MacroeconomicsI_working_version (1)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Fiscal Policy in Details 113<br />

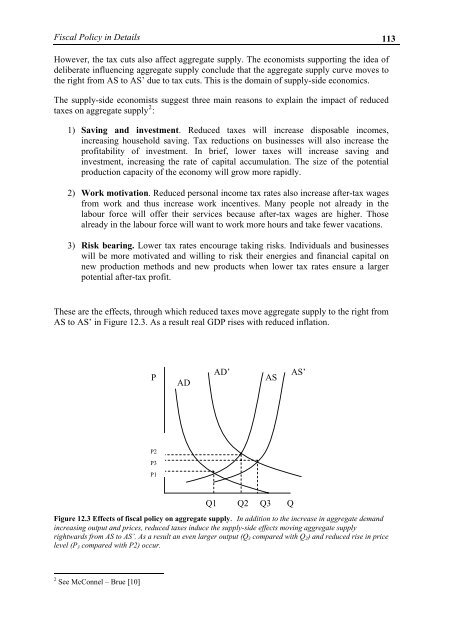

However, the tax cuts also affect aggregate supply. The economists supporting the idea of<br />

deliberate influencing aggregate supply conclude that the aggregate supply curve moves to<br />

the right from AS to AS’ due to tax cuts. This is the domain of supply-side economics.<br />

The supply-side economists suggest three main reasons to explain the impact of reduced<br />

taxes on aggregate supply 2 :<br />

1) Saving and investment. Reduced taxes will increase disposable incomes,<br />

increasing household saving. Tax reductions on businesses will also increase the<br />

profitability of investment. In brief, lower taxes will increase saving and<br />

investment, increasing the rate of capital accumulation. The size of the potential<br />

production capacity of the economy will grow more rapidly.<br />

2) Work motivation. Reduced personal income tax rates also increase after-tax wages<br />

from work and thus increase work incentives. Many people not already in the<br />

labour force will offer their services because after-tax wages are higher. Those<br />

already in the labour force will want to work more hours and take fewer vacations.<br />

3) Risk bearing. Lower tax rates encourage taking risks. Individuals and businesses<br />

will be more motivated and willing to risk their energies and financial capital on<br />

new production methods and new products when lower tax rates ensure a larger<br />

potential after-tax profit.<br />

These are the effects, through which reduced taxes move aggregate supply to the right from<br />

AS to AS’ in Figure 12.3. As a result real GDP rises with reduced inflation.<br />

P<br />

AD<br />

AD’<br />

AS<br />

AS’<br />

P2<br />

P3<br />

P1<br />

Q1 Q2 Q3<br />

Figure 12.3 Effects of fiscal policy on aggregate supply. In addition to the increase in aggregate demand<br />

increasing output and prices, reduced taxes induce the supply-side effects moving aggregate supply<br />

rightwards from AS to AS’. As a result an even larger output (Q 3 compared with Q 2 ) and reduced rise in price<br />

level (P 3 compared with P2) occur.<br />

Q<br />

2 See McConnel – Brue [10]