MacroeconomicsI_working_version (1)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Monetary Policy in Details 121<br />

i<br />

MS<br />

i 0<br />

M*<br />

MD<br />

M<br />

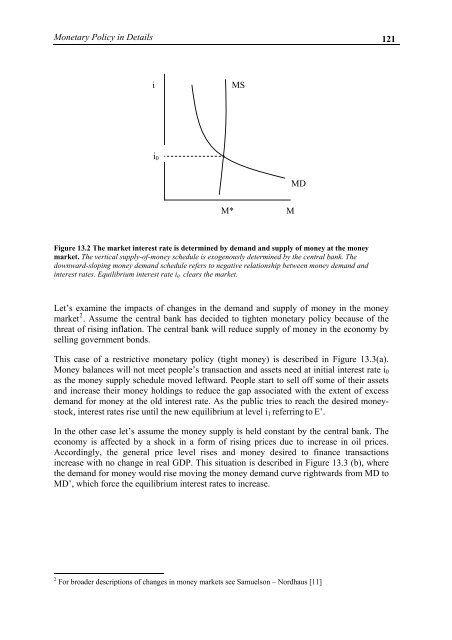

Figure 13.2 The market interest rate is determined by demand and supply of money at the money<br />

market. The vertical supply-of-money schedule is exogenously determined by the central bank. The<br />

downward-sloping money demand schedule refers to negative relationship between money demand and<br />

interest rates. Equilibrium interest rate i 0 clears the market.<br />

Let’s examine the impacts of changes in the demand and supply of money in the money<br />

market 2 . Assume the central bank has decided to tighten monetary policy because of the<br />

threat of rising inflation. The central bank will reduce supply of money in the economy by<br />

selling government bonds.<br />

This case of a restrictive monetary policy (tight money) is described in Figure 13.3(a).<br />

Money balances will not meet people’s transaction and assets need at initial interest rate i 0<br />

as the money supply schedule moved leftward. People start to sell off some of their assets<br />

and increase their money holdings to reduce the gap associated with the extent of excess<br />

demand for money at the old interest rate. As the public tries to reach the desired moneystock,<br />

interest rates rise until the new equilibrium at level i 1 referring to E’.<br />

In the other case let’s assume the money supply is held constant by the central bank. The<br />

economy is affected by a shock in a form of rising prices due to increase in oil prices.<br />

Accordingly, the general price level rises and money desired to finance transactions<br />

increase with no change in real GDP. This situation is described in Figure 13.3 (b), where<br />

the demand for money would rise moving the money demand curve rightwards from MD to<br />

MD’, which force the equilibrium interest rates to increase.<br />

2 For broader descriptions of changes in money markets see Samuelson – Nordhaus [11]