 and 95: and also was estimated in recent re

- Page 96 and 97: market. Nevertheless, the construct

- Page 98 and 99: Figure 2-23 Net Investment as a Sha

- Page 100 and 101: Percent 80 Figure 2-25 Total Payout

- Page 102 and 103: Figure 2-28 Foreign Real GDP and U.

- Page 104 and 105: Figure 2-30 Sources of Productivity

- Page 106 and 107: Figure 2-32 Nominal Wage Growth Ove

- Page 108 and 109: Figure 2-35 Long-Term Inflation Exp

- Page 110 and 111:

Percent 18 Figure 2-36 Nominal 10-Y

- Page 112 and 113:

Table 2-1 Selected Interest Rates,

- Page 114 and 115:

are close to those projected by the

- Page 116 and 117:

International Economics (Petri and

- Page 118 and 119:

History Forecast 1953:Q2 to 2015:Q3

- Page 120 and 121:

inflation up to 2007 and then expec

- Page 122:

Upside and Downside Forecast Risks.

- Page 125 and 126:

earlier forecasts. Figure 3-1 shows

- Page 127 and 128:

Real GDP/WAP Growth 2011-2014 Figur

- Page 129 and 130:

economists would expect capital dee

- Page 131 and 132:

Figure 3-i Actual and Forecasted Wo

- Page 133 and 134:

affected the demographic trajectory

- Page 135 and 136:

over the first three quarters of 20

- Page 137 and 138:

Percentage Points 35 30 Figure 3-7

- Page 139 and 140:

the President for a discussion of t

- Page 141 and 142:

Box 3-2: Market Volatility in the S

- Page 143 and 144:

potential for rapid spillovers betw

- Page 145 and 146:

absorb unexpectedly high losses. In

- Page 147 and 148:

Box 3-3: Commodity Prices and Infla

- Page 149 and 150:

In November 2015, the IMF voted to

- Page 151 and 152:

Billions of U.S. Dollars 250 200 15

- Page 153 and 154:

U.S. exports are 12.5 percent of th

- Page 155 and 156:

Box 3-4: The Importance of the Tran

- Page 157 and 158:

The challenging environment for U.S

- Page 159 and 160:

child’s environment. Despite the

- Page 161 and 162:

and Rossin-Slater 2015).5 These adv

- Page 163 and 164:

Figure 4-2 Official Poverty Rate fo

- Page 165 and 166:

Figure 4-3 Likelihood of Scoring Ve

- Page 167 and 168:

Percent 100 90 80 70 60 50 40 30 20

- Page 169 and 170:

Figure 4-7 Achievement Gap is Large

- Page 171 and 172:

Hours per Week 24 22 20 Figure 4-9

- Page 173 and 174:

Percent 65 Figure 4-11 Preschool En

- Page 175 and 176:

Box 4-1: Gender Differences in Earl

- Page 177 and 178:

Card and Rothstein 2007; Dickerson

- Page 179 and 180:

depend on how parents choose to inv

- Page 181 and 182:

y many factors, which makes it diff

- Page 183 and 184:

Box 4-3: Federal Early Childhood Pr

- Page 185 and 186:

program served over 45 million Amer

- Page 187 and 188:

Reauthorization Act of 2015, signed

- Page 189 and 190:

document that desegregation of hosp

- Page 191 and 192:

to alleviate hunger by supplementin

- Page 193 and 194:

adulthood (Hoynes, Schanzenbach, an

- Page 195 and 196:

of preschoolers support their child

- Page 197 and 198:

program and up to 15 years after co

- Page 199 and 200:

a longer period than is true of mos

- Page 201 and 202:

to be higher today than in the past

- Page 203 and 204:

Figure 4-18 Most Early Childhood Pr

- Page 205 and 206:

the preschool programs in Georgia a

- Page 207 and 208:

test scores by 6 to 9 percent of a

- Page 209 and 210:

Figure 4-20 Increase in Probability

- Page 211 and 212:

increased earnings by 31 percent (F

- Page 213 and 214:

Figure 5-1 Labor Productivity Growt

- Page 215 and 216:

Competition and Dynamism Play a Cri

- Page 217 and 218:

adopts pre-existing technology or k

- Page 219 and 220:

Figure 5-2 Quantity and Volume of V

- Page 221 and 222:

Box 5-2: Occupational Licensing One

- Page 223 and 224:

in consumer welfare as they erode t

- Page 225 and 226:

Finally, some workers may acquire s

- Page 227 and 228:

Box 5-3: Major Research Initiatives

- Page 229 and 230:

Figure 5-5 Federal and Nonfederal R

- Page 231 and 232:

Figure 5-7 Federal Research and Dev

- Page 233 and 234:

Figure 5-10 Percent of Patent Appli

- Page 235 and 236:

percent of all cases in 2009 to ove

- Page 237 and 238:

(Bloom, Sadun, and Van Reenen 2012)

- Page 239 and 240:

Figure 5-12 Estimated Annual Shipme

- Page 241 and 242:

was relatively flat through the 200

- Page 243 and 244:

In contrast, recent papers by Autor

- Page 245 and 246:

services, such as 4G LTE. At the sa

- Page 247 and 248:

Box 5-5: The On-Demand Economy “O

- Page 249 and 250:

vision of services that may not hav

- Page 251 and 252:

Figure 5-17 Household Income and Ho

- Page 253 and 254:

about half since ConnectED was laun

- Page 256 and 257:

C H A P T E R 6 THE ECONOMIC BENEFI

- Page 258 and 259:

enefits to a wide set of consumers

- Page 260 and 261:

Figure 6-1 Composition of Public Sp

- Page 262 and 263:

Age, Years 29 27 Figure 6-3 Average

- Page 264 and 265:

Type CAN FRA DEU ITA JPN GBR USA 20

- Page 266 and 267:

Box 6-1: Clean Energy and Transport

- Page 268 and 269:

Industry Government Investment Dire

- Page 270 and 271:

infrastructure investment is crucia

- Page 272 and 273:

Box 6-2: Elasticity of Output to Pu

- Page 274 and 275:

and output ignore potential inter-t

- Page 276 and 277:

Thus, ideas are exchanged, workers

- Page 278 and 279:

kilometers of road) in 1983 resulte

- Page 280 and 281:

Prospects for Increased Infrastruct

- Page 282 and 283:

Figure 6-6 Relationship between Out

- Page 284 and 285:

there is a clear demand for an infr

- Page 286 and 287:

user fees or shadow tolls.11 Throug

- Page 288 and 289:

to transportation facilities caused

- Page 290 and 291:

Tax-Exempt Bonds Transportation inf

- Page 292 and 293:

Recent Legislation In December 2015

- Page 294 and 295:

enefit freight movements. The Act a

- Page 296 and 297:

C H A P T E R 7 THE 70 TH ANNIVERSA

- Page 298 and 299:

and composition of the labor force,

- Page 300 and 301:

it, “[t]he CEA and its chairman h

- Page 302 and 303:

jected reductions in the deficit. I

- Page 304 and 305:

example, the Environmental Protecti

- Page 306 and 307:

Keyserling and the Council particip

- Page 308 and 309:

Countercyclical Policy in Other Adm

- Page 310 and 311:

In designing the Recovery Act, one

- Page 312 and 313:

incorporating risk and discounting

- Page 314 and 315:

and Freddie had lots of friends in

- Page 316 and 317:

(USEC). USEC was responsible for pr

- Page 318 and 319:

can be reported to him as the perce

- Page 320 and 321:

By contrast, Keyserling had activel

- Page 322 and 323:

goals of the government in their ar

- Page 324 and 325:

Gather, Analyze, and Interpret Info

- Page 326 and 327:

the unemployment insurance system w

- Page 328 and 329:

an informational basis for appropri

- Page 330 and 331:

had experience working in governmen

- Page 332 and 333:

emained. I joined forces with Budge

- Page 334:

Of course, relying on short-term ac

- Page 337 and 338:

Carson, Ann. 2015. “Prisoners in

- Page 339 and 340:

Kleiner, Morris M. and Alan B. Krue

- Page 341 and 342:

Congressional Budget Office (CBO).

- Page 343 and 344:

Kocin, Paul J. and Louis Uccellini.

- Page 345 and 346:

Fajgelbaum, Pablo and Amit Khandelw

- Page 347 and 348:

World Bank. 2016. “Global Economi

- Page 349 and 350:

Belfield, Clive R., Milagros Nores,

- Page 351 and 352:

Campbell, Jennifer A., Rebekah J. W

- Page 353 and 354:

Council of Economic Advisers. 2014.

- Page 355 and 356:

Eissa, Nada and Jeffrey B. Liebman.

- Page 357 and 358:

Hastings, Justine S. and Ebonya Was

- Page 359 and 360:

Kalil, Ariel, Rebecca Ryan, and Mic

- Page 361 and 362:

Maxfield, Michelle. 2013. “The Ef

- Page 363 and 364:

Olds, David, John Eckenrode, Charle

- Page 365 and 366:

Solon, Gary. 1992. “Intergenerati

- Page 367 and 368:

Wherry, Laura R., Sarah Miller, Rob

- Page 369 and 370:

Bloom, Nicholas, Mark Schankerman,

- Page 371 and 372:

Graham, Stuart JH, Cheryl Grim, Tar

- Page 373 and 374:

Melitz, Marc J. 2003. “The Impact

- Page 375 and 376:

______. 2015. “Patent Assertions:

- Page 377 and 378:

Congressional Budget Office. 2009.

- Page 379 and 380:

Peshkin, David G., Todd E. Hoerner,

- Page 381 and 382:

______. 2001. Designing U.S. Econom

- Page 383 and 384:

Krueger, Alan B. 2000. “Honest Br

- Page 385 and 386:

Weidenbaum, Murray L. 1983. “An E

- Page 388 and 389:

letter of transmittal Council of Ec

- Page 390:

Council Members and Their Dates of

- Page 393 and 394:

The Members of the Council Sandra E

- Page 395 and 396:

In May, the Council issued a report

- Page 397 and 398:

Nirupama S. Rao . . . . . . . . . .

- Page 399 and 400:

Jessica Schumer resigned from her p

- Page 402 and 403:

C O N T E N T S GDP, INCOME, PRICES

- Page 404 and 405:

General Notes Detail in these table

- Page 406 and 407:

Table B-1. Percent changes in real

- Page 408 and 409:

Table B-2. Gross domestic product,

- Page 410 and 411:

Table B-4. Growth rates in real gro

- Page 412 and 413:

Year or quarter Total Table B-6. Co

- Page 414 and 415:

Table B-8. New private housing unit

- Page 416 and 417:

Table B-10. Changes in consumer pri

- Page 418 and 419:

Table B-11. Civilian labor force, 1

- Page 420 and 421:

Year or month Table B-13. Unemploym

- Page 422 and 423:

Table B-14. Employees on nonagricul

- Page 424 and 425:

Year or quarter Table B-16. Product

- Page 426 and 427:

Table B-18. Federal receipts, outla

- Page 428 and 429:

Table B-20. Federal receipts, outla

- Page 430 and 431:

Table B-22. State and local governm

- Page 432 and 433:

End of month Table B-24. Estimated

- Page 434 and 435:

Table B-25. Bond yields and interes